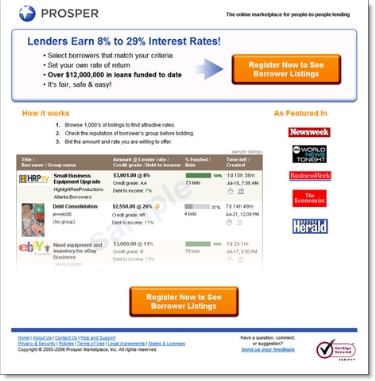

At its first annual user meeting, which kicked off today in San Francisco, Prosper unveiled a number of changes to its person-to-person lending exchange. The most interesting is that the site is no longer taking loan listings from all comers. They have eliminated the New Credit (NC) category and now require a minimum FICO score of 520 to participate (see email announcement below).

At its first annual user meeting, which kicked off today in San Francisco, Prosper unveiled a number of changes to its person-to-person lending exchange. The most interesting is that the site is no longer taking loan listings from all comers. They have eliminated the New Credit (NC) category and now require a minimum FICO score of 520 to participate (see email announcement below).

Neither change will affect loan-origination volume in a measurable way, since few of those loans were funded by investors. However, it does eliminate one of the feel-good aspects of the site, the ability for anyone to use it to start, or re-start, their credit history.

Price increase

But Prosper is first and foremost a for-profit business, so the policy change is not surprising. In the same vein, the company announced a price increase for riskier credits, doubling the loan-origination fee to 2% on high-risk (E & HR) loans, and doubling the annual servicing fee to 1% of the outstanding balance on on all but A and AA loans. Late payment fees also tripled from $5 to $15 each month. Finally, Group Leader rewards have increased up to four-fold, which will have the effect of raising rates for many borrowers.

But Prosper is first and foremost a for-profit business, so the policy change is not surprising. In the same vein, the company announced a price increase for riskier credits, doubling the loan-origination fee to 2% on high-risk (E & HR) loans, and doubling the annual servicing fee to 1% of the outstanding balance on on all but A and AA loans. Late payment fees also tripled from $5 to $15 each month. Finally, Group Leader rewards have increased up to four-fold, which will have the effect of raising rates for many borrowers.

Lender enhancements

Prosper also added several enhancements to assist lenders in evaluation loans, including:

Prosper also added several enhancements to assist lenders in evaluation loans, including:

- 100% identity-theft protection providing full refunds for fraudulent loan applications

- ROI estimator, a tool that uses historical Prosper data to project return on investment

- Public borrower Q&A: Like eBay, lenders can now ask borrowers specific questions, and the borrower can opt to answer the question with a public response to be displayed within the loan listing

- Additional credit report data: Six new fields are now available to lenders, making 12 credit bureau-sourced data points for each loan listing (see screenshot below). This is a huge change from a year ago, when only the letter grade was available to make lending decisions (Prosper's full explanation of credit data available is here).

Borrower enhancements

Although attracting lenders is the key to the company's survival, Prosper added a new feature to help borrowers make their loan listing more believable, member endorsements. Now, any Prosper member, including the Group Leader, can add an endorsement or testimonial to a loan listing (see Group Leader endorsement below; the full loan listing is reprinted in the Notes section).

Although attracting lenders is the key to the company's survival, Prosper added a new feature to help borrowers make their loan listing more believable, member endorsements. Now, any Prosper member, including the Group Leader, can add an endorsement or testimonial to a loan listing (see Group Leader endorsement below; the full loan listing is reprinted in the Notes section).

Borrowers can also show a list of "Prosper friends" to further enhance their credibility. The friends' network shows in the upper-right info box (see inset).

Notes:

- For a more detailed look at Prosper and person-to-person lending, refer to Online Banking Report #127.

- Previous NetBanker coverage is here.

- Full loan listing shows endorsement (at right, click to enlarge).

- Feb. 12 email announces the changes (see Lender section above, click on image to enlarge).

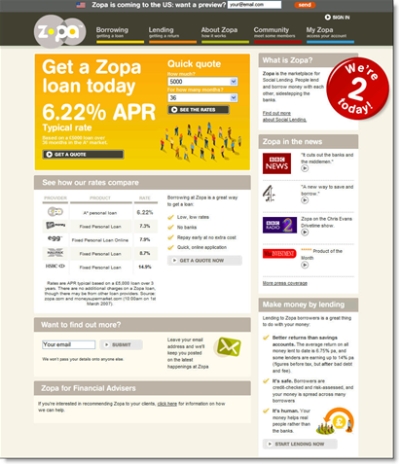

Since its September launch,

Since its September launch,