With the launch of Kabbage Payments, SME cash flow management solution provider Kabbage is ready to help small businesses get paid, as well as get funded.

“Since 2011, we’ve helped hundreds of thousands of small businesses access over $8 billion in funding,” Kabbage CEO Rob Frohwein said. “We know first-hand a primary need is to cover cash-flow gaps while waiting to be paid.”

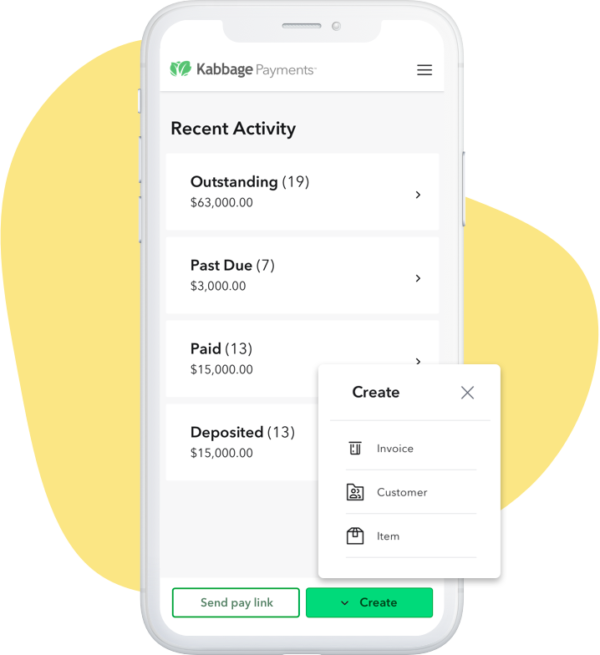

Currently available to Kabbage customers and scheduled for public availability “soon,” the new payment solution from Kabbage will feature no-fee, unlimited, online invoicing; next-day deposits; low costs for card payments (cash and check payments free); and a dashboard that provides a view of all payments activity in a single location.

One standout feature of the new solution is a custom pay link that is especially geared toward SMEs that rely on invoice payments. Customers using Kabbage Payments will be able to create a unique URL for their business that enables them to send payment requests by text, email, or the web to collect card payments. With this secure, fast, and flexible option, there is no need to create new accounts manually or open new payment orders, and avoids having to do duplicate work for recurring invoices.

“Kabbage Payments not only expands our suite of products, but the very definition of our company. We deeply believe in the mission of small businesses and understand what they need to succeed – namely, more time building their businesses and less time worrying about cash flow,” Frohwein said.

Businesses interested in the solution can reach out to Kabbage Payments and request early access.

Kabbage demonstrated its Kabbage Card offering at FinovateSpring 2015. Part of the company’s “Kabbage Everywhere” product expansion, the Kabbage Card makes it more convenient for small business owners to use their Kabbage line of credit while on the go. More recently, the company has launched an interactive index analyzing U.S. SME revenue trends, acquired small business insights firm Radius Intelligence, and closed a new, four-year, $200 million revolving credit facility. This transaction followed Kabbage’s massive $700 million securitization – the largest ever by a small business online lending platform – announced this spring.

Earlier this month, Kabbage announced that its customers had accessed more than $715 million in funding via its platform in Q3, and that 42,000+ unique customers were added year-to-date, which tops 2018’s 37,000 total customer gain. At the same time, the company noted that the core of its funding activity comes from repeat customers, who represent more than 75% of all funding activity on the platform and more than $6 billion of the $8+ billion accessed to date.

“It’s essential to have a business model that’s built on scalable long-term growth, and repeat business is a critical metric,” Frohwein said. He praised the platform’s ability to “re-underwrite customers daily,” providing SMEs with a 24/7 source of funding. “Thanks to the speed at which our technology allows us to serve them, we’ve seen record highs,” Frohwein said, “serving nearly 1,900 small businesses who have accessed over $13 million in a single day.”

Founded in 2009, Kabbage is headquartered in Atlanta, Georgia.