Earlier this year we published a post titled Data or Die that describes the ways firms can leverage their data. Collecting data is hard, analyzing data is hard, but dying is simply not an option. So how do financial services companies stay alive?

In a recent report by McKinsey, authors Peter Bisson, Bryce Hall, Brian McCarthy, and Khaled Rifai set out to learn how companies who are successful at leveraging data analytics are able to do so at scale. The team surveyed 1,000 companies with more than $1 billion in revenue that operated in 13 sectors and across 12 geographic locations to learn the tricks to winning at data analytics.

As it turns out, successfully leveraging data analytics across an organization isn’t easy. In fact, only 8% of the companies in the survey thrived in this area.McKinsey found nine strategies the top performers use to outperform their peers:

- Obtain a strong, unified commitment from all levels of management: 61% have executive leadership that is aligned on an analytics vision and strategy

- Increase investment in analytics: 65% spend more than 25% of their IT budget on analytics

- Develop a clear data strategy with strong governance: 67% have a clear strategy to support their analytics program

- Use sophisticated analytics methodologies: 63% have a clear methodology for model development, insight interpretation, and new deployment

- Possess analytics expertise and hire talent that does, too: 89% employ more than 25 data and analytics professionals per 1,000 full time employees

- Create cross-functional, agile teams: 58% have models that revolve around multi-skilled teams

- Prioritize decision-making: 55% prioritized the top areas in which to embed analytics

- Establish decision-making rights and responsibilities: 58% establish decision-making accountability

- Empower front lines to make analytics-driven decisions: 57% make decisions quickly and continually refine their approach

While these numbers are convincing, not all of the most successful companies in the study abide by these categories. In fact, based on the numbers above, these only held true for an average of 67% of the top performers. The one area where there seemed to be more consensus may, however, be worth paying attention to. That is, successful companies have data analytics experts already on their team and they focus on hiring talent that is skilled in this area, as well.

Overall, McKinsey advised firms to “conquer the last mile” of their analytics journey by starting with… the last mile:

“Most companies start their analytics journey with data; they determine what they have and figure out where it can be applied. Almost by definition, that approach will limit analytics’ impact. To achieve analytics at scale, companies should work in the opposite direction. They should start by identifying the decision-making processes they could improve to generate additional value in the context of the company’s business strategy and then work backward to determine what type of data insights are required to influence these decisions and how the company can supply them.”

Now that McKinsey has shown you where to start, fintechs can help by showing you how. There are numerous fintechs who specialize in leveraging data across organizations. Below are nine companies across three categories:

Marketing

- GoodData offers an insights platform-as-a-service that provides data management and analytics to improve the operational decision-making process for employees, users, and partners. The company enables users to build standalone or embedded analytic apps that pull data from multiple sources.

- Race Data leverages customer data and turns it into market intelligence. By looking at consumer behavior, the company builds personalized engagements with the brand. The company offers a fintech platform built specifically to help community banks have more meaningful conversations with their customers.

- Red Zebra Analytics creates loyalty and engagement solutions for retail and bank customers. The tools leverage analytics to monitor and predict customer behavior and to serve as an incentive for customers to return to the bank’s online and mobile banking channels.

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations

Business intelligence

- Ephesoft offers a document capture and analytics platform that automatically extracts data. Using machine learning, the company puts that data to work to improve business processes such as invoicing, mortgage approvals, compliance checks, and insurance claims.

- Hyper Anna aims to democratize data by offering an AI-powered data analyst that firms can interact with using natural language. The assistant writes code, analyzes data, creates charts, and answers questions about key business drivers.

Fraud protection

Fraud protection

- Guardian Analytics uses data on banking clients’ behavior to detect and prevent banking fraud. The company creates a unique ID for each user by analyzing how they interact with their device and the bank’s website.

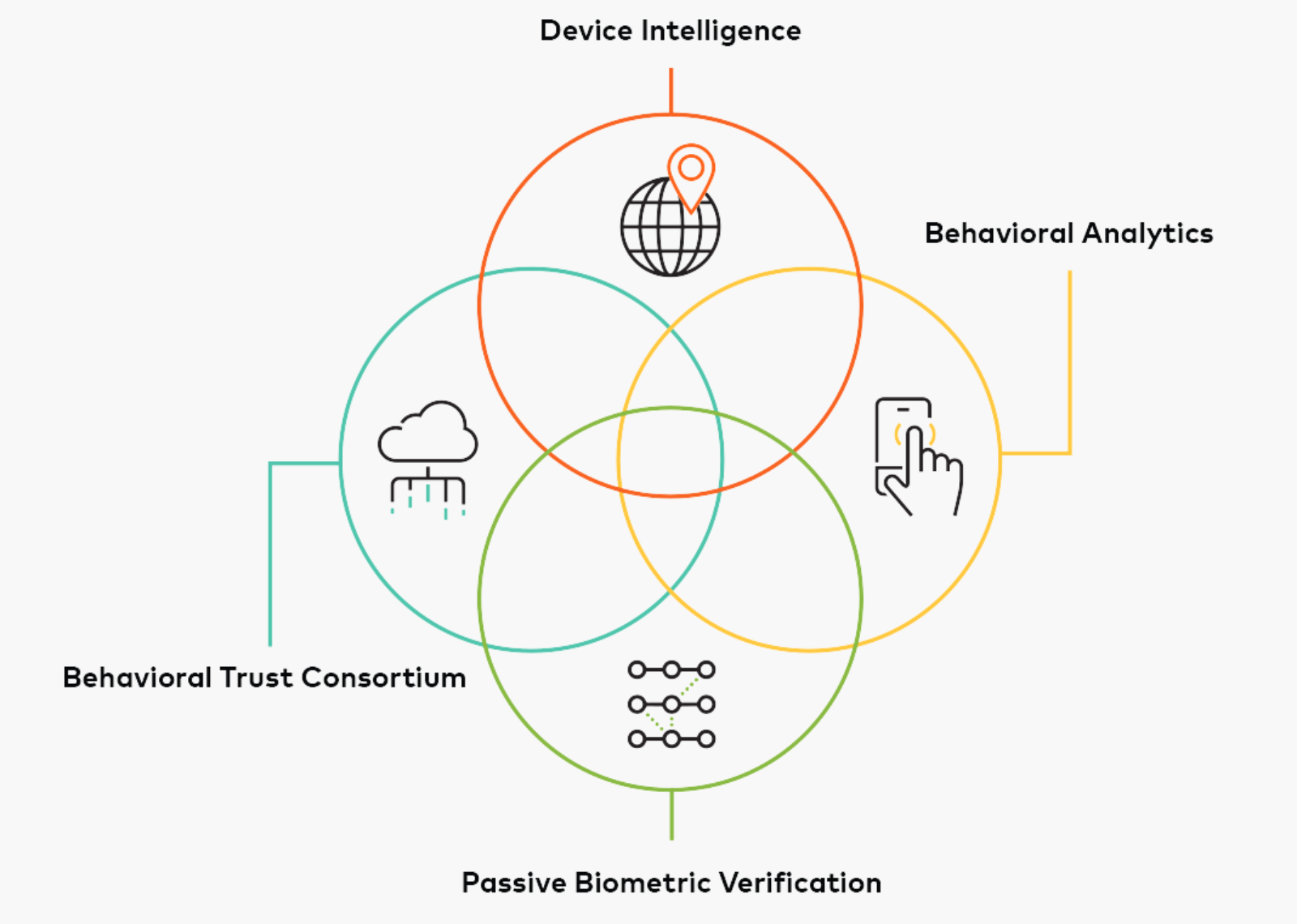

- NuData Security identifies users based on data gathered from their online interactions. By leveraging four layers of intelligence (pictured right); passive biometric verification, behavioral trust consortium, behavioral analytics, and device intelligence; the company can identify and prevent fraud.

- ID Analytics maintains an ID Network, a database of cross-industry consumer behavioral data, that offers an assessment of consumer creditworthiness and risk. The ID Network is composed of consumer data contributed from the company’s clients.

- ThetaRay’s analytics platform enables clients to detect anomalous behavior across a large data set of transactions. Once an anomaly is detected, the bank can migrate the transaction to protect against loss.