In an era when half of millennials are not saving for retirement, robo-advisors have entered the market to help make the task less daunting. One of the players on the robo-advisory field, FutureAdvisor, released metrics today supporting its growth.

The San Francisco-based company currently markets two products, one aimed to help users build their existing retirement fund and another to grow 529 college savings funds. The company’s freemium service offers either a fully managed account service or a free, advice-only resource.

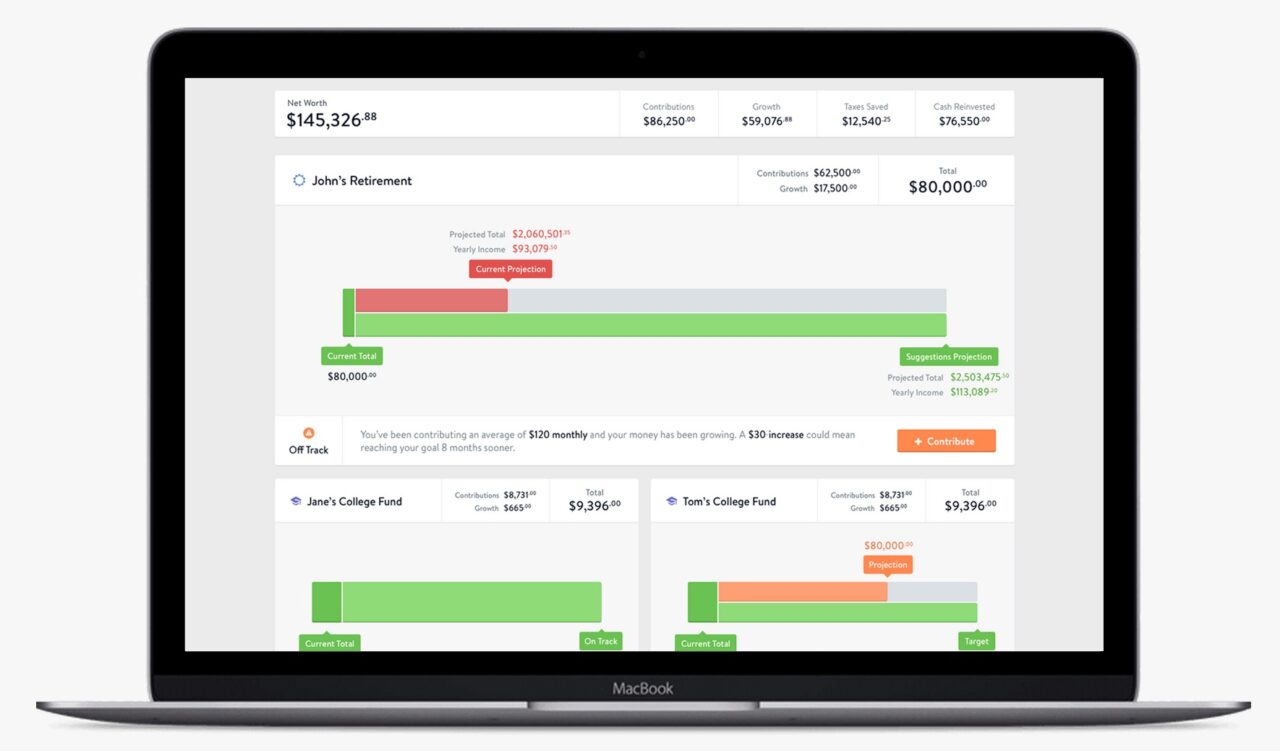

As a money manager, FutureAdvisor invests on behalf of 4,000 clients whose average portfolio totals $143,000. The company’s assets under management now total $603 million, a figure which has grown 10x since last June.

The company’s free, advisory-only service tracks $40 billion in assets for its 320,000+ registered users.

FutureAdvisor, which differentiates itself by using real people in tandem with its algorithm-based robo-advisory service, has raised $21.5 million, including a $15.5 million Series B round in May 2014.

The startup debuted FutureAdvisor Premium at FinovateFall 2013 in New York.