London-based fintech Paysend announced late last week that it had reached its fundraising goal of $5.3 million (£4.2 million) after a three-day campaign on Seedrs. The company noted that more than 200 investors have participated in funding round, which was led by VC’s Plug & Play, Digital Space Ventures, and Marcorp Fintech. The funding puts Paysend’s total capital at more than $25 million and gives the company a valuation of more than $158 million (£1.25 million).

“We believe that (transferring money) should be as easy and immediate as sending an email, and finally the digital age is being able to facilitate this,” Paysend CEO Ronald Millar explained. He blamed the banking and payments industry for “conditioning” customers into believing that the difficulty of transferring money justified the complex process that most bank customers endure. “I have always been a firm believer that earning money can be tough but spending shouldn’t be,” Millar said.

The company said the funds will be used to fuel Paysend’s international expansion goals, including new partnerships with FIs. Paysend is currently active in 70 countries around the world, and Millar noted that the company is adding new customers at a pace of 2,000 a day. In fact, Paysend’s funding announcement comes as the company reports adding another six countries to its money transfer network. India, South Africa, Sri Lanka, Nepal, Pakistan, and Turkey are all slated to be brought onboard this year.

“We are on a major expansion path,” Millar told The Courier UK. “We’ve just launched the global account and we want to continue to grow the business and establish the operational team and launch more marketing.”

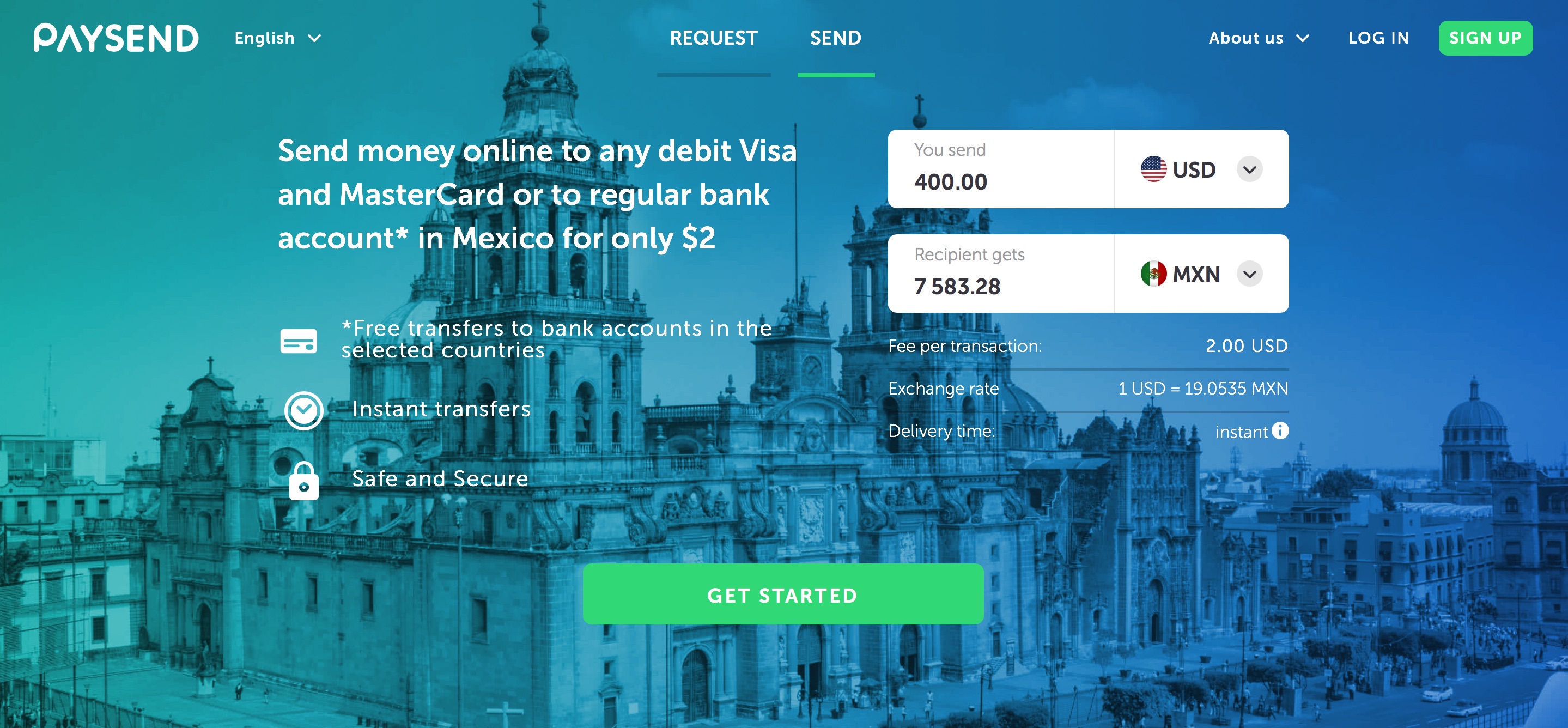

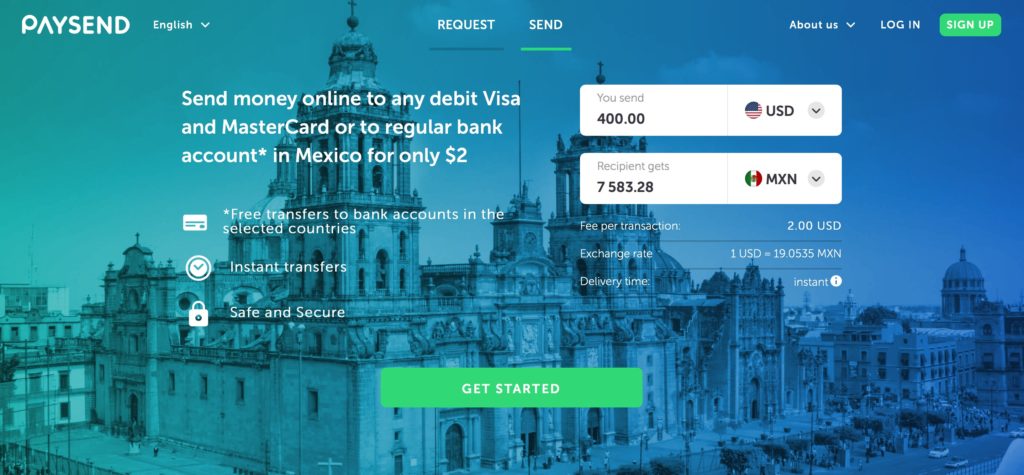

Founded in 2016 and headquartered in London, U.K., Paysend demonstrated its Global Account at FinovateSpring 2018. The solution enables users to store both fiat and crypto currencies in their wallet, exchange funds between currencies, send funds to other Global Accounts, and make payments from their account both online and in-person. The account comes with a prepaid card (both physical and virtual) that can be linked to the currencies in the user’s wallet, enabling them to make everyday transactions in the currency of their choice as easily as spending with a debit card. Users can also use their Global Account card to withdraw cash in 125 currencies.

Paysend has more than 750,000 users of its technology, and facilitates more than two million transactions a month. In May, the company announced the launch of its new payments app, Paysend Link, which enables users to send money to anyone, anywhere using only the recipient’s mobile phone number. Also in May, Paysend reported that its new stablecoin would be available on the Stellar Network this summer.