One thing about operating in competitive markets, when one player hits on a good idea, it’s not long before others follow suit.

One thing about operating in competitive markets, when one player hits on a good idea, it’s not long before others follow suit.

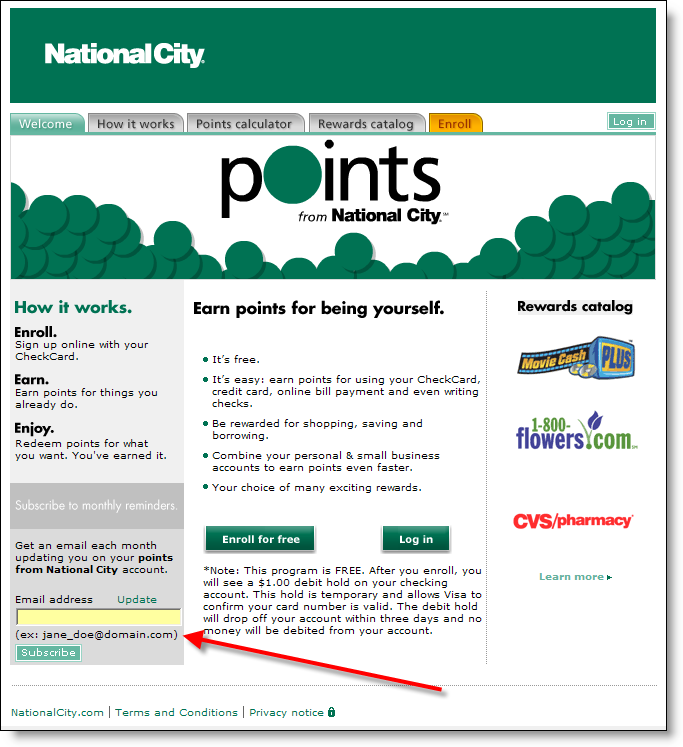

It looks like National City <nationalcity.com> wins the honor of first-to-copy-Citi-Thankyou-Points. The Cleveland-based bank today unveiled its comprehensive Points program <nationalcity.com/points> with a multi-media barrage including television, print, billboard, and transit ads. Its website includes a large, animated points-gathering graphic in the upper right (see the series below).

With rewards ranging from a $5 Starbucks card (2000 points) to cruises (420,000 points), there is something for everyone. The standard domestic round-trip air ticket runs 100,000 points. The program covers both personal and business accounts allowing, according to the company, a typical business owner to amass 140,000 points per year across both personal and business accounts.

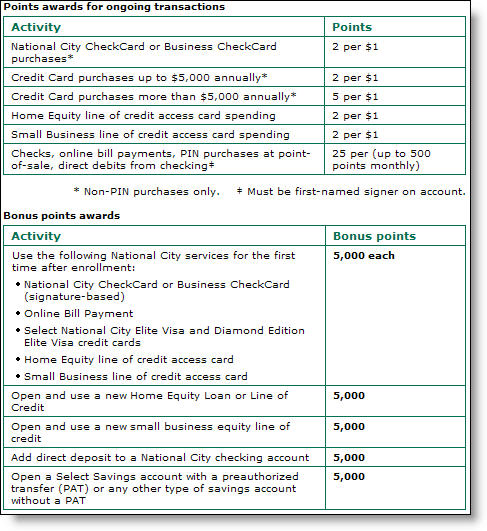

The program revolves around spending, paying two points per $1 spent on a National City credit, signature debit card, or line of credit. Card customers can also earn five points per dollar once they surpass $5000 in annual spending, enough to earn round-trip airfare with every $20,000 spent.

Checking account customers also earn 25 points per bill payment, PIN-debit purchase, paper check, or direct debit (ACH) transaction. The 25-point transactions are capped at 500 points per month, the equivalent of $250 in credit card spending. There are also 5000-point bonuses for new accounts including online bill payment (click on the table for details).

Checking account customers also earn 25 points per bill payment, PIN-debit purchase, paper check, or direct debit (ACH) transaction. The 25-point transactions are capped at 500 points per month, the equivalent of $250 in credit card spending. There are also 5000-point bonuses for new accounts including online bill payment (click on the table for details).

Analysis

While the program is primarily a card-based rewards program, it’s good to see online bill payment included, even at minimal points levels. A typical household paying eight bills online per month would earn enough for a grande mocha at Starbucks, about once every 10 or 11 months. It’s not a lot, but we believe it’s enough to matter, especially combined with the other reward opportunities.

However, we believe the bank erred in including paper checks in the program. Clearly, the points are about rewarding the use of electronic payments and transactions, especially those that lead to credit balances. In throwing a bone to traditional check writers, the bank eliminates much of the incentive to migrate transactions to electronic channels, since the 500-point monthly cap means that once someone writes 20 paper checks (at 25 points each), there are essentially no points for electronic transactions.

However, we believe the bank erred in including paper checks in the program. Clearly, the points are about rewarding the use of electronic payments and transactions, especially those that lead to credit balances. In throwing a bone to traditional check writers, the bank eliminates much of the incentive to migrate transactions to electronic channels, since the 500-point monthly cap means that once someone writes 20 paper checks (at 25 points each), there are essentially no points for electronic transactions.

Users can sign up for a monthly email update on their points balance. The bank makes it easy with a one-line entry form on the main "Points" page (click on inset for a closeup). After inputting their email address, users are sent to a short form to add their full name and card number.

For more information on rewards programs, click here for previous NetBanker articles.