If you are looking to boost student-loan volume, you had better postpone that summer vacation. The upcoming July 1st interest-rate boost has created much FUD (fear, uncertainty, and doubt) for borrowers. The reason: existing borrowers have the opportunity to lock in the current rate of 5.3% on Stafford loans or 6.1% on PLUS if they consolidate their loans and refinance prior to July 1. After that, most lenders will raise rates on these loans by almost 2% to the new rate caps of 7.14% and 7.94% respectively.

If you are looking to boost student-loan volume, you had better postpone that summer vacation. The upcoming July 1st interest-rate boost has created much FUD (fear, uncertainty, and doubt) for borrowers. The reason: existing borrowers have the opportunity to lock in the current rate of 5.3% on Stafford loans or 6.1% on PLUS if they consolidate their loans and refinance prior to July 1. After that, most lenders will raise rates on these loans by almost 2% to the new rate caps of 7.14% and 7.94% respectively.

Unless you already have resources in place, it's probably too late to participate in the student loan refi boom. However, a high level of activity will continue through July and August as students and their parents look for money to cover that big tuition bill in September.

With the vast majority of college-bound teenagers using search engines, online marketing is a powerful way to find prospects. However, you won't be alone. A Google search today for "student loan" had 87 advertisers bidding on the term (see screenshot above). So it's going to take more than a simple ad buy to break out from the online crowd.

The top 10 advertisers on Google today for "student loan" (11 am PDT search from Seattle ISP):

- NextStudent.com (across top)

- loantolearn.com (across top)

- AstriveStudentLoans.com (across top)

- National City (right)

- CollegeLoanSite.com (right)

- GMAC Bank Funding (right)

- ScholarPoint.com (right)

- MyRichUncle (right)

- Key Bank Education (right)

- EducationFinancePartners.com (right)

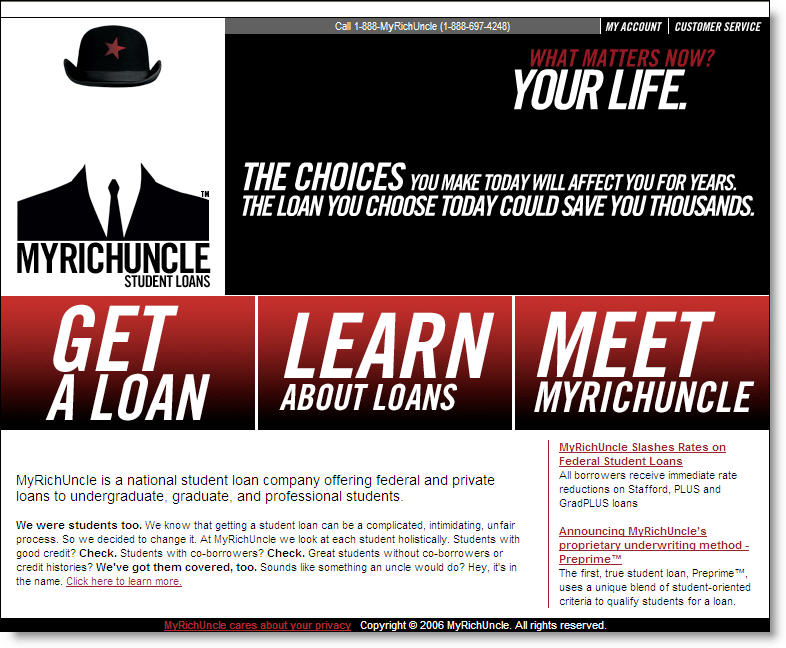

MyRichUncle If you look through these top advertisers, you'll see a number of innovative techniques for capturing loan applications or leads. One of the big innovators, advertiser #7, MyRichUncle (see screenshot right), has recently earned positive PR by announcing that it will continue to price its Stafford and Plus loans 1% to 1.75% BELOW the new July 1 maximum rates. The company even earned a nice Jane Kim sidebar in today's Wall Street Journal.

If you look through these top advertisers, you'll see a number of innovative techniques for capturing loan applications or leads. One of the big innovators, advertiser #7, MyRichUncle (see screenshot right), has recently earned positive PR by announcing that it will continue to price its Stafford and Plus loans 1% to 1.75% BELOW the new July 1 maximum rates. The company even earned a nice Jane Kim sidebar in today's Wall Street Journal.

Aside from its pricing and memorable name, MyRichUncle also does a good job of succinctly summarizing the available options and steering borrowers into the correct program. It even offers a Preprime loan option for students without credit histories or co-borrowers.

—JB