Innovative Upost@home provides real-time credit for

mailed deposit items

In a remarkably simple yet highly innovative service Pennsylvania State

Employees Credit Union (Harrisburg, PA; 290,000 members; 160,000 online

users) www.psecu.com

gives qualified members immediate credit for items “deposited” online.

Users logged into online banking simply choose the Move Money tab and

follow the simple instructions. Members then have 10 days to get the deposit

to the credit union via U.S. mail before the items are backed out. There is

no fee.

To limit fraud and errors, only about 20% of the CU’s member base is

eligible for the program. These 65,000 eligible members start with $1500 in

deposit credit, but it can be increased at the discretion of the credit

union to as much as $8000 based on usage. Deposited funds are immediately

available for use and earn interest from the day of the online deposit

entry.

History

PSECU has long used a similar system for ATM deposits offering credit as

high as $20,000. The online version Upost@home, the brainchild of VP

Tom Ruback, was launched in November 2001. However, until

recently it hadn’t been publicized widely outside its member base. Four

months ago a second CU, Pentagon Federal Credit Union’s http://www.penfed.org/

launched a service modeled on PSECU’s. Pentagon Federal’s Trust In

You program has tighter limits, beginning with only $750, and increasing

to $2500 based on usage.

Results

The CU already had experience with real-time credit of ATM deposits,

suffering minimal losses across its 68,000 users (making about 180,000

deposits/month). So it was confident members would continue to be

trustworthy through a similar online system.

The online version’s volumes are lower, but are building. In December,

nearly 11,000 members made 24,000 deposits, worth $10.5 million. In the

first two years, more than 19,000 members have made deposits of $125

million, $83 million of that in 2003. More importantly for anyone thinking

of recreating the program, the service has lost only $2000 to fraud, while

saving the CU more than $100,000 in interchange.

Active users average two deposit sessions per month, with each session

containing slightly less than two items, for a total of 3.8 items per month.

At an average of $260 per item, total monthly deposits average $1000 per

active user.

Consumer Benefits

Since it’s an unusual benefit, members often need coaxing to try the

feature. PSECU sends online banking users a letter explaining the service.

Follow-ups to non-users contain a $1.37 check that can only be deposited

through the Upost service. Repeat usage is high once members

experience the benefits.

Pros

- Added convenience of simply dropping deposits in the mail; no trip

to a branch or ATM, no waiting in line - Peace of mind knowing an image of each item will be available in

case of dispute - Earns interest immediately

- Can immediately withdraw cash or make payments with the virtual

deposit - A record of each deposited item is viewable within the check

register - Preaddressed envelopes are available at no charge (NOT prepaid)

Cons

- Must order or provide envelopes and locate and pay for stamps

- Must remember to mail within a few days

- Failure to mail deposit could result in negative balance and

bounced checks

Business Case

For a credit union serving 290,000 members through two branches (10 total

teller windows) and 20 deposit-taking ATMs, the remote deposit program is a

win-win. Members like it for all the reasons mentioned above, and the CU

saves more than $0.70 per deposit compared to foreign ATM interchange fees.*

The CU can continue to minimize its bricks and mortar costs (90% of its

members have never set foot on PSECU property) while offering an innovative

benefit to online banking users.

*The CU estimates each Upost deposit cost $1.16 to process

including an “inflated” value for lost float. In comparison, it pays

about $2 for each deposit put into a non-PSECU ATM.

Table 19

Deposit Float

calendar days to receive online deposits, 2003

Source: PSECU, 1/04, deposits processed Jan through Nov 2003

How it Works

Initiating a deposit online is a simple process:

1. Within the CU’s online banking area, members then choose the

Move Money tab (screenshot 1).

2. Choose Start to initiate a new deposit

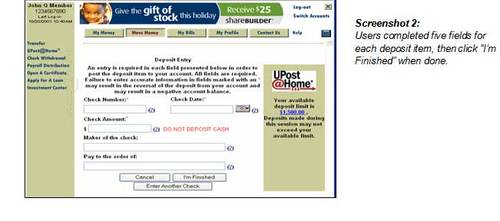

3. Member enters five fields: check number, date check written,

amount, who wrote it, who it was made out to (screenshot 2):

4. Repeat 3 for each deposit item, choose Finished

5. Write the session number in the space provided on pre-printed or

blank envelope

6. Drop the deposit into the mail

7. Deposited items are processed and images posted; the deposit line

is reset

Members receive instant credit for the deposit and can view deposit

details either through the Move Money interface, by selecting

Deposit Details, or by clicking on the deposit within their online

check register. Once the paper items have been processed, members can view

images of the deposited items.

The CU contacts the member by phone if the deposit has not been received

by the eighth day. In 2003, 81% of Upost deposits were received by

day four and more than 98% were received by day eight. Just five out of

every 1000 (0.5%) never arrived.

Table 20

PSECU Online Deposit Activity for 2003

Upost usage by PSECU

members

Source: PSECU, 1/04

Contacts

Greg Smith is CEO, [email protected]

Tom Ruback is VP Card Services,

[email protected]