With markets near all-time highs and Bitcoin teasing the $100,000 mark, investors have become increasingly interested in new opportunities to diversify their investments, reduce risk, and grow their wealth. Unfortunately, there are many assets — from cryptocurrencies to real estate to art — that can be difficult for investors to access and incorporate in their overall investment plan.

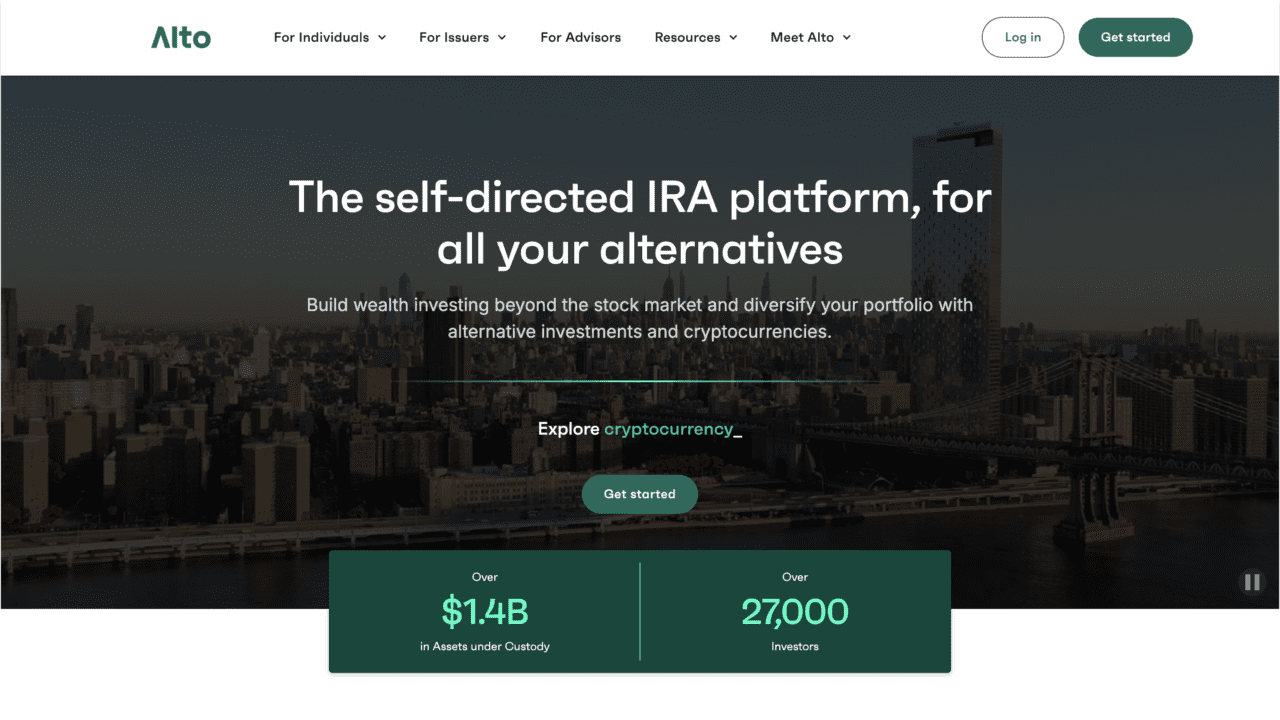

In this month’s column, I caught up with Scott Harrigan, President of Alto and CEO of Alto Securities. Alto provides a self-directed investment platform that empowers investors to build their wealth by investing not just in stocks, but also in alternative investments, including cryptocurrencies. The platform supports more than 27,000 investors and has more than $1.4 billion in assets under custody.

Alto has three primary divisions: Alto Solutions, a self-directed IRA administrator; Alto Securities, a wholly-owned registered broker-dealer; and Alto Capital, an exempt reporting advisor that provides alternative investment opportunities to accredited investors. Alto Solutions made its Finovate debut at FinovateFall 2023 in New York with founder and CEO Eric Satz leading a demo of the company’s Alto IRA offering.

In this conversation, Harrigan talks about the pain points investors have when trying to integrate alternative investments into their portfolios and what Alto does to help resolve these issues. We also talked about the opportunities a growing number of investors are seeing in crypto and the challenge of making historically difficult-to-access private investments available to a broader community of investors.

Headquartered in Nashville, Tennessee, Alto was founded in 2015.

What problem does Alto solve and who does it solve it for?

Scott Harrigan: Alto aims to lower the barrier to entry for alternative investments, making alternatives available within an IRA so investors can diversify their retirement savings, reap the benefits of reduced volatility, and have the potential to increase returns. Alto IRA account users can benefit from tax-advantaged investment options in a wide range of alternative assets, including private equity, venture capital, real estate, art, crypto and more, providing them with the opportunity to diversify their investment portfolio while planning for retirement.

How does Alto solve this problem better than other companies or solutions?

Harrigan: With the goal of lowering the barrier to entry, Alto addresses these two pain points: investors want to understand their various alternative investment options and they want easy access to these types of investments in a streamlined platform.

Alto is the only digitally native self-directed IRA provider with multiple alternative investment options. This is unique because many legacy IRA providers have been around for decades and continue to operate in the same fashion they always have, showing no urgency to grow or evolve. They are overlooking the importance of the digitally-oriented experiences that individuals demand these days. Alto understands the importance of being digital-first and bringing a seamless and enjoyable experience to investors.

As for providing multiple alternative investment options, we are forging diverse opportunities in how and where individuals invest their retirement dollars. Alto offers Traditional, Roth, and SEP IRAs so investors can select the right vehicle for their money based on their unique goals, and individuals have the option to put their retirement funds toward anything from biotech to bitcoin, wine to whiskey, and farmland to fine art.

Who are Alto’s primary customers and how do you reach them?

Harrigan: Our goal is to bring alternative investments to everyday investors, and we do this by removing the hurdles that have long prevented them from investing in this sector. There are three areas key to our success in expanding access and awareness. The first is expanding the number and type of investment opportunities offered, so that individuals have freedom of choice and can identify what options are right for them. The second is creating a user-friendly digital experience that makes investing in alternatives more approachable. Last, but certainly not least, is providing education, and disseminating more information and resources to help investors make confident investment decisions.

In addition to expanding our reach more broadly, we also curate opportunities for accredited investors. This past year, we launched Alto Marketplace, a new part of the Alto platform dedicated to curating private alternative investment opportunities for accredited investors. The platform allows eligible investors to invest in historically difficult-to-access private investments which are curated specifically by Alto. Investors now have access to private equity, venture capital, real estate, fine wine, art, and more, all in one platform.

Can you tell us about a favorite implementation or deployment of your technology?

Harrigan: Our technology provides investors access to unique investment opportunities in the alternatives space within an IRA. We provide opportunities for investors to build wealth beyond the stock market and diversify their retirement portfolio with alternative investments.

As part of our commitment to enabling individuals to invest in a wider variety of alternative assets, we were proud to go live with the Alto Marketplace this past year. Marketplace enables Alto’s users to enjoy a streamlined, consolidated investing experience as they explore offerings that range across a variety of different asset classes. Accredited investors can benefit from alternative assets that may offer portfolio diversification and a chance of achieving long-term financial stability in today’s volatile market.

What in your background gave you the confidence to tackle this challenge?

Harrigan: My experiences have helped me become deeply familiar with SEC and FINRA guidelines, critical to bringing fair, transparent and compliant opportunities to the everyday investor. Having worked in private markets for the past seven years, I gained a much deeper understanding of how alternative asset investment structures work and how we could work within regulatory guidelines to provide the access that we have today. Creating special purpose vehicles is complex, but we do it because we want to bring a modernized and simplified experience for investing in alternatives.

You recently announced a partnership with SignalRank? Why team up with SignalRank? What will this partnership accomplish?

Harrigan: As mentioned, we launched Alto Marketplace to curate exciting private alternative investment opportunities for investors. Partnering with SignalRank, the first private markets index made up of preferred Series B shares in high growth venture-backed companies, is in line with our commitment to provide investors with wider access to investment opportunities that, by nature, were formerly more exclusive.

We have had prior venture capital opportunities through our Marketplace, but SignalRank is unique in that its algorithm has successfully predicted successful transitions of Series B startups to billion dollar companies. This partnership will help us accomplish our goal to bring unique strategies that aren’t more widely publicly available, and have been largely limited to ultra-high-net-worth individuals and institutional investors, to more investors. Alto’s special purpose vehicles bring investors these opportunities at lower thresholds, for example by lowering the minimum investment to $25,000 whereas typically it might be closer to $500,000 or even higher.

What excites you about the growth of the alternative asset market? Is there an education gap to be covered in order to get more eligible individual investors interested in alternative assets?

Harrigan: I am excited about how we’re in the early days for the alternatives space. The industry is just starting to recognize how big alternative investments will become in the next five years. If you don’t know what this business is about, you’re going to need to, because this is where wealth management is headed in the next five years.

Because we are in the early days, there is absolutely an education gap. Our original study found that a lack of familiarity with alternative investments was the most significant barrier to investing in these assets as part of a diversified retirement portfolio. One common misconception is that the long-term nature required of some alternative assets is a drawback. However, there is a definite advantage in combining the tax efficiency of self-directed IRAs with the extended investment horizons of alternatives. This long-term alignment allows investments to compound and realize strong returns.

As alternatives are poised on this incredible growth trajectory, we’re excited to be ahead of the curve in providing education on how Alto IRA account users can benefit from tax-advantaged portfolios and outsized returns.

What are your goals for Alto? What can we expect to hear from you in the months to come?

Harrigan: In 2025, we expect to bring a much larger variety of alternative investments to our platform. In 2024, we launched 15 deals, so we expect to continue on this momentum and bring investors even more optionality and choice.

We’re also keeping an eye on the preferences of Gen Z and Millennials, two groups that research shows are engaging with investments differently than the generations before them. Notably, those aged 21 to 43 are currently more likely to choose alternatives over stocks.

Last, we will continue to advance our proficiency in how we educate investors. We feel a significant obligation to provide investors with as much information as possible so that they can make informed, confident decisions about their retirement savings. In line with this strategy, we plan to focus on scaling information about and access to Alto CryptoIRA. Crypto presents an immense opportunity for investors to diversify their portfolios and realize greater returns. We want to make more individuals aware of the opportunity they have to invest in crypto as part of an IRA.