For financial institutions, there may be no more valuable information than real-time transaction data. And that may be why a company like INETCO, which has competed in more than one tech-rodeo since its 1984 founding, has developed technology to put real-time transaction data right where bank CMOs want and need it.

“Often this kind of software is very general,” INETCO’s VP of Product Marketing Marc Borbas explained to me in a conversation during FinovateSpring 2015 in San Jose. “We flipped that on its head. ‘You’re a channel manager,’ we asked. ‘How do we provide you with the things you need to do well?'”

From left: Dallas Pretty, CFO, and Marc Borbas, vice president of product marketing, demonstrated INETCO Analytics at FinovateSpring 2015 in San Jose.

INETCO demonstrated its solution, INETCO Analytics, in its Finovate debut in San Jose, Calif., this past spring. The technology has been on the market since January 2015, and it functions as a self-service analytics application for channel managers. The ATM deployment of the technology was on display in San Jose, but Borbas says that other channels are just a matter of time. The point, he emphasized, was the fundamental shift away from focus on the device (i.e., the ATM, the POS terminal), and more focus on the customer and their actual interaction with the network.

“We ask all these questions about what the device is doing, whether it has paper, whether it has cash, how available it is,” Borbas said. “What if we looked instead at how customers are actually using it? And what if we did this not just for the ATM channel, but for any channel, mobile, online, branch, IVR, you name it … that’s what we’re doing with INETCO Analytics.”

Company facts:

- INETCO was founded in June 1984

- Headquartered in Burnaby, British Columbia, Canada

- Produced more than 100% revenue growth annually since 2012

- Serves more than 150 banking, retail, telecommunications, and payment-processing customers in more than 50 countries.

- Bijan Sanii is CEO

How it works

The special sauce at the heart of INETCO Analytics is how the technology is able to pull transaction data from the network, and the plaform’s ability to package that data into “role-specific” solutions. INETCO manages to pull this off with a patented set of technologies (seven of them, to be specific) that do not rely on agents on the ATM—no changes to the transaction switch or host, no data warehouse or data mart in the FIs environment is touched.

“What’s nice is that you don’t have to change your app,” Borbas said. “It’s a very light way to get at that data.”

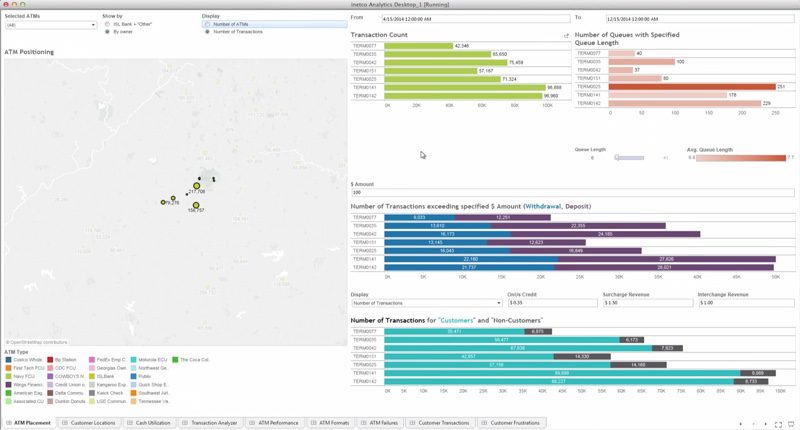

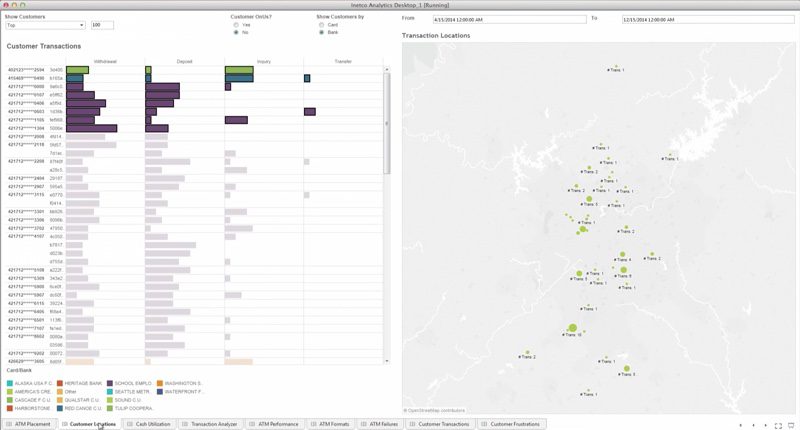

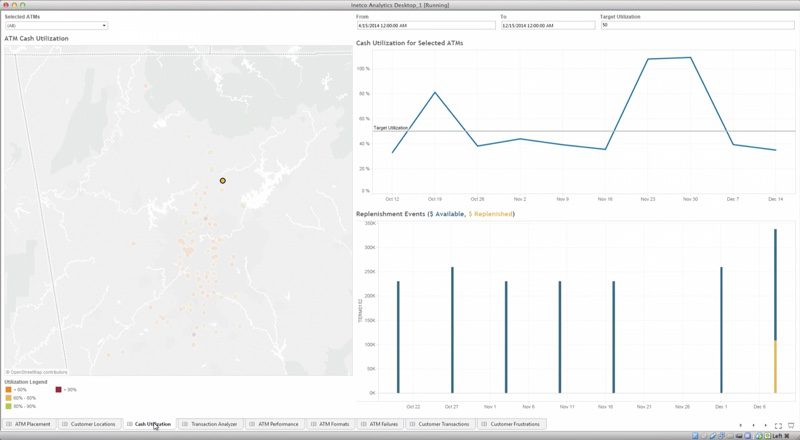

INETCO Analytics currently provides ATM content managers with essential information about where their customers are, which ATMs are being used most frequently and when, whether there are competing ATMs in the area, and more. The technology even lets channel managers know who their best customers are, as revealed by ATM-usage data, at least, as well as cash-utilization rates and levels.

“You can see if there are cash dispensers, or other banks, and use that to refine your placement strategy,” Borbas said. He also talked about how the solution could help ATM channel managers see just how efficiently their machines are working. “When you run a large ATM estate,” he explained, “you want to know where do you have lineups building, where are you disappointing customers, where is someone hitting the end of a queue and leaving because they don’t want to do business with you.”

Borbas says INETCO can see the transactions not only as they happen, but also how frequently those transactions occur. “It’s the next best thing to having a college intern sitting by the machine watching people go by,” he says.

INETCO’s role in bringing big (transaction) data to banks comes after three decades of experience producing network software. Borbas said while building network software has been good for the company, there was a realization that much might be gained by turning the equation around.

“IT people were saying that the transaction data flowing through the channel would be valuable to marketing folks,” Borbas said. So now, instead of focusing on software that runs networks, INETCO is making sure the “network is monitoring the software.”

The future

INETCO has had a busy 2015. In addition to launching Analytics at the beginning of the year, and demonstrating the technology at Finovate in the spring, INETCO in May forged a partnership with Mexico’s Edenred, a corporate services provider with more than 2 million users, and inked a deal with BECU (Boeing Employees Credit Union; $12 billion in assets) to deploy its Analytics platform with the 850,000+ member credit union.

“It’s no secret that omnichannel is big with bankers,” Borbas said, adding that the next step for INETCO Analytics will be to take the technology beyond ATMS to channels such as mobile and POS. He says that 2015 is an ideal time for the channel expansion, and that it’s “just a matter of deciding which one.”

INETCO will be guided by what Borbas called “the pain-point story.” The company made the bet that somewhere in the bank the data exists and that it’s just hard to get. The issues with ATMs in terms of time lags made it a first choice, but the company is looking for the next best way to deploy the technology. “Who is going through the most pain to get the information they need?” Borbas said, framing the question. “We have the aspirin.”

Check out the FinovateSpring 2015 demo video for INETCO below.