The best time to grab the attention of your online banking customers is immediately after they log in. Many financial institutions post offers and important information on a "splash screen" shown to customers before they see their account info. PayPal has been especially active in this area, placing new info in front of users every month or so for the past four years.

Where’s the second-best place to position an offer to online banking customers? In our view, it’s the screen displayed after successfully logging out. At that point, customers have completed their tasks, but you still have their attention as they wait to see that they’ve successfully ended their session. Last month, we looked at Bank of America’s preapproved credit card offer at logout (NetBanker Feb. 23).

Where’s the second-best place to position an offer to online banking customers? In our view, it’s the screen displayed after successfully logging out. At that point, customers have completed their tasks, but you still have their attention as they wait to see that they’ve successfully ended their session. Last month, we looked at Bank of America’s preapproved credit card offer at logout (NetBanker Feb. 23).

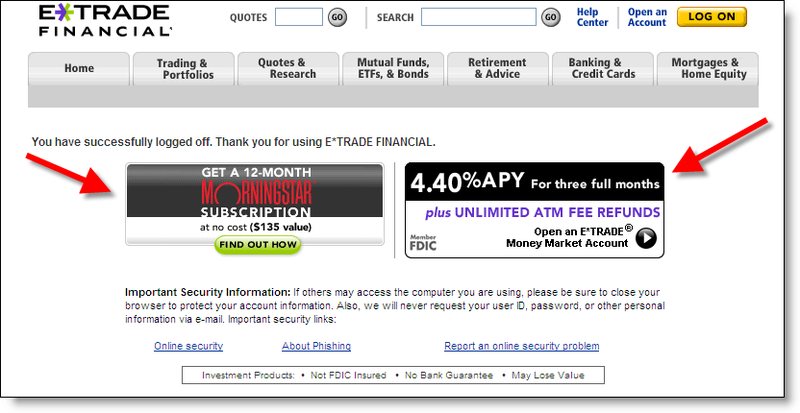

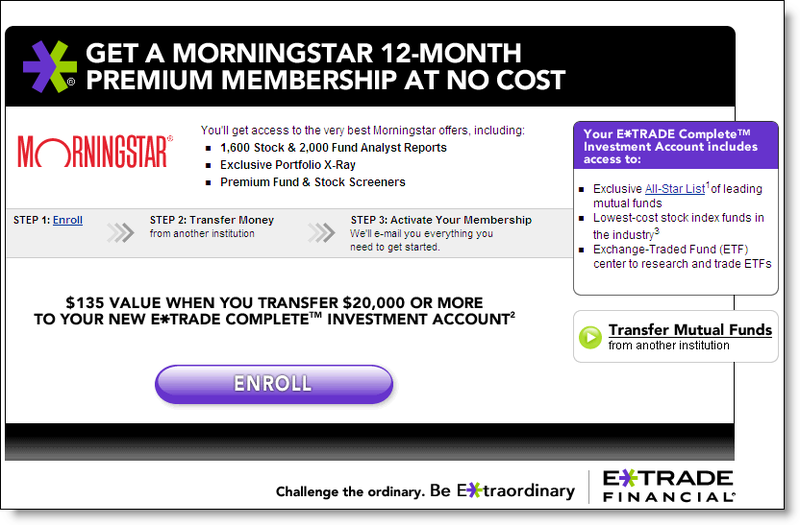

E*Trade is another financial institution using the logoff-screen real estate effectively. Today, they displayed two offers designed to attract additional customer assets to the bank (click on inset for a closeup):

- Free one-year subscription to MorningStar’s stock-information service ($135 value) for transferring $20,000 or more into a new E*Trade Complete Investment Account (see the landing page below)

- 4.4% teaser rate (good for three months) for deposits into the bank’s Money Market Account. New customers earn the rate on any deposit amount, existing customers must deposit $25,000 or more to earn the special rate. After three months, rates revert to the normal, 3.6% for $50k or more or 2.75% for $5k to $25k (see the landing page below).

MorningStar offer landing page >>>

–

––

4.4% APY offer landing page>>>

—JB