Courtesy of a new partnership with authentication specialist Veridium (formerly known as Hoyos Labs), mobile banking customers of bunq, a mobile-only Dutch bank, will have access to 4 Fingers (4F) biometric authentication. The technology, 4 Fingers TouchlessID, is part of VeridiumID, and will be the first implementation of hand-recognition software in financial services.

Founder of bunq, CEO Ali Niknam, praised 4F as an “easy-to-use and safe banking experience,” and called deploying “the latest technology and biometric authentication solutions” part of fulfilling his mobile-only bank’s commitment to “giving people control over their money again.” Veridium COO Todd Shollenbarger added that Veridium’s “flexible, secure, and extendable” solution would scale well as bunq grew and expanded into new countries.

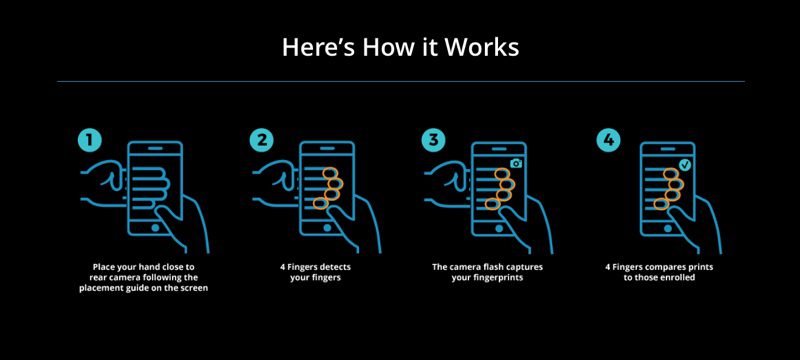

4F uses the rear camera on a smartphone to simultaneously capture the four fingerprints of the index, middle, ring, and little fingers. The four prints are compared to those stored and when the match is confirmed, access is granted. Veridium says that the 4F approach provides a more precise and reliable degree of certainty, as compared to face, voice, and single-fingerprint authentication methods.

New York City-based Veridium was founded in 2013 and demonstrated its technology (as Hoyos Labs) at FinovateFall 2014. The company’s products also include VeridiumAD, an enterprise-ready solution that provides Microsoft Active Directory environments with biometric authentication.