Small business loyalty

One consistent trait across all small businesses: loyalty.

Once you land one, it takes significant upheaval, such as a new commercial

loan relationship, before they make a move. NFO research indicates that 81%

of small businesses use the same bank for personal and business services.

And in a survey of Barlow Research clients, about 60% said they kept their

personal and business accounts at the same bank. Evidently, it’s just not

worth the entrepreneur’s time and energy to shop banks, unless they are in

the midst of raising capital. That’s why we believe it is vitally important

to establish a credit relationship with every small business customer

regardless of size.

However, high loyalty is not necessarily the same as high

satisfaction. According to NFO, in 2003 57% of small businesses are very

or extremely satisfied with their primary financial institution, up

from 50% in 2002. This is a mediocre score overall. And with the advent of

the online channel, it is easier than ever to shop around. And since only

22% of small business customers report being actively courted for their

deposits and investments, incumbent financial institution may be vulnerable.

Typically it has been the interaction between the business

owner and the commercial loan officer that has maintained, or sunk, the

relationship. Though personal relationships are still the primary factor,

electronic communications and online services are becoming important side

benefits. The savvy loan or banking officer can use email, instant

messaging, and a Web presence to supplement and extend the face-to-face

relationship. Staying in touch, asking for feedback, and identifying new

needs can all be done through frequent electronic communications.

Growth potential

|

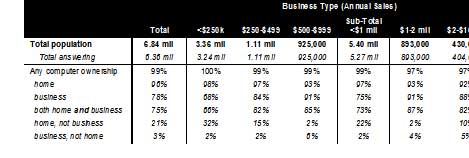

Table 17 Accounting Method by Small Business Type

Source: Online Banking Report, 5/04 |

The small and microbusiness market holds much promise for financial

institutions looking to grow revenues and profits. Smaller businesses, which

are almost 100% computerized (Table 18, next page), are particularly

well-suited for online delivery; however, since most lack dedicated

resources to handle banking matters, they can be reluctant to change

existing processes and procedures. Even though your bank’s latest online

feature may draw an enthusiastic response in focus groups, expect slow

adoption by small business clients. They are simply too busy to pay

attention to incremental banking improvements.

While banks and other financial providers have long coveted the small

business market, most have found it difficult to provide the high-touch

services needed by business owners at prices that a smaller business can

afford. However, we believe small business online banking offers a new

paradigm. Automated online tools and electronic communications such as

instant messaging and webinars, allow banks to deliver customized products

at affordable price points, both for the smallest home-office-based sole

proprietor as well as companies with hundreds of employees.

Table 18

Small business PC ownership

Source: NFO Financial Services Group SOHO/Small Business Owner 2002 Online

and Channel Use