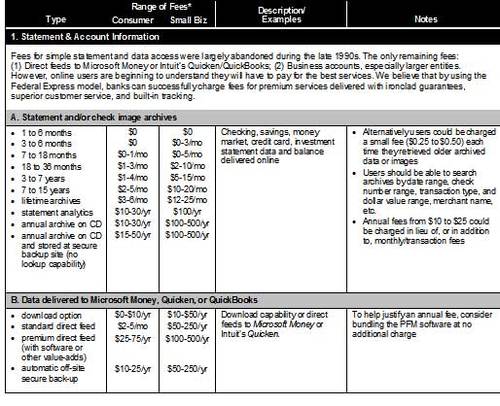

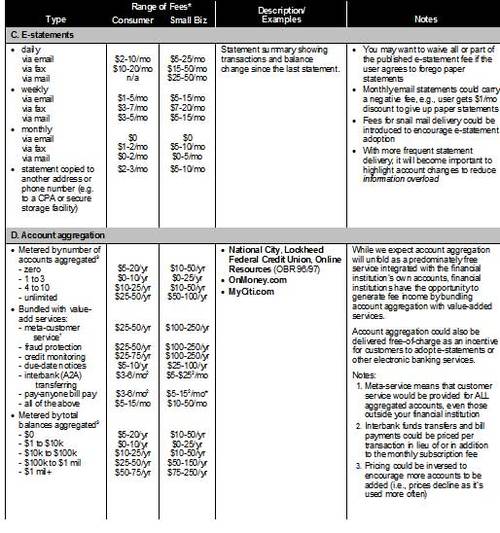

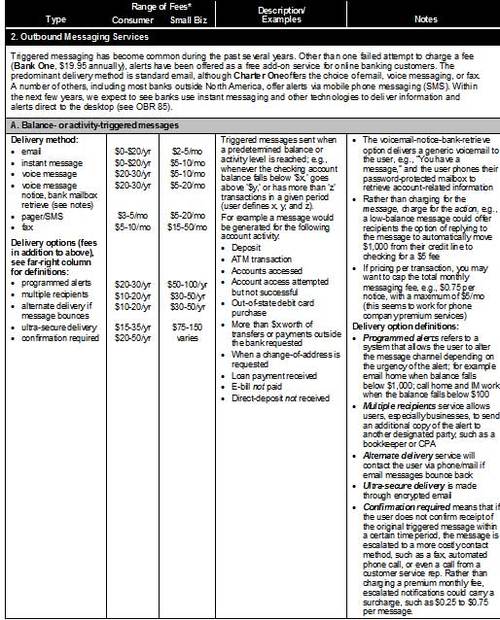

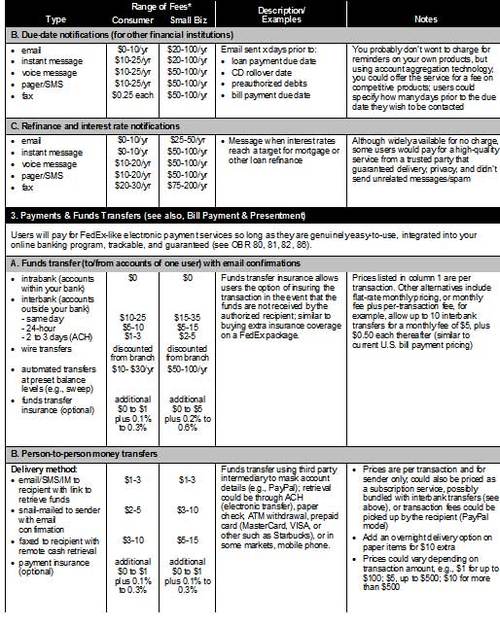

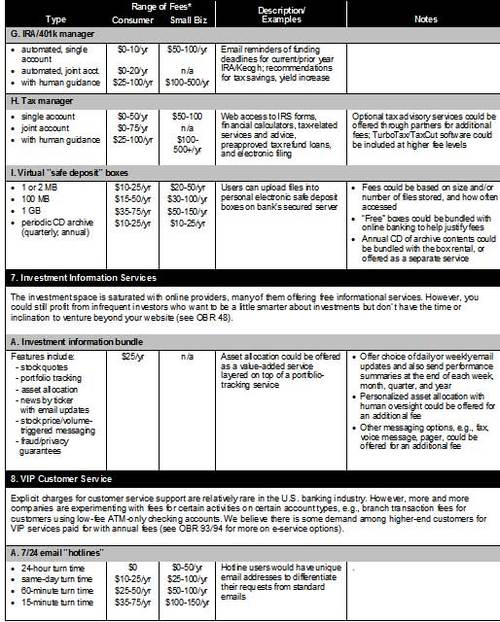

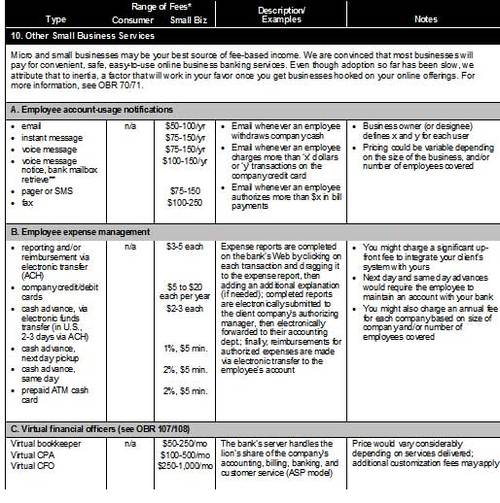

In the U.S., online banking fees have all but disappeared. Online account

access fees went by the wayside at the beginning of the Internet era (circa

1995) and bill pay fees have been disappearing in the wake of Bank of

America’s highly advertised strategic decision to give away bill payment

beginning in 2002. However, as we discussed last month, do not give

up the notion of charging for online services. On the contrary, as more

users go online, there is a much bigger market for premium services along

the lines of American Express and Federal Express. Following is our list of

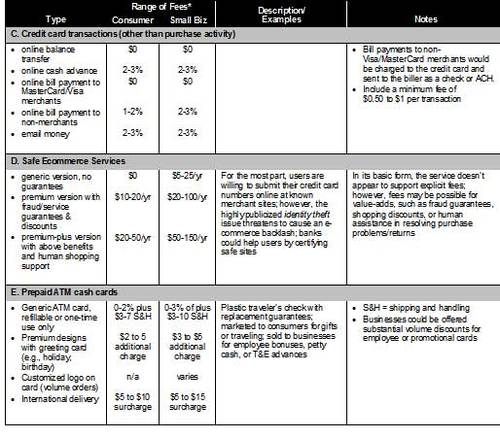

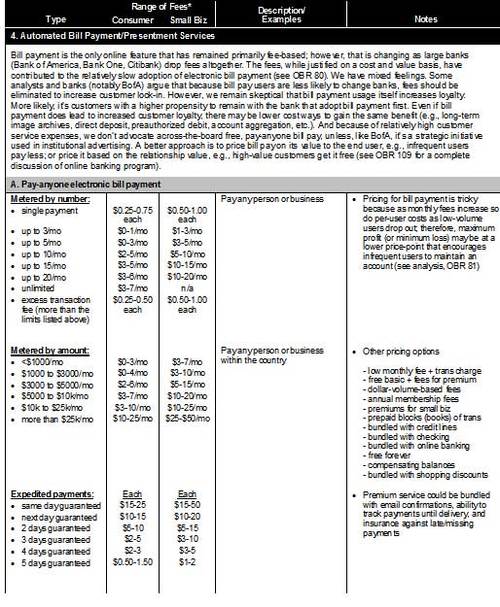

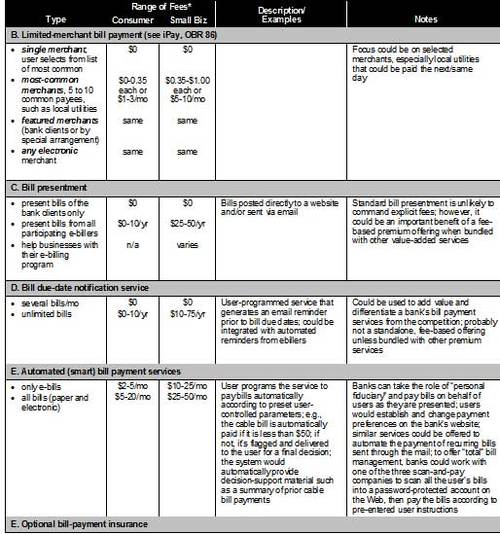

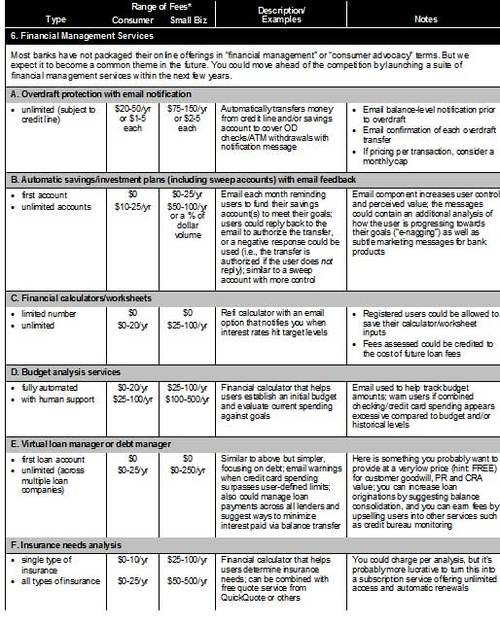

potential fee-based services and the range of potential charges. The “Low”

column lists the range of fees geared towards consumers, while the fees in

the “High” column are more appropriate for small businesses, which are much

less fee averse, and other high-end consumers.

Note: Commentary applies to the U.S. market only. Other international

markets have much different appetites for or against various fees.

Source: Online Banking Report, 9/04

Notes:

*The fees in the Low column are more appropriate for average consumer

users; the fees in the High column are more appropriate for micro and

small businesses, and some consumers with complex finances; for simplicity, we

have rounded most fees to the nearest whole dollar; however, common retail

pricing practices are to set prices below natural price points such as $9.95

instead of $10