This post is part of our live coverage of FinovateSpring 2015.

Our next presenter is LendingTree with its personalization platform to help consumers save.

Our next presenter is LendingTree with its personalization platform to help consumers save.

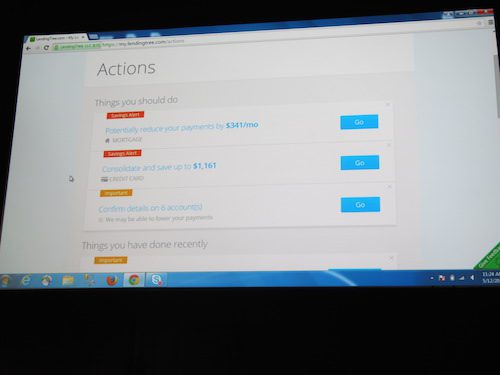

My LendingTree is a personalization platform with a dashboard to view all credit-related accounts. Using a proprietary, intelligent savings and recommendation engine, LendingTree alerts consumers when an opportunity emerges to save money, based on real-time data on the LendingTree network.

My LendingTree presenters: Nikul Patel, CTO, CPO; Gabe Dalporto, CMO, president

Product Launch: May 2015

Metrics: Employees: 220; Market Cap:$496.53M; stock price: $47.00 per share as of market close 2/25/15, up over 35% year-over-year; partnerships: more than 350 active lenders, including Wells Fargo, Prosper Marketplace, Lending Club, Quicken Loans, Discover, and more. To date, we’ve facilitated more than 35M loan requests and almost $300B in closed-loan transactions.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed.

HQ: Charlotte, North Carolina

Founded: N.A.

Website: lendingree.com

Twitter: @LendingTree