A look at the companies demoing at FinovateEurope on March 15 digitally and live in London on March 22 and 23, 2022. Register today and save your spot.

MoEngage is an insights-led customer engagement platform that enables brands to personalize experiences across relevant channels and helps marketers build strong relationships throughout the customer experience.

Features

- Unified Customer View

- Enhanced customer profile and real-time insight into preferences and behavior

- Predictions and RFM – Customer Segmentation with the RFM Model and Predictive AI

Why it’s great

Enterprise-grade platform with scalability, security, and compliance. It processes 1 trillion data points per month, sends 80 billion messages, 1 billion emails, and engages 900 million MAUs.

Presenters

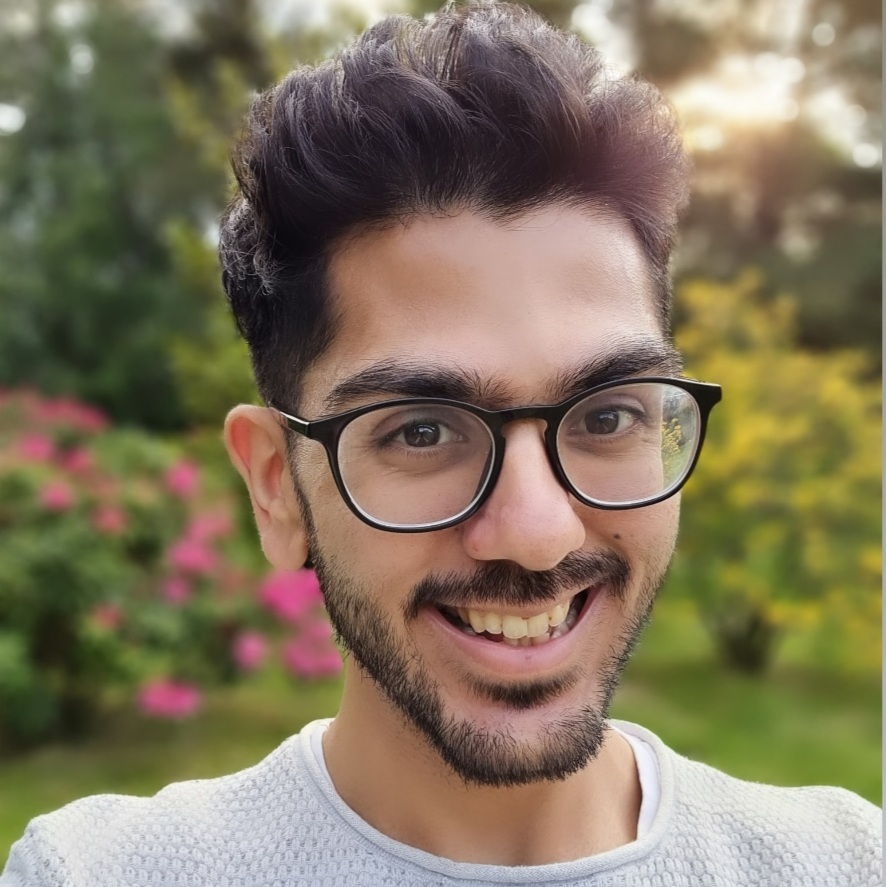

Saket Toshniwal, Senior Director Growth, Europe

Toshniwal is a MarTech leader who has worked across CRM, Growth, and Product Management in consumer tech companies in Europe.

LinkedIn

Ed Balcomb, Senior Solutions Manager, Europe

Balcomb is dedicated to providing enterprise SaaS solutions that make sense to both business and technical teams.

LinkedIn