GoCardless has teamed up with TransferWise to launch the first global network for collecting recurring payments via bank debit, reports Jane Connolly of Fintech Futures (Finovate’s sister publication).

Customers of recurring payments fintech GoCardless will be able to collect subscriptions, invoices and installments in over 30 countries, without having to open a new bank account in every relevant country or pay large foreign currency receiving fees.

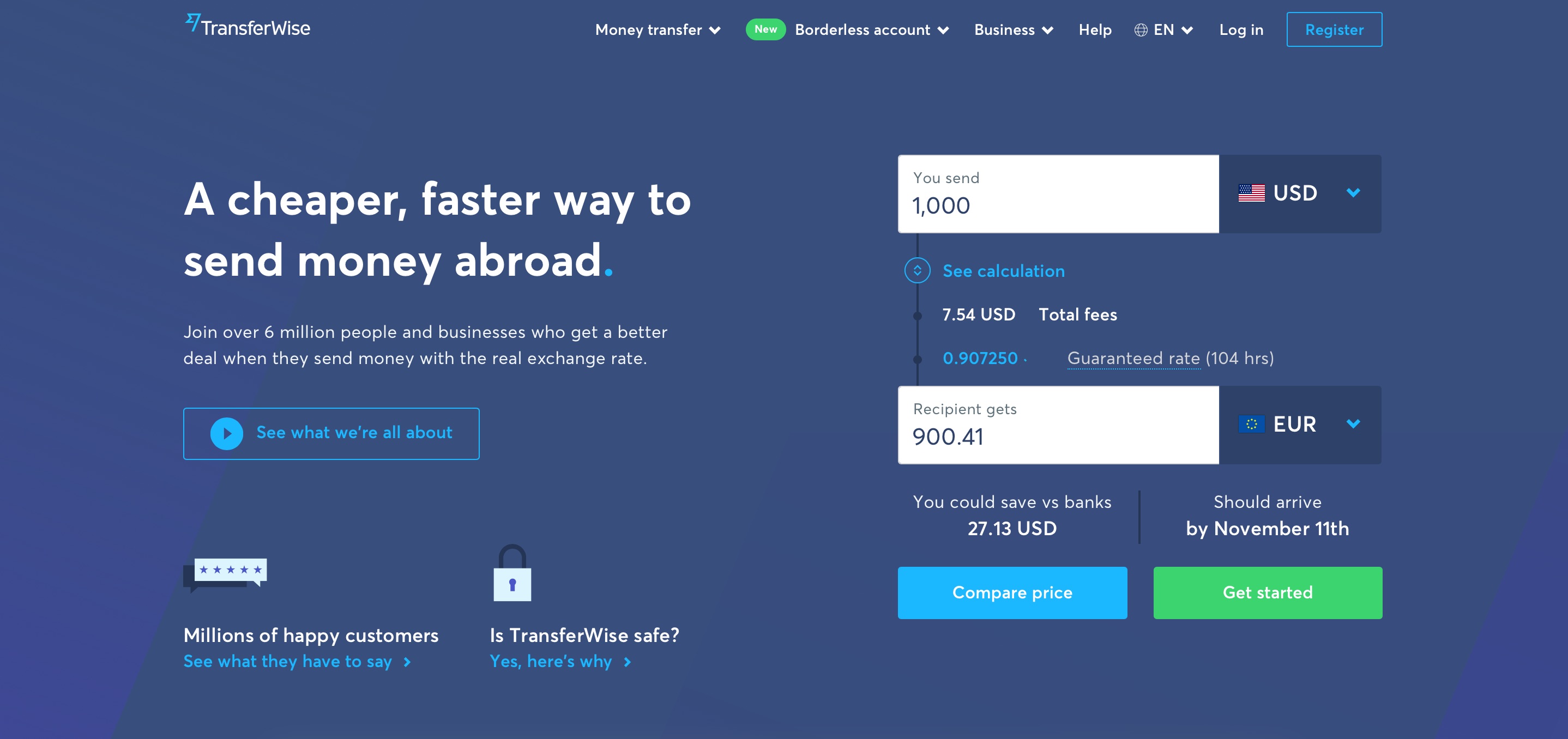

The new network enables customers to collect payments via multiple bank debit schemes around the world through the GoCardless API, dashboard or partner integrations. The partnership claims that a direct integration to the TransferWise API will provide low cost, convenient and transparent pricing.

“Businesses today have global ambitions, but an antiquated, fragmented and opaque payment system is holding them back,” said Hiroki Takeuchi, CEO and co-founder of GoCardless.

“Our new network represents a major milestone in our mission to fix this broken system. Companies of all sizes can now tap into the only global network for recurring payments, built on the tried and trusted method of bank debit, with real exchange rates powered by TransferWise. This will take the pain out of getting paid and enable every business to operate in a way that’s truly borderless.”

Taavet Hinrikus, chairman and co-founder of TransferWise, added: “Together, we’re setting the new standard for business banking, using new technology to offer cheaper, faster, more transparent services that truly meet the needs of today’s businesses.”

Rolling out in phases from mid-November, the network will allow businesses to receive payments at the real exchange rate in GBP, USD, EUR, SEK, DKK, CAD, AUD and NZD.

TransferWise demonstrated its platform at FinovateEurope 2013. Founded in 2010 and headquartered in London, U.K., the company has raised more than $772 million in funding from investors including Vitruvian Partners and Lone Pine Capital. The firm’s competitors include fellow Finovate alums Revolut and Currencycloud.