BBVA Compass and Dwolla began their partnership in October 2014, when BBVA opened its network to the Iowa-based startup.

Today, the two disclosed the first stage of their plan. BBVA Compass is using the startup’s FiSync payments protocol for real-time money transfers. The Alabama-based bank is the largest FI customer to implement the technology.

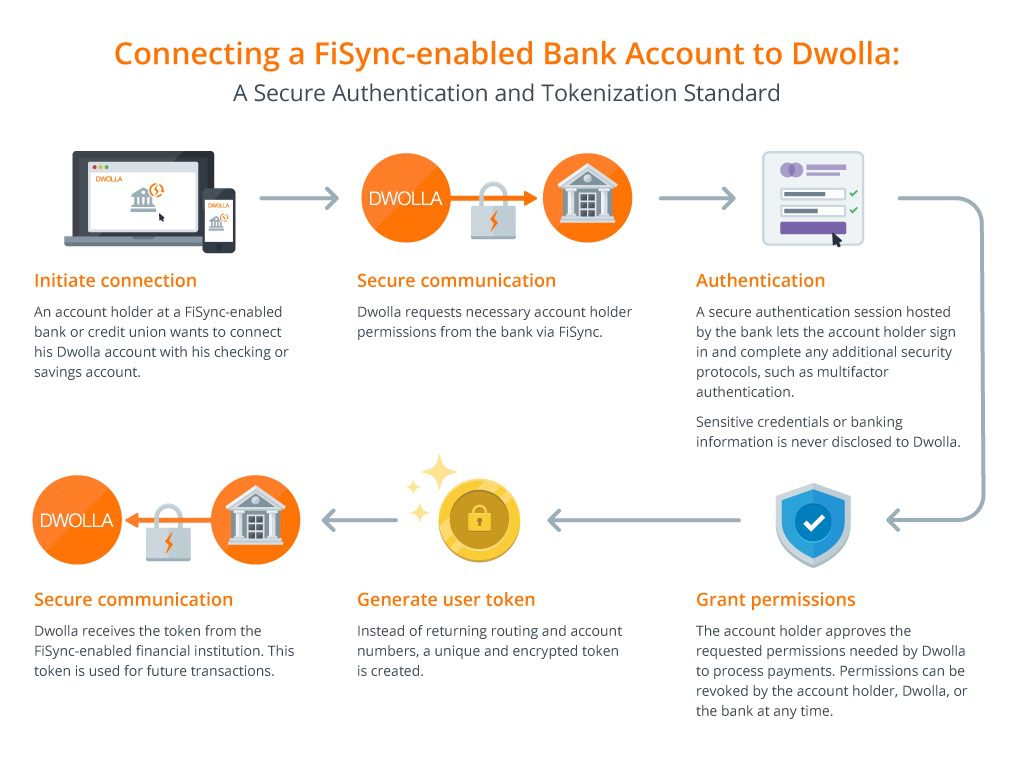

Dwolla will implement FiSync’s authentication and tokenization processes developed jointly by the two parties. These security processes eliminate the need for customers to grant merchants direct access to their bank account, thereby disclosing account and routing numbers.

Starting today, BBVA Compass clients can send funds in real-time to other BBVA account holders or Dwolla users.

The partnership is also good news for developers. Those with a BBVA Compass account can use Dwolla’s APIs to create their own real-time payments apps. BBVA Compass Chairman and CEO Manolo Sánchez says the FiSync payments protocol will help the bank adapt to customers who are used to getting everything on-demand and instantly. Sanchez says that by working with Dwolla, “BBVA Compass is ensuring that money is able to keep up with the speed of the instant economy. This will have a real and lasting impact on businesses and consumers alike.”

The partnership is also good news for developers. Those with a BBVA Compass account can use Dwolla’s APIs to create their own real-time payments apps. BBVA Compass Chairman and CEO Manolo Sánchez says the FiSync payments protocol will help the bank adapt to customers who are used to getting everything on-demand and instantly. Sanchez says that by working with Dwolla, “BBVA Compass is ensuring that money is able to keep up with the speed of the instant economy. This will have a real and lasting impact on businesses and consumers alike.”

BBVA is mimicking Dwolla’s pricing structure of $0.25 for transactions above $10, with everything under $10 free. The two companies plan to roll out additional updates in the coming months.

Dwolla demonstrated FiSync at FinovateSpring 2012. You can also catch them at the upcoming FinovateSpring show in San Jose next month.