A look at the companies demoing at FinovateSpring in San Francisco on May 23 and 24. Register today and save your spot.

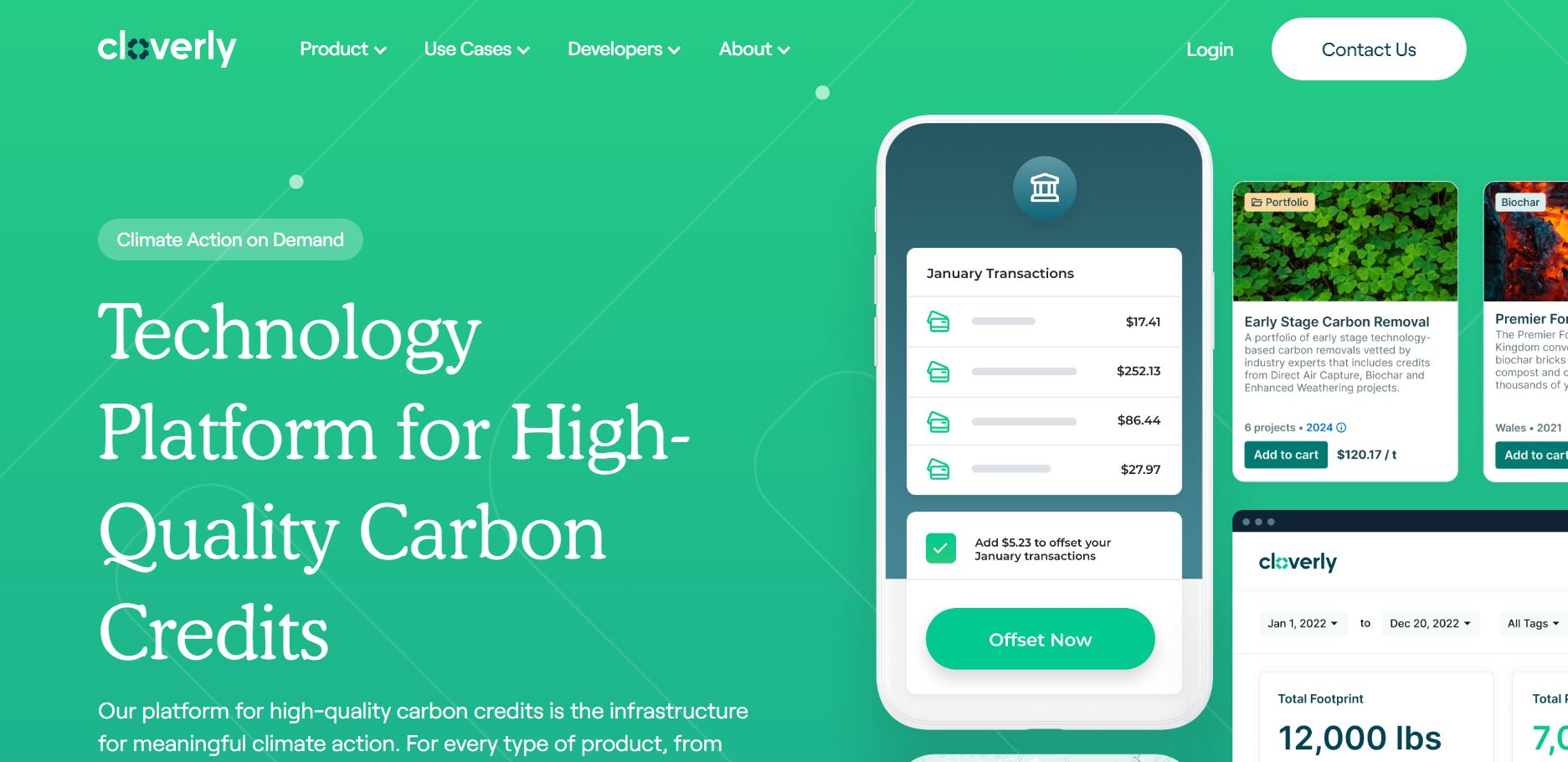

Cloverly is a technology platform for integrating climate action into financial products and is trusted by several financial institutions, like Visa, American Express, ecolytiq, and more.

Features

- Flexible API for building innovative products

- White-labeled marketplace and dashboard for commercial customers

- No-code checkout feature for easy integrations

Why it’s great

Integrating climate into a company’s financial product is a high-impact, positive ROI initiative that is made effortless with Cloverly’s technology.

Presenters

Christina Kaney, Director of Climate Solutions

Kaney focuses on financial services and was previously with Microsoft. She is an entrepreneur, a talented dancer, and an awkward ginger.

LinkedIn