While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings.

While the term PFM is dead, the concept, employing software to watch over your finances, is more widespread than ever. It’s just called AI, spending management, or nothing at all since it’s now baked into many digital banking offerings.

However, automated spending management is still not widely used by customers because the big players don’t make it available by default, except Wells Fargo’s My Spending Report. So there is still room for new companies in this arena, especially if they invoke AI in their value proposition. And it doesn’t hurt to have celebrity business connections either.

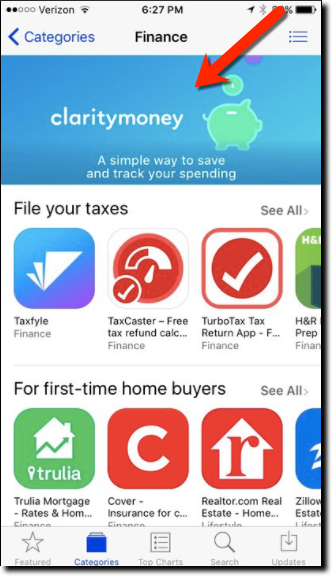

Enter Clarity Money into the crowded field. But with Michael Dell’s brother Adam as founder, and $3.5 million in funding from VC heavyweights Soros Fund, Maveron Partners and Bessemer Venture Capital, the mobile PFM startup has attracted a slew of press mentions (NY Times, TechCrunch, Business Insider, Bank Innovations, and a dozen more). But the biggest help to the fledgling business came a few weeks ago when Apple nam ed it a “new app we love” that pushed the app from nowhere to #16 (USA app store, free Finance apps). Today it is number 56 (see above).

ed it a “new app we love” that pushed the app from nowhere to #16 (USA app store, free Finance apps). Today it is number 56 (see above).

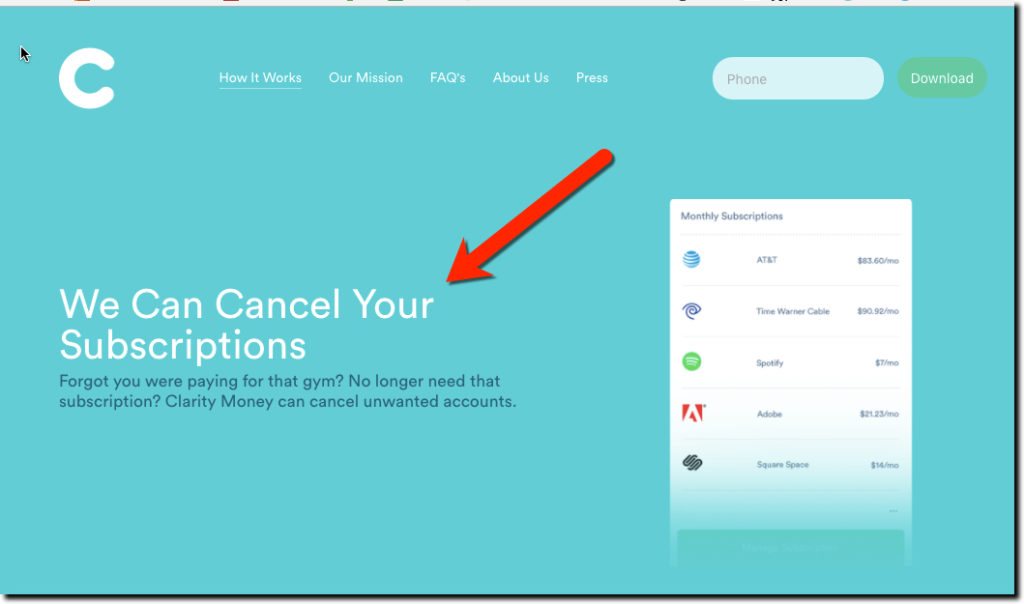

The mobile-only free service reminds us of BillGuard (acquired by Prosper) married to Moven, with a sprig of Mint on the side (see image posted to Clarity’s Instagram left). The value proposition is around monitoring transactions to save money on unneeded recurring services and/or bloated bills (in which the company takes a one-time commission on savings) while building a small nest egg in an integrated FDIC-insured savings account.

Bottom line: There’s much to learn from Clarity’s marketing messages, value proposition, and mobile-first build. If you don’t offer these benefits for customers, someone else will.

Consumer value prop

Consumer value prop

- Save money on bills

- Build a savings account

- Don’t get ripped off by unauthorized or unneeded recurring charges

- Keep your spending organizes

Business model

- Consumer loan lead gen (e.g., a Chase credit card is shown on a screenshot)

- Deposit spread

- Commission on bill savings

- Offers

Team (co-f0unders)

- Adam Dell, CEO, brother of Michael Dell (yes, THAT Michael Dell)

- Hossein Azari, Chief Data Scientist and formerly of Google Research

- Matt Jacob, VP of Engineering, formerly of CommonBond

Service providers:

- BillShark for bill savings

- Experian for credit and transaction monitoring

- Wells Fargo for savings accounts

Advisors:

- Dan Ariely, behavioral economist and popular TED speaker (7.8 million views)

- Niall Ferguson, author and historian

- Eric Johnson, Director of Decision Sciences at Columbia

Product roadmap

- Investing

- 401(k)s

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as

Principal of BUX Advisors, a financial services UX consultancy.