Try wrapping your brain around this little nugget. There are now 2.5 billion unique users of messaging apps worldwide. And they are fast becoming news, search and ecommerce platforms on their own.

Try wrapping your brain around this little nugget. There are now 2.5 billion unique users of messaging apps worldwide. And they are fast becoming news, search and ecommerce platforms on their own.

How does chat morph into ecommerce, let alone banking? In China and other Asian countries, embedded chatbots are all the rage on messaging platforms such as Wechat, WhatsApp, Kik, Telegram and Slack.

Telegram is the only messaging platform to open up its chat API, such that there are now 120,000 bots serving its 5 million users (for example, see @gif and @vid at work here).

Tencent’s WeChat, the most popular messaging app in China … lets users shop, pay bills and book appointments.

—Wall Street Journal, 22 Dec 2015

Just yesterday, YC-incubated Chatfuel demoed its platform at W16 Demo Day. And it’s coming soon to Facebook’s Messenger (of course).

Just yesterday, YC-incubated Chatfuel demoed its platform at W16 Demo Day. And it’s coming soon to Facebook’s Messenger (of course).

Chatbot is hard to define. Google tells us:

chat·bot /ˈCHatbät/

nouna computer program designed to simulate conversation with human users, especially over the Internet.

“Chatbots often treat conversations like they’re a game of tennis: talk, reply, talk, reply.”

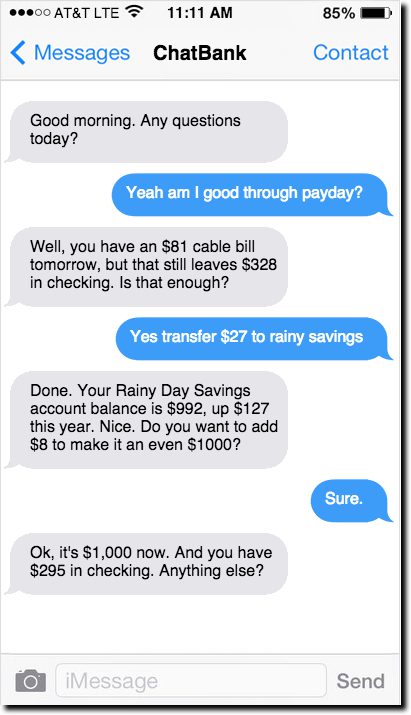

Unlike sales/service “live chat” that’s become commonplace within online banking, chatbot banking is 100% automated and includes a back and forth “chat” designed to hone in on the precise question or request. They are a boon to mobile self-service, where the limitations of screen size make traditional searching less user-friendly.

But chatbots can also handle transactions, especially the repetitive routine ones typical of online/mobile banking sessions. See the inset for how I imagine text banking might work for one of the most common tasks: balance inquiry with a subsequent funds-transfer.

Looking ahead

If you think of online banking via a PC as digital banking 1.0, and mobile as digital banking 2.0, then the upcoming invisible UI (or the “no UI, UI” coined by USAA’s Neff Hudson) using chatbots, AI and machine learning could very well be version 3.0. At least, that’s my hope. It reminds me of my all-time favorite quote about banking (circa late 1990’s), from noted technologist Esther Dyson:

Banking is like vacuuming; it’s vital, but everybody tries to reduce their vacuuming time.

Embrace the vacuum. People pay good money for them (no relation to Esther, I think).