“When banks compete, you win,” LendingTree is famous for saying. Now the same may be said of student loan refinancing, as well.

LendingTree unveiled its Student Loan Refinance Tool this week. The solution enables students to compare their student loans to see if they can save money by refinancing to a loan with lower rates and better terms. With some basic information about the current loan (balance, monthly payment, and interest rate) as well as the interest rate and loan term of the new loan, student borrowers can determine whether or not there are better loan options for them in a matter of minutes. “It is completely free to use, only takes a few minutes to get results, and can save people a lot of money by letting them optimize their student loans,” wrote LendingTree Content Specialist, Tom Sumrak in an email.

Pictured: LendingTree’s Gabe Dalporto (CMO and President, Lending) demonstrating My Lending Tree at FinovateSpring 2015.

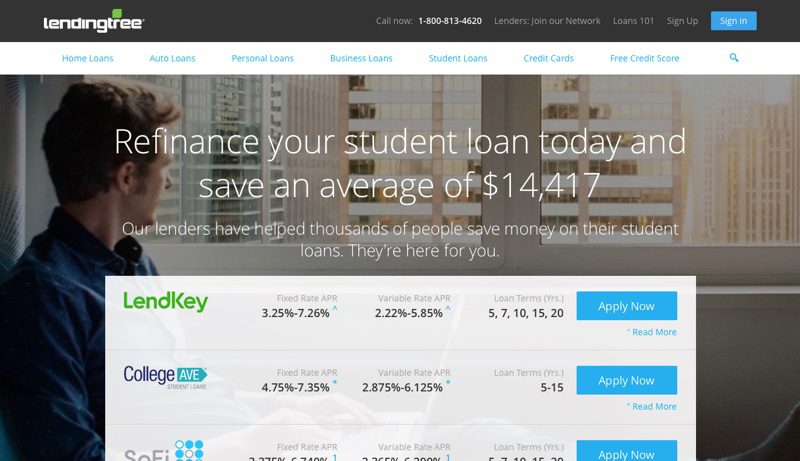

Students can follow up with LendingTree to take advantage of the average $14,417 the company has saved student borrowers over the life of their loans. In order to secure refinancing, students need a picture of their driver’s license, a paystub, and a picture of their current student loan. Students with bachelor’s, master’s, and doctorate degrees are all eligible for refinancing. Current employment and good credit are a plus.

LendingTree is now competing with newcomers such as SoFi, which launched as a student loan platform in 2011 and expanded to offer mortgages in 2014. Headquartered in Charlotte, North Carolina, LendingTree demonstrated its My Lending Tree personalized borrower’s platform at FinovateSpring 2015. In November, the company acquired credit card comparison and education portal, CompareCards, in a deal valued at $130 million. In September, LendingTree was named a top workplace by The Charlotte Observer, and in June, the firm launched its CRA-Eligibility Tool to make it easier for lenders to comply with the Community Reinvestment Act. With partnerships with more than 350 active lenders including Prosper Marketplace, Lending Club, and Quicken, LendingTree was included in our look at the emerging PropTech and MortgageTech sectors last month.