In gaining direct access to the U.K.’s Faster Payment scheme, Transferwise is the first non-bank to take advantage of a settlement directive from the Bank of England. The new policy, designed to add both competition and innovation to the country’s payment system, will give non-bank payment service providers (PSPs) direct access to the payment systems that settle in central bank money.

Accessible systems will include Faster Payments, Bacs, Chaps, Link, and Visa. The BoE’s new digital cheque imaging system, once activated, will also be available to non-bank PSPs. In addition to reducing processing costs, the move by TransferWise will enable it to leverage its new borderless accounts further by offering instant transfers to GBP. TransferWise customers paying with debit and credit cards will also benefit from TransferWise’s direct connection to RTGS (Real-Time Gross Settlement) and the Faster Payments scheme.

“Today is game changing for TransferWise and millions of our customers around the world. The Bank of England is giving tech companies the same rights to process payments as the retail banks – enabling us to cut out the middlemen and offer people a faster, cheaper service,” TransferWise CEO and co-founder Kristo Käärmann said. “I truly believe that money should move around the world as quickly and as cheaply as email, and this is a vital step on that journey.”

The company said the initiative will help provide a level playing field with banks and encouraged central banks around the world to pursue similar policies. Previous to gaining a settlement account in RTGS, TransferWise was relegated to using the traditional banking rails to access the fastest available system. Käärman told Reuters that his company has been seeking this kind of access for five years.

Ranked by The Financial Times on its FT 1,000 list of Europe’s fastest growing companies earlier this month, TransferWise demonstrated its technology at FinovateEurope 2013. Earlier this year, the company partnered with Wirecard to launch a debit card to accompany its new digital borderless account offering, and teamed up with Seedrs to power payroll for the crowdfunding platform.

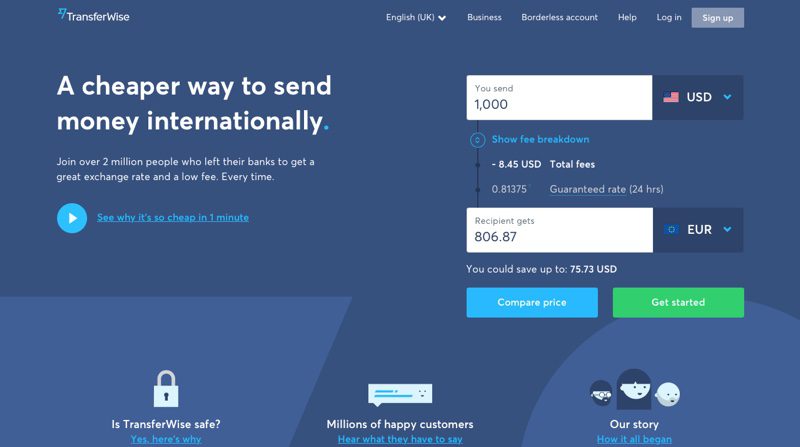

TransferWise has raised more than $396 million in funding, and includes Index Ventures, Andreessen Horowitz, Seedcamp, Institutional Venture Partners (IVP), IA Ventures, Valar Ventures, Bailie Gifford, and Old Mutual Global Investors among its equity holders. The company facilitates the transfer of more than $2 billion worldwide every month and claims savings of $80 million a month for consumers compared to transfers made using traditional banks.