As the banking sector stands at the precipice of a new era powered by fintech innovation, mastering the rapid deployment of AI technologies is not just beneficial—it’s imperative. At FinovateSpring 2024, Chris Brown, President of Intelygenz USA, will share pivotal insights during his keynote on “Accelerating Bank-Fintech Fusion: Deep Tech & AI Solutions in Action.” However, the core themes of his talk resonate beyond the conference, offering valuable lessons for all financial institutions navigating the complex terrain of digital transformation.

Chris Brown’s address will confront a stark reality in the fintech space: while many AI projects begin with promise, few successfully bridge the gap from development to production. An overwhelming 85% of these initiatives falter, yet Intelygenz has carved a niche in ensuring projects land within the successful 15%. This capability is not just a differentiator but a strategic imperative that positions banks to lead rather than follow in the digital age.

The keynote will explore three strategic areas where AI can significantly impact banking operations, tailored to both conference attendees and the broader industry audience:

Building Data-Driven Architecture with AI

Leveraging AI to enhance data architectures transforms the foundational operations of banking. By integrating predictive analytics for credit scoring, automated compliance monitoring, and real-time fraud detection systems, banks can enhance decision-making, ensure compliance, and secure transactions, streamlining operations while significantly improving risk management and customer trust.

Streaming AI to Automate Day-to-Day Operations

The deployment of streaming AI moves the technology from a conceptual stage to an operational necessity, automating critical operations such as transaction monitoring and customer interactions. This shift not only boosts operational efficiency but also enhances the quality of customer service, providing real-time, actionable insights that empower banks to make informed decisions swiftly.

Implementing Human Experience-Centric AI Solutions

At the heart of technological advancements lies the need to enhance human interactions. By focusing on AI-driven enhancements in customer service operations and user interfaces, banks can forge deeper connections with their customers, resulting in increased loyalty and satisfaction. From AI-enhanced financial wellness programs to advanced biometric authentication and accessibility improvements, these technologies are reshaping how banks interact with their customers.

These areas underscore Intelygenz’s expertise in rapidly transitioning AI projects from development to deployment, ensuring they not only meet but exceed their intended goals swiftly.

For those attending FinovateSpring, Chris Brown’s session will not only illuminate pathways to leveraging AI but also provide practical insights into overcoming the implementation challenges often encountered by financial institutions. For the broader audience, these themes serve as a blueprint for understanding and deploying AI technologies effectively within their organizations.

For a deeper dive into these transformative strategies, attend Chris Brown’s session at FinovateSpring, or reach out directly via his contact details for more personalized insights and solutions from Intelygenz.

By embracing these insights, banks and Fintechs can ensure they not only participate in the digital revolution but lead it, transforming potential technological disruptions into opportunities for significant growth and customer satisfaction.

About Intelygenz:

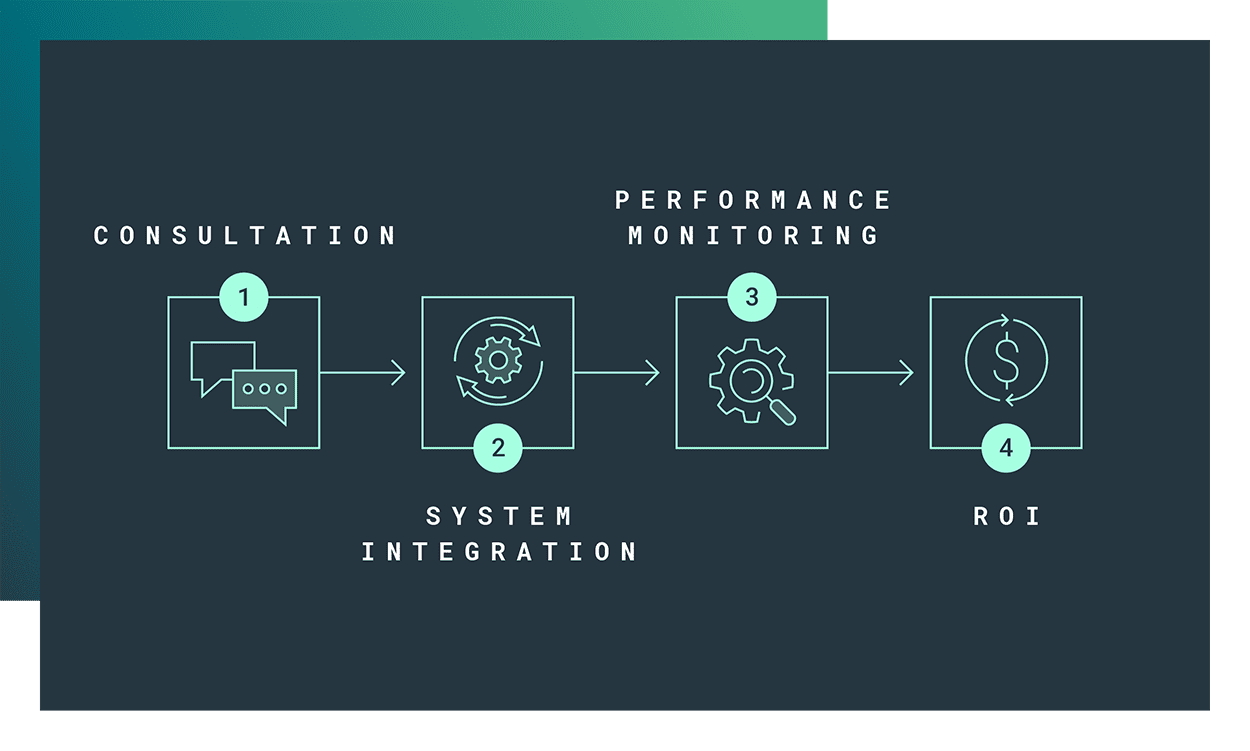

Intelygenz is a leading deep tech and AI services consultative company, specializing in delivering tailored solutions that leverage advanced technologies to drive business transformation in the banking and fintech sectors. With over two decades of expertise, Intelygenz specializes in enhancing operational efficiency and elevating customer engagement, thereby delivering measurable returns on investment. As a full-service end-to-end consultancy, Intelygenz collaborates closely with its clients’ internal teams from concept through to deployment, helping to develop, integrate, and maintain customized solutions.

Intelygenz’s key strength is its ability to facilitate rapid deployment, enabling its clients to realize tangible ROI within weeks, not months or years. Banks and fintech companies trust Intelygenz to tackle their most complex challenges, confident in the company’s capacity to support their teams in delivering critical AI-enabled projects on time and within budget.

To learn more about Intelygenz and how we can empower your organization, visit our website at Intelygenz Banking and Fintech Solutions.

About Chris Brown

Chris Brown, President at Intelygenz USA, is a seasoned leader in the AI and tech industry, specializing in transformative solutions for banking and fintech. Leading a team dedicated to innovation, Chris drives the development of tailored Deep Tech solutions to meet evolving client needs. LinkedIn