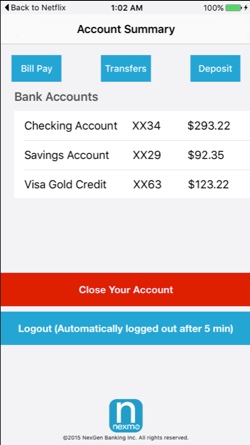

Adding better verification technology to banking and financial apps is a balancing act. One the one hand, there’s necessary friction that deters unauthorized access. On the other hand, however, too much friction quickly turns user experiences into user ordeals. In its Finovate debut in London earlier this year, Nexmo, a worldwide leader in cloud communications, demonstrated its solution to this challenge: an SDK that enables developers to add phone verification to their apps with a single function call.

Nexmo says its Verify SDK is the only white-label solution that “manages user identities across multiple devices and platforms without building a complex user-management backend and adds a new level of security by tying phone numbers to unique device IDs.”

Company facts:

- Founded in January 2010

- Headquartered in San Francisco, California

- Employs more than 160

- Works with more than 100 vendors around the world

- Directly connects to 350 carriers

- Key investors include Sorenson Capital, NHN Capital, and Initial Capital

- Recognized as a 2014 Cool Vendor in Communication Services by Gartner

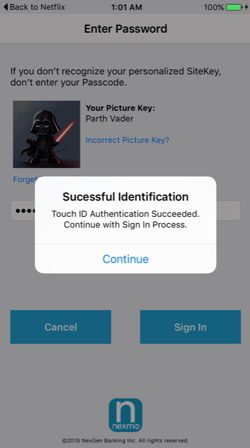

Pictured: Product Lead for Nexmo, Parth Awasthi demonstrated the Nexmo Verify SDK at FinovateEurope 2016 in London.

“At Nexmo we’ve built a verification solution, which is a turnkey product, available as an SDK, that allows you to seamlessly build strong authentication solutions inside your mobile banking app,” Nexmo Product Lead Parth Awasthi explained from the Finovate stage. Nexmo’s security solution focuses on the triumvirate of verification—something you have, something you know, and something you are—leveraging passwords, unique device IDs, TouchID, and more to provide consumers with the most friction-free, multifactor authentication possible.

——–

We spoke with Awasthi during conference week at FinovateEurope. Then we followed up with a few questions by email for more about Nexmo, its Verify SDK, and what to expect next from the company. Awasthi has been with Nexmo since 2014, and was previously a program manager at Microsoft.

We spoke with Awasthi during conference week at FinovateEurope. Then we followed up with a few questions by email for more about Nexmo, its Verify SDK, and what to expect next from the company. Awasthi has been with Nexmo since 2014, and was previously a program manager at Microsoft.

Finovate: What problems does Nexmo solve?

Parth Awasthi: Nexmo is a global cloud-communications platform leader providing innovative communication APIs and SDKs for voice, text, messaging and phone-verification services. Nexmo enables applications and retailers to communicate with their customers reliably and with ease, no matter where in the world they are located, effectively increasing efficiency, enhancing customer service and reducing overall processing costs.

Finovate: Who are your primary customers?

Finovate: Who are your primary customers?

Awasthi: Nexmo has more than a hundred thousand customers, and they are primarily from the fintech BitGold; retail/ecommerce like Alibaba; transportation/travel/hospitality like Airbnb; gaming like Garena and social markets like Viber.

Finovate: How does Nexmo’s technology solve the problem better?

Awasthi: Nexmo’s cloud communications APIs and SDKs are incredibly easy to implement and leverage the power of Nexmo’s unique global cloud communications platform. Only Nexmo has hundreds of direct-carrier relationships to reduce latency while using its Adaptive RoutingTM algorithm to continuously calculate millions of data points and find the most efficient route in near real-time. This all allows Nexmo to deliver messages with unmatched speed, efficiency and reliability rates.

Finovate: Tell us about your favorite implementation of your technology.

Awasthi: Our Verify SDK that I presented at Finovate London is a really cool product, and the way that Call Levels used it was pretty interesting. The Verify SDK is a turnkey solution that texts a one-time password to help verify the identity of someone. Call Levels—a financial monitoring service that sends immediate, strategic investment information—used the SDK to verify a customer from any device they want to use. This is a cool balance of safekeeping a person’s financials without making the barrier to entry too difficult.

Finovate: What in your background gave you the confidence to tackle this challenge?

Finovate: What in your background gave you the confidence to tackle this challenge?

Awasthi: We have verified more than 3.5 billion numbers, and help massive companies like WeChat verify users daily. This was a challenge that we were well prepared for.

Finovate: What are some upcoming initiatives from Nexmo that we can look forward to over the next few months?

Awasthi: We are constantly improving our performance through updates to our Adaptive Routing algorithm and making new direct-to-carrier relationships, and will be adding new features in the near future. Stay tuned to Nexmo.com for the latest news!

Finovate: Where do you see Nexmo a year or two from now?

Awasthi: In 2015, we nearly doubled the volume of our business (measured by API calls) and maintained a close focus on customer support, achieving an average customer satisfaction level of more than 85%. We’re looking forward to continuing this growth and pushing the boundaries of cloud communications right into 2018.

Check out the video of Nexmo’s FinovateEurope 2016 demonstration.