Looking at the entire universe (including self-employed and contractors),

for 2004 we project growth of 2 million new small business online banking

users, a slight decline from the 2.5 million who came online in 2003. And

the rate of growth, due to the higher base, will slow to 17% from

2003’s 28% (see Table 9, below).

Table 9

Forecast of U.S. Small, Microbusiness, and Self-Employed Online

Banking Usage

includes broadest definition of small business

users, population estimated at 23 million

Source: Online Banking Report projections based on industry data (+/-

30%), 3/04;

% OLB = percent of total population that is actively banking and/or paying

bills online (activity within past 6 months)

Table 10

OBR Forecast: Small Business Use of Online Banking

businesses with annual revenues from $50,000 to $10 million, not

including self-employed/contractors

Sources: 1998 to 2002 estimates, TNS Financial Services Small Business

Market Track, April ’03; (1) 1995 to 1997 and 2003 to 2013: Online

Banking Report estimates plus or minus 33%

The opportunity at your financial institution

For a rough approximation of the small business potential in

your market, use the national average business-to-consumer penetration. For

example, there are approximately 90 million U.S. households with bank

accounts. Therefore about 25% (23/90) are business owners. About 8% (7.3/90)

own businesses that are relatively easy to find via identifiable business

phone lines, D&B reports, compiled lists and so on. The difference, about 16

million, are harder-to-find self-employed and contractors.

Table 11

Estimating the Number of Microbusinesses in Your Market

Number of banking households in your market

(fill in)

Multiply by the percentage of all households that are microbusinesses

x 8% or 25%*

Approximate number of microbusinesses in your market

= _____

Source: Online Banking Report, 6/04 *Depends on whether you are looking

at all businesses including self-employed/contractors, or just the

larger small and microbusiness segment

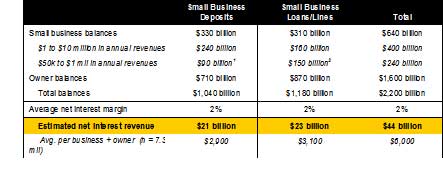

Total market size of balance-driven banking products

Looking at just the 1.2 million larger small businesses with

revenues from $1 million to $10 million (not including

self-employed/contractors), TNS Financial estimates total business deposits

of $240 billion and the total loans and lines of $160 billion for a total of

$400 billion. In addition, we estimated the microbusiness segment ($50k to

$1 million) has another $240 billion in deposits and loans. In addition, NFO

estimates that small- and microbusiness owners have another $1.6 trillion of

deposit and loan balances in their personal accounts, for a total of $2.2

trillion. Assuming a 200 basis point (2%) spread on the balances, the sector

is generating about $44 billion in net interest revenues, an average of

$6,000 per business/owner.

But, this only accounts the money paid out to financial

services companies. It ignores the significant internal and often hidden

costs associated with financial management: accounting, bookkeeping,

payroll, treasury, and so on. With the Web, banks have an opportunity to

compete not just for the traditional financial products, but also for the

entire financial operations of the business.

Table 12

Deposit and Loan Balances and Net Interest Margin from Small-and

Microbusinesses

Source: Small business ($1 to $10 million) segment and owner balances

from TNS Financial Services Group 2003 Small Business Studies, 4/03;

Microbusiness balances and average net interest margin are estimates from

Online Banking Report, accuracy estimated at plus 100%, minus 50%

1OBR estimate of $15,000 per microbusiness, n =

6.0 million

2OBR estimate of $25,000 per microbusiness, n =

6.0 million

Table 13

Small Business Assets by Type, Numbers and Balances

Source: Balances from TNS Financial Services Group (formerly NFO World

Group) 2003 Small Business Studies, 4/03

Table 14

Small Business Liabilities by Type, Numbers and Balances

Source: Balances from TNS Financial Services Group (formerly NFO World

Group) 2003 Small Business Studies, 4/03

Table 15

Misc. Product Usage

Source: Balances from TNS Financial Services Group (formerly NFO World

Group) 2003 Small Business Studies, 4/03

Table 16

Financial Products Purchased for Personal Use1 by Small

Business Owners

Warning: Small sample sizes of respondents with large balances may distort

the numbers.

Source: Balances from TNS Financial Services (formerly NFO World Group/PSI

Global) 2002 SOHO and

Small Business Owner Studies, 4/02; number of small and microbusinesses from

NFO’s 2003 Small Business Study, 4/03

Total population (N) = 7.3 million U.S. small and microbusinesses, not

including self-employed/contractors, OBR estimate +/- 20%

Does not include the value of the owner’s business, commercial real estate

investments, stock options, and other misc. categories

1Products used personally, not for the business

2Total market = (% using) x (average balance) x (7.3 million micro

and small business owners)

3Total balances only, does not include auto leases or insurance

4Across all business owners, users and non-users

5Net worth = personal assets less personal liabilities, does not

include net value of business or non-residential real estate holdings

6Total personal assets less value of residential real estate, does

not include net value of business or non-residential real estate