A look at the companies demoing at FinovateFall on September 13-15, 2021. Register today and save your spot.

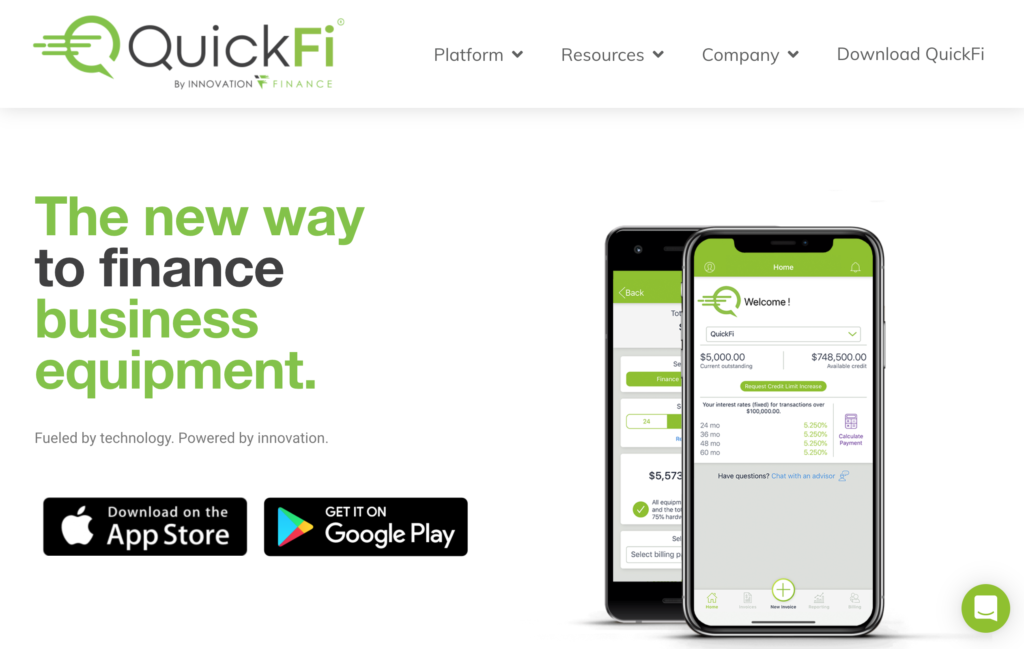

QuickFi allows business borrowers to obtain low, fixed rate business equipment term-loans in minutes, instead of days or weeks. The borrower completes the loan process on a mobile device, 24/7/365.

Features

- Flexible platform integrations for global manufacturers, serving direct, dealer, and e-commerce sales channels

- Stated, fixed interest rates with no hidden fees

- 24/7 equipment financing in 3 minutes

Why it’s great

The QuickFi platform is designed to dramatically improve the business borrower experience by enabling self-service, transparent, digital financing available 24/7/365, with no fees and no hidden costs.

Presenters

Nathan Gibbons, COO

Gibbons oversees the platform’s operational strategy, leveraging automation and technology to enable dramatic improvements to the borrower experience.

LinkedIn

Jillian Munson, Technology Project Manager

Munson leads core technology projects at QuickFi. She develops seamless user experiences for both internal and external business processes.

LinkedIn