Editor’s note: This guest post was written by Daniel Thomas, a 25-year veteran of the financial services industry and a principal consultant with Mindful Insights LLC. He’s been involved in strategy and product development for Online Resources Corporation, ARINC, and TeleCheck. He recently authored a report on merchant-funded in-statement rewards for Online Banking Report.

——————————-

Admittedly, my online game prowess is more closely aligned with Pong and Donkey Kong than the latest complex and socially intricate diversions. Back in the day, computer games garnered only a single payment transaction: when it was actually purchased. But today, in order to reach the next level, buy virtual pets or beat your opponent a half a world away, a player/avatar/consumer will typically transact multiple times per month in order to buy Facebook credits or other virtual currency (cash, coins, gems, etc.).

Admittedly, my online game prowess is more closely aligned with Pong and Donkey Kong than the latest complex and socially intricate diversions. Back in the day, computer games garnered only a single payment transaction: when it was actually purchased. But today, in order to reach the next level, buy virtual pets or beat your opponent a half a world away, a player/avatar/consumer will typically transact multiple times per month in order to buy Facebook credits or other virtual currency (cash, coins, gems, etc.).

These transactions can often occur in the heat of battle (literally), and the last thing any good soldier wants to do is stop progress in order to begin the seemingly weeklong process of taking out their credit card and typing a bunch of numbers just to spend a $2.99 to re-fill their weapons cache.

Before you could say billabong, along came Zong to make it as quick and as easy as a song. How? They ask if you want the charge to tag along on your mobile phone bill. And before long, you are back in action and that much stronger.

Before you could say billabong, along came Zong to make it as quick and as easy as a song. How? They ask if you want the charge to tag along on your mobile phone bill. And before long, you are back in action and that much stronger.

So, what’s the big deal? What has tickled my lifelong fascination with payments is not where Zong is now but where they are headed. Keep in mind that all these newfound payment transactions are seen only by the game company (merchant);, Zong (acquirer and network); and the mobile phone company (issuer). Financial institutions are involved only when the phone bill is paid at the end of the month.

Furthermore, the fees that Zong and a throng of other “carrier billing” processors command can be as high as 40% of the transaction amount. Ding-dong! Hello? After all, the cost of goods sold for a new virtual tank is pretty small and so is the actual transaction amount once the price has been converted from the game company’s internal currency.

But even so, 40% ain’t chicken singsong, especially when you consider that the online gaming (not gambling) market today is along the lines of $100 billion. Admittedly, 90% of that market belongs to the non-virtual console and PC games that Zong will be moving into as those products enter headlong into the virtual world.

Future plans

Zong, which now has 100 employees, is already available as a form of payment for Facebook Credits and virtual goods in 42 countries. The company has big plans to expand with its model. Online gaming is just phase one of its multi-prong strategy. Zong knows that moving into markets where physical and digital goods are purchased online (phase 2) will require a reduction in the processing fee percentage. But they already have millions of loyal consumers enrolled in their service which they can leverage to expand to merchants selling relatively low-priced products with reasonable margins (think: books, music, etc.)

Phase three takes things one step further as Zong’s strategy intersects with mobile payments at the physical point-of-sale. The idea is that consumers will use the Internet to research their next purchase, as they do today, and will buy the item online using Zong to place the charge on their mobile phone bill. That payment information is then stored in the cloud so that their customers can go to the physical store, pick up the item and show proof of purchase to the merchant.

That should keep traditional payment providers awake all summer long.

—————————————

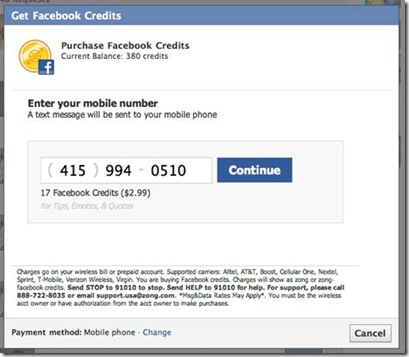

Purchasing Facebook credits with Zong

Step 1: Choose number of credits

Step 2: Enter mobile number

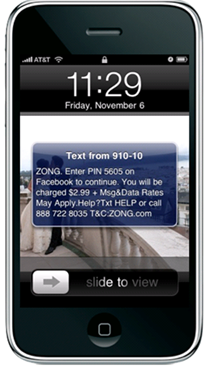

Step 3: Random 4-digit authorization PIN is sent via Text message

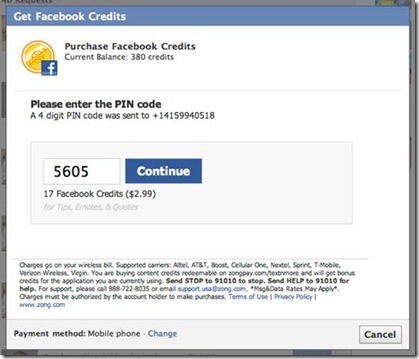

Step 4: The PIN is entered into Facebook

Final confirmation screen