A look at the companies demoing at FinovateFall in New York on September 8 – 10. Register today using this link and save 20%.

Castellum.AI

Castellum.AI is a financial crime compliance platform with in-house risk data, AML/KYC screening, and AI agents. Through its use, institutions identify risk and take on business with confidence.

Features

- 83% less time reviewing AML alerts

- 94% reduction in false positives

- Instant AML alert adjudication

Who’s it for?

Community banks, BaaS sponsor banks, credit unions, fintechs, and crypto exchanges.

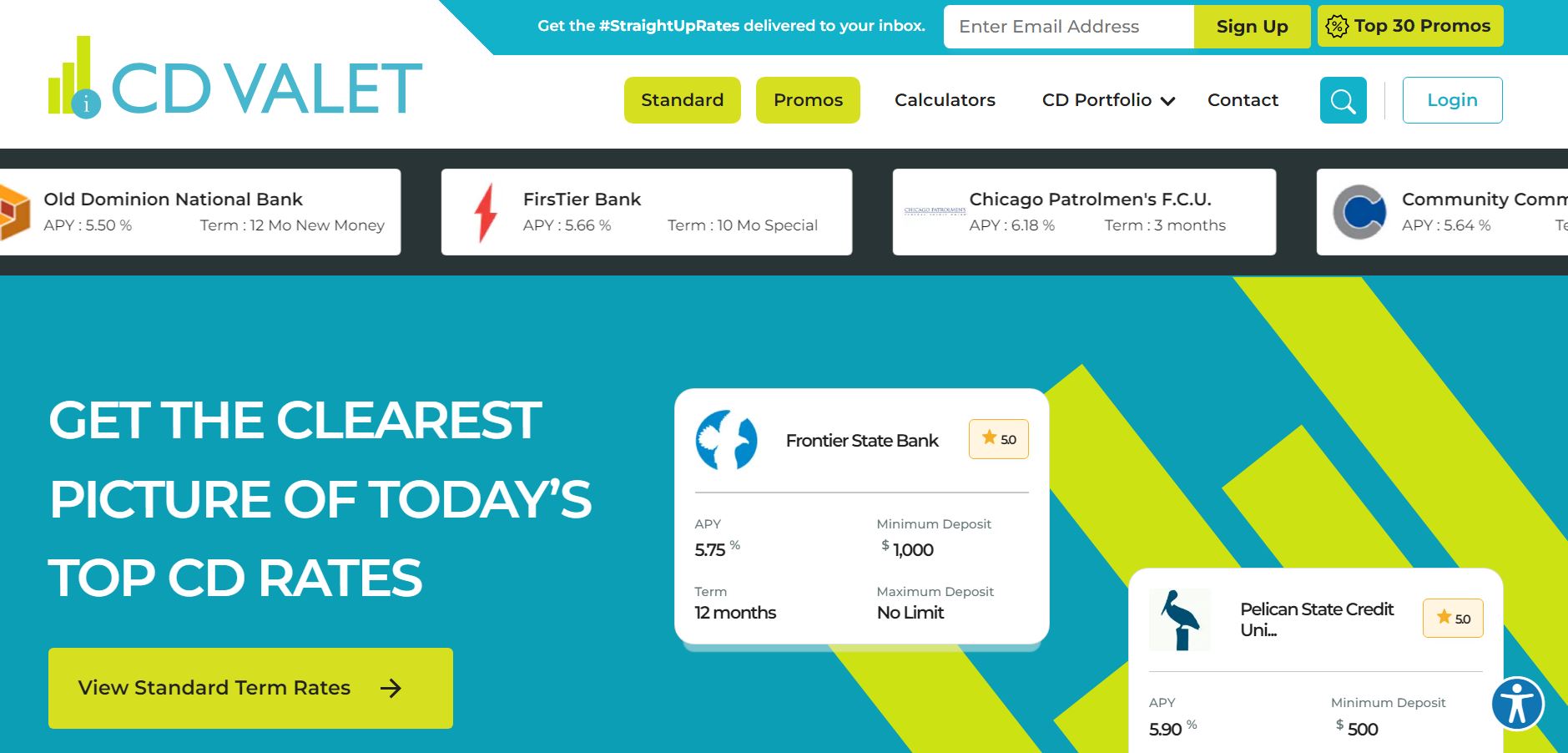

CD Valet

CD Valet is a digital marketplace connecting financial institutions with consumers to compare and open CDs with the best rates and terms nationwide.

Features

- Offers comprehensive data to price CD offers that win deposits

- Delivers insights that help users understand competitor strategies and consumer behavior

- Provides marketing services to help companies succeed on a digital marketplace

Who’s it for?

Credit unions and banks with $1B+ in assets, CMOs, and CFOs.

Charm Security

Charm Security is an AI-powered scam defense platform proactively protecting financial institutions and their customers from scams, social engineering, and human-centric fraud.

Features

- Delivers AI-powered scam defense agents

- Offers protection, prevention, and remediation of scams, social engineering, and human-centric fraud

- Reduces losses and operational costs

- Builds customer trust and company reputation

Who’s it for?

Banks, credit unions, and payment providers.

Fideo Intelligence

Fideo Intelligence’s Verify provides an AI-powered, unified series of real-time risk checks through a single API to help banks, financial institutions, and financial platforms proactively verify identities pre-KYC.

Features

- Comprehensive: Eight categories of checks per session

- Cost-Effective: Low-cost application, saving operational and fraud-related expenses

- AI-Powered: Dynamic, adaptive, real-time risk scoring

Who’s it for?

Financial services (including banks and credit unions), fintechs, and telecom companies.

Fravity

Fravity’s AI Agentic Copilot for investigations and operations in Fraud Risk and AML Compliance (FRAML) works alongside existing tools, acting as an AI expert to help investigate complex cases, enforce policies, perform investigative leg-work, and help users make faster, more accurate decisions with complete confidence.

Features

- Offers a catalog of tuned AI agents and workflows for FRAML investigations operations

- Provides Copilot as a plug-n-play browser extension for analysts

- Delivers an AI studio that lets users build their own agents and workflows

Who’s it for?

Banks, credit unions, payment providers, and fintechs.

Sequretek

Sequretek offers AI-powered, cloud-native, open, modular, and cost-effective solutions that simplify security and empower business growth.

Features

- Utilizes single console visibility

- Produces organizational risk scores

- Offers Defense-in-Breadth and Defense-in-Depth

- Provides asset threat mapping

- Delivers AI-based attack detection enhanced by GenAI analytics

Who’s it for?

Financial services, credit unions, community banks, healthcare, manufacturing, SMB’s, pharmaceuticals, retail, technology, and more.

Warrant

Warrant is an AI platform that reviews marketing content against 1,500+ regulations, flags risks instantly, and streamlines approvals and recordkeeping to keep teams compliant.

Features

- Flags risks instantly across 1,500+ regulations with AI compliance checks

- Delivers faster approvals, cutting review time down from weeks to minutes

- Reduces labor costs, savings average $200K+ annually

Who’s it for?

Banks and credit unions.