Nebraska-based D3 Banking secured $10 million from West Partners this week to bolster its Data Driven Digital banking technology. As part of the deal, San Diego-based West Partners is offering D3 the ability to borrow under a 3-year credit facility.

After today’s round, D3’s funding totals just over $27 million. CEO Mark Vipond said that West Partners offered the funds in response to recognizing “the pace and direction of change in the digital landscapes and the role D3 Banking can play in arming banks and credit unions with the tools they need to competitively differentiate themselves.”

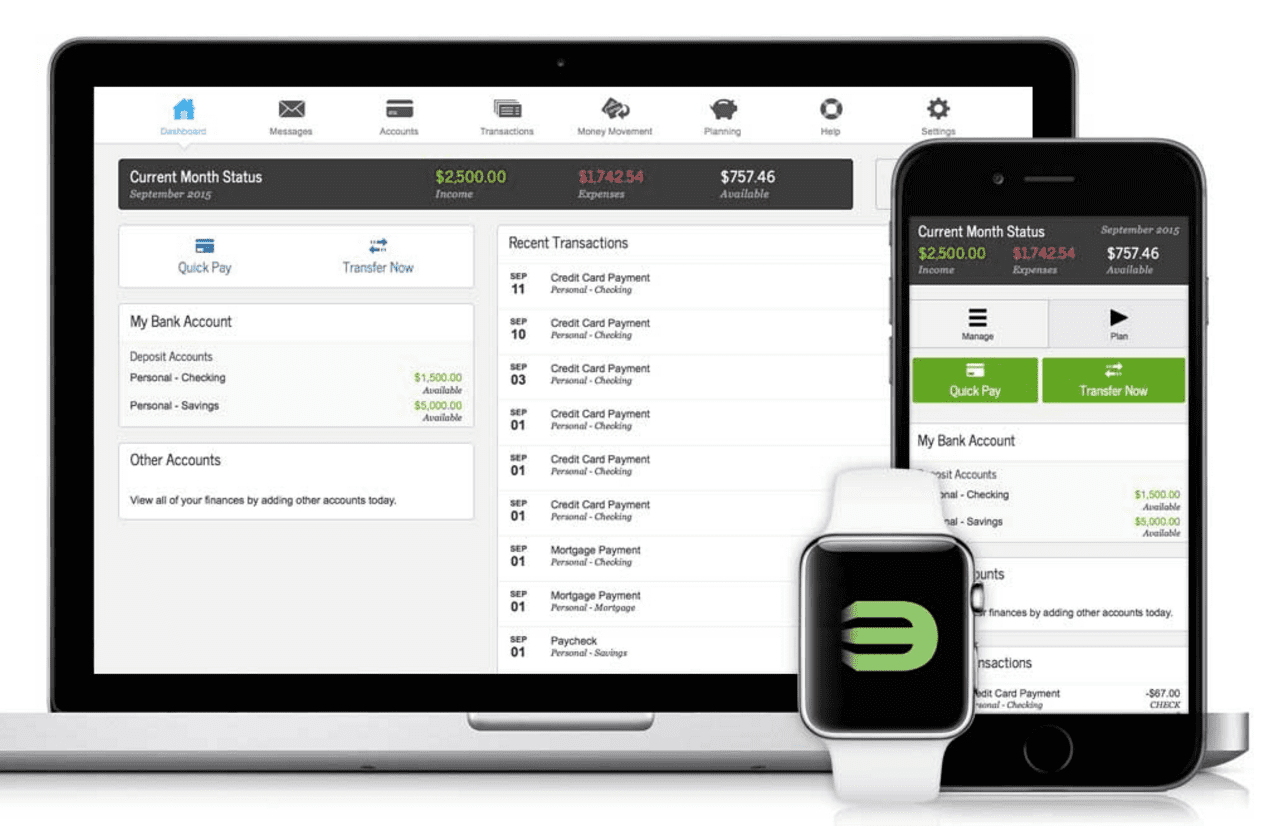

D3 will use the funds to expand its digital banking offering to keep up with demand, invest in R&D and build its team. The company works with banks such as Arvest, First Tennessee Bank, and IBERIABANK and counts more than 1.5 million end users of its personalized banking offerings.

At FinovateFall 2015, D3 launched its small business banking offering that provides PFM tools to help entrepreneurs manage their small business. The platform analyzes transactions to generate cash flow and income statements and offer budget suggestions. In addition, banks gain visibility into the cash flow of the business, which provides insight into optimal times to extend loan offers and other banking products.

Earlier this year D3 integrated FI Navigator’s mobile banking module, furnishing the company with market intelligence on mobile banking services offered by 6,000 financial institutions. D3 was founded in 1997.