Leveraging machine learning and secure, federated data from its customer base and third-party vendors, Feedzai announced this week the release of its latest financial crime prevention solution, Risk Ledger.

Feedzai’s Risk Ledger uses the 30 million transactions processed by its system every day – including more than 100 different payment methods – to deliver a more accurate and comprehensive anti-fraud solution compared to siloed data offerings. By processing such a wide range and number of data elements (i.e., cards, IPs, merchants, emails) along the full cycle of the customer journey (from onboarding to compliance), Risk Ledger provides anti-fraud and anti-money laundering defense for all members of the payment process from issuers and acquirers to merchants and networks.

“Our goal has always been to make it harder and harder for fraudsters to hide, while making it easier for businesses to serve their loyal customers without friction,” Feedzai Head of Product Saurabh Bajaj explained. “As our customer base across the world continues to grow, the network effect of all of that data will only make Risk Ledger stronger.”

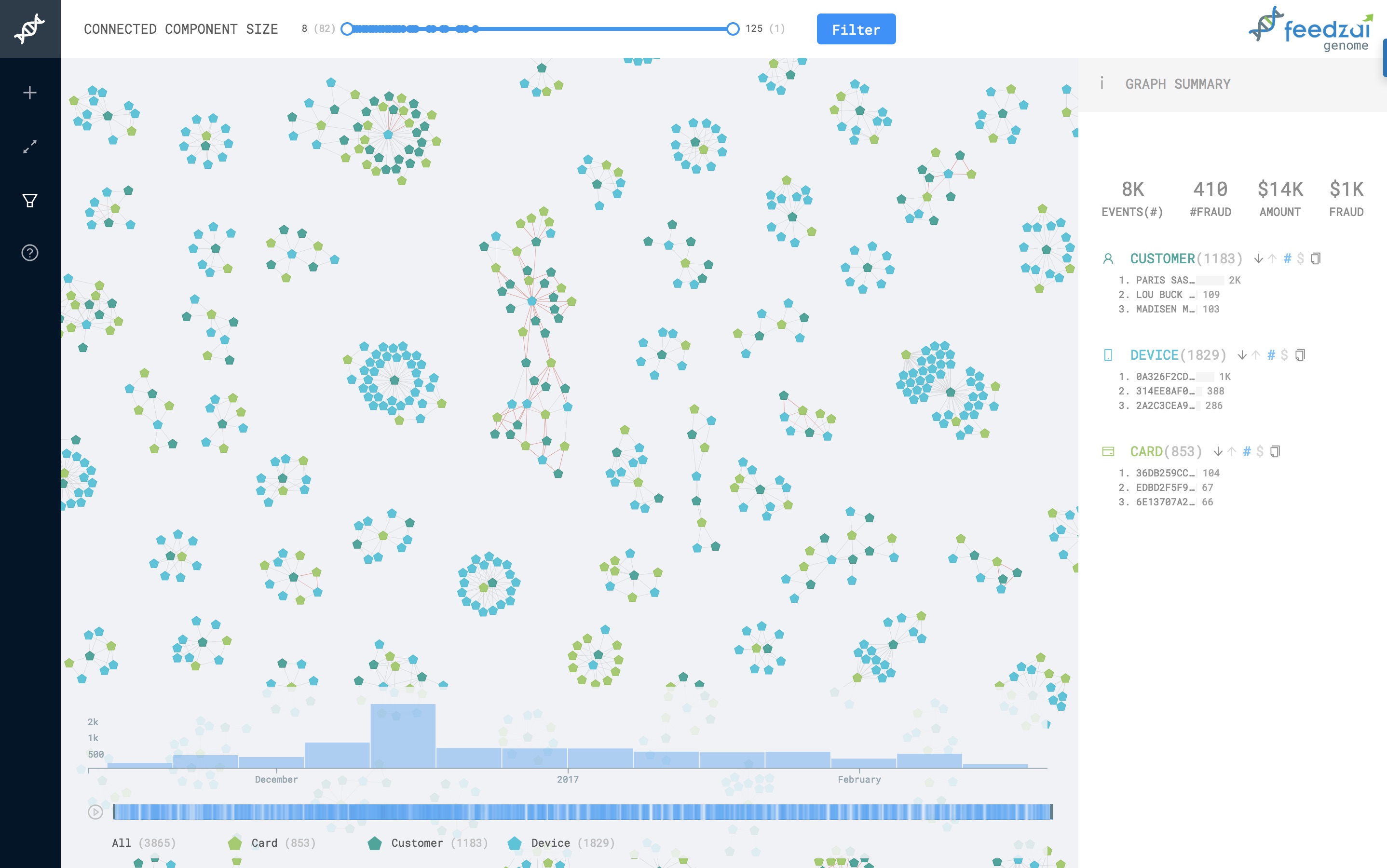

Risk Ledger is the latest solution from Feedzai designed to help fight financial crime. In October, the company unveiled Feedzai Genome, which enables financial fraud investigators to use link analysis graph technology to visualize and identify complex financial crime patterns and take action in real time. Powered by Feedzai’s advanced AI, Feedzai Genome learns over time, keeping pace with evolving AML and fraud typologies.

“Fraud patterns are getting more complex as criminals continue to get more sophisticated to avoid detection,” Feedzai CTO and co-founder Paulo Marques said when the technology was introduced. “Feedzai Genome gives our customers a full picture of financial crime so that they can fight it more effectively.”

With $5 billion in transactions scored daily, Feedzai serves ten of the largest 25 banks in the world, protecting 200 million people against cyberfraud. The company has raised $82 million in funding and includes Data Collective DCVC, Sapphire Ventures, Citi Ventures, and Oak HC/FT among its investors.

Earlier this year, Feedzai introduced its AutoML technology, leveraging machine learning to automate many of the most time-consuming processes for data scientists fighting cybercrime. In July, the company teamed up with Credorax, an e-commerce focused commercial bank, to help merchants better defend themselves against fraud.

Named to the Inc. 5,000 Europe roster for 2018 this summer and honored with a spot on the Forbes Fintech 50 at the beginning of the year, Feedzai demonstrated its fraud prevention technology at FinovateEurope 2014. The company was founded in 2008 and is based in San Mateo, California.