The Internet has changed a lot of things in the past 10 years, but banking isn’t one of them. Sure, it’s now much easier to check your balance or see who you wrote check #1127 to. But these are incremental improvements. Nothing like what online brokerages did for trading stocks, or eBay for selling junk.

The Internet has changed a lot of things in the past 10 years, but banking isn’t one of them. Sure, it’s now much easier to check your balance or see who you wrote check #1127 to. But these are incremental improvements. Nothing like what online brokerages did for trading stocks, or eBay for selling junk.

Thanks to government guarantees, and consumer cautiousness with their money, it’s a bit hard to disintermediate the banking system. Or is it?

Take a look at UK’s Zopa, a recently-launched online loan exchange built by execs from Internet-only bank Egg. Zopa matches lenders and borrowers, cutting out the middlemen (actually inserting themselves in the middle instead of a bank), potentially creating a more transparent and less expensive system (Zopa takes a 1% loan fee).

Take a look at UK’s Zopa, a recently-launched online loan exchange built by execs from Internet-only bank Egg. Zopa matches lenders and borrowers, cutting out the middlemen (actually inserting themselves in the middle instead of a bank), potentially creating a more transparent and less expensive system (Zopa takes a 1% loan fee).

Like the U.S. mortgage system, risk is spread around by splitting each loan into 50 or more pieces that are pooled and repackaged into loans that are placed with individual investors (i.e. lenders). The borrowers and lenders remain anonymous to each other.

Funding from Benchmark Capital and Wellington Partners is further insurance that the company will be taken seriously.

Analysis

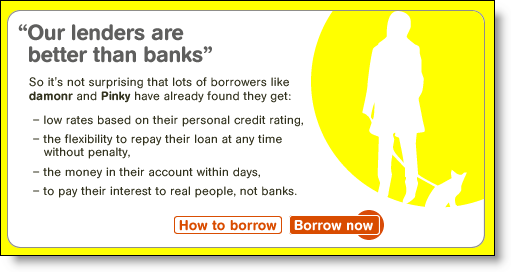

Is this a disruptive banking technology? Maybe. Variations on this theme, such as Circle Lending, are in existence. But there hasn’t been an effort as well funded and stocked with talent as Zopa. If anyone can pull this off, it’s the Egg folks. The Zopa website is fresh and irreverent, taking on banks at every step of the way (click on inset above).

Banks are easy targets, but to make this work, it’s going to take an extremely user-friendly system, some fantastic marketing, and a little luck. One of the big problems any startup lender faces is adverse selection. In other words, too many borrowers will be on the verge of a sharp decline in their creditworthiness; a decline not yet reflected in the credit score used to screen borrowers and price their loan.

The only real cure for that is perfect underwriting and lots of volume, that’s why preapproved credit card direct mail has worked so well for several decades.

The company hopes to take the concept to the United States later this year. Given the speed of our regulatory approval process, that seems unlikely. Look for it in late 2006 or early 2007, if the UK version begins to gain traction.

We’ll take a look at the concept in much more detail in an upcoming Online Banking Report.

—JB