There were many themes that fintech analysts expected to dominate this year. But there were few among them who had “Buy Now Pay Later” (BNPL) on their 2020 bingo cards.

From big recent M&A in the BNPL space to the rash of installment payment offerings recently launched by both fintechs and incumbent financial services companies alike, it is clear that Buy Now Pay Later is one of the hottest trends in fintech and e-commerce right now.

We thought this would be a good time to catch up with one of the leaders in the BNPL movement. QuadPay co-CEO and co-founder Brad Lindenberg shared with us his insights into what’s driving interest and excitement in the Buy Now Pay Later space, and what we can expect to see in the months and years to come.

Finovate: The Buy Now Pay Later phenomenon is one of the more unexpected developments in e-commerce this year. From the perspective of a company that’s been active in this space for years, what made the difference in 2020?

Brad Lindenberg: There are a number of factors in play that have led to the rapid ascent of buy now, pay later (BNPL) globally in 2020. First, consumers – particularly millennials – are wary of high interest credit cards and accruing additional debt. This concern was prevalent before 2020, as many millennials are saddled with student loan debt, but now has been heightened by the economic impact from COVID-19. The BNPL industry has been a major disruptor to credit cards and companies like QuadPay represent the new world of interest-free, transparent digital payment products.

Secondly, BNPL empowers retailers to provide their customers with flexibility to pay over time, which ultimately fosters customer loyalty, increases conversions, and a better customer experience. In the case of QuadPay, merchants that have implemented our BNPL product for e-commerce have seen a 20 percent increase in conversions and 60 percent increased average checkout value.

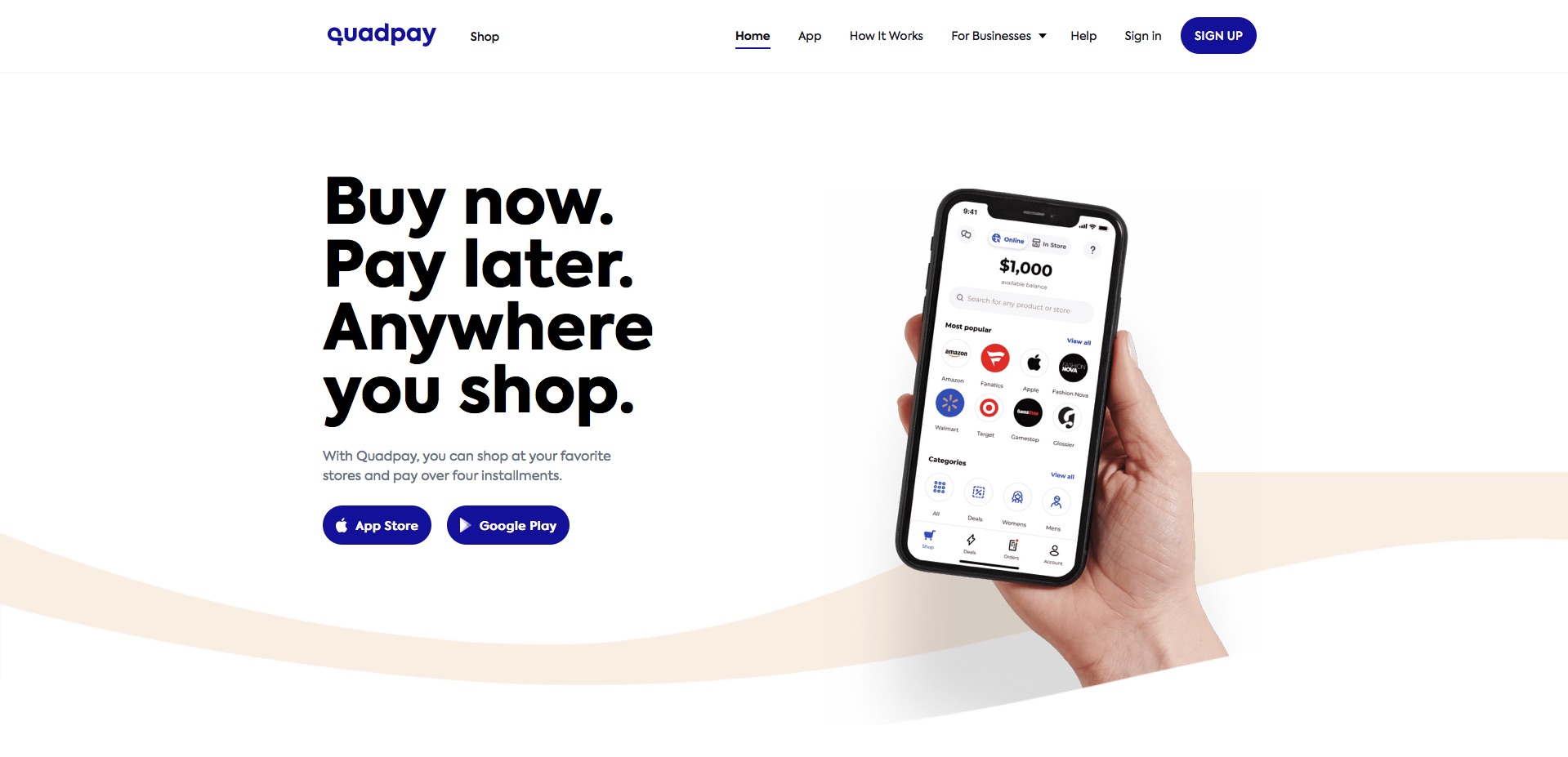

I would also point out that for QuadPay the BNPL phenomenon is not solely within e-commerce. With QuadPay, consumers can use BNPL to shop everywhere for everything – whether it’s online or in the-physical retail locations of the thousands of merchants on the QuadPay app. QuadPay has direct partnerships with 7,200 world-class retailers that are promoted within the QuadPay app to our four million and growing customer base in the U.S.

Finovate: We can’t talk about 2020 without talking about COVID. How has the pandemic affected both your company, and your company’s relationship with its customers?

Lindenberg: In many ways, QuadPay is the right company at the right time. Almost overnight the industry witnessed a drastic shift in consumer spending to focus almost exclusively online with retailers responding in kind to support that demand and QuadPay was able to facilitate those needs on both sides. We have built a digitally-forward payment product that fits the mobile-first lifestyle of today’s budget conscious consumers that can also be quickly and efficiently implemented by merchants across industries and of all sizes trying to adapt. We have experienced an uptick in interest in BNPL overall, but particularly from small and medium businesses – this has by far been our fastest growing vertical since the pandemic.

Finovate: In this increasingly competitive space, what does QuadPay offer that its competitors don’t?

Lindenberg: Competition is inevitable in a fast-growing and successful category like BNPL and serves as validation that the credit card industry is badly broken. The entry of new players has not changed our strategy or lessened our opportunity. We remain laser-focused on providing our users the best possible products fueled by our drive to innovate. Our recent merger with Aussie payments pioneer Zip Co. (ASX: Z1P) forged a $1 billion global fintech alliance and has us solidly positioned to continue our leadership position in this category.

QuadPay’s true differentiator remains innovation – we are the only installment platform that gives consumers the power to shop anywhere – at any retail location, on any website and with QuadPay’s integrated merchants on the app – and that’s a substantial advantage. We believe our recent partnerships with Fiserv, MasterCard Vyze and GameStop are key indicators of our continued mission to forge the future of BNPL.

Finovate: How easy is it for consumers to qualify for BNPL compared to traditional consumer financing options? Who is left “holding the bag” if the consumer does not hold up their end of the bargain?

Lindenberg: The BNPL qualification process is drastically modern compared to that of traditional consumer financing options. We leverage proprietary technology and algorithms to assess the eligibility of each applicant across a variety of variables and approval can happen within minutes. There is no hard inquiry to the consumer’s credit history. It is in our own interest to approve consumers for an amount commensurate with eligibility. Our platform caters to purchases between $35 – $1,000 so the risk is relatively small. Less than 2 percent of our customers are late to make repayments in any given month – far below the national average for delinquent credit card payment. And in the event they are unable to pay, they can no longer make purchases on the QuadPay platform.

Finovate: Some critics of BNPL say that, unlike old-fashioned layaway programs, Buy Now Pay Later encourages consumption at the expense of saving. How do you think we should understand BNPL in the overall context of individual financial wellness?

Lindenberg: Financial responsibility is built into our model. Our mission is to provide consumers a transparent, financially responsible way to expand their spending power without the debt-spiral of credit cards. Installment payments are set to be charged automatically on the due date, so customers can just sit back and relax without worrying about missing a payment. QuadPay sends SMS and email reminders before installments are due so customers can make sure they have enough funds available to cover an upcoming installment.

In the event a customer can’t make a payment, we can adjust their payment schedule at their request. And if they stop making payments all together, they can no longer use the platform for purchases until the balance is paid. It’s really that simple and easy. There’s no impact on the consumer’s credit score and no interest accrues which is the real driver of most debt. We are here to help, not hurt, consumers. In fact, we have seen many consumers leverage QuadPay to expand their spending power for things like groceries, personal care, and other essentials particularly during COVID-19.

We very much see QuadPay as a critical first step for many consumers to learn and implement overall healthier budgeting habits which could ultimately improve savings.

Finovate: You recently announced a partnership with Gamestop. What is the significance of this relationship?

Lindenberg: The GameStop partnership was rolled out just ahead of the highly-anticipated release and pre-order availability of the new Sony PlayStation 5. It serves as a great example of how retailers can really leverage flexible payment solutions like BNPL to get the latest and greatest products into the hands of an enthusiastic customer-base ahead of the 2020 holiday shopping season.

We are thrilled to be partnered with GameStop, the world’s largest video game retailer, as they look to provide their customers with a simple and flexible way to pay over time both online and at the point of sale inside their more than 3,300 U.S. retail locations.

Finovate: QuadPay has also received significant backing from Goldman Sachs and Oaktree recently. What does this relationship do for QuadPay going forward?

Lindenberg: QuadPay has secured a committed revolving line of credit of up to $200 million from Goldman Sachs, with mezzanine financing provided by Oaktree Capital. The support of two strong institutions like Goldman Sachs and Oaktree is a testament to QuadPay’s leadership position within the BNPL industry.

Finovate: What is the future of Buy Now Pay Later? As a consumer financing option, what innovations have yet to be brought to this space that we might see in the next few years?

Lindenberg: The future for BNPL is very bright. We are only in the nascent stages of adoption in the U.S. market and expect installment payments to become as ubiquitous as “Visa accepted here” logos at checkout or at the register in-store. Consumers will begin to expect merchants to offer interest-free, installment payments as an alternative to high interest credit cards. We also believe that as contactless payments become more widely accepted, BNPL will continue to flourish.

On our part, we will continue to introduce new features and capabilities that make it easier to search and find particular types of items across retailers so shoppers can find the best deals on the items they want. We recently acquired Urge, a retail search engine providing shoppers access to all the world’s leading brands, stores and online retailers in one place which will change the game for BNPL globally.

Photo by Miguel Á. Padriñán from Pexels