A little over a year ago, U.K. challenger bank Starling and automated online insurance advisory Anorak Technologies forged a partnership to bring personalized life insurance options to bank customers. Now, the two companies are back in the fintech headlines with a new offering. Starling announced that it will offer income protection insurance for the self-employed courtesy of its collaboration with Anorak.

“If you’re a freelancer, contractor, or sole trader, you may need income protection insurance to provide peace of mind if something happens that means you can’t work,” Team Starling noted on the company blog this morning. “Everyone has bills to pay, sometimes for a whole family, and if something goes wrong, an insurance provider could cover your outgoing when you don’t have a regular income.”

In order to access the insurance offering, Starling app users simply tap on the Anorak link in the Insurance category of the app. Anorak will guide the user through a quick, free, online assessment during which the user’s Starling Bank transactions are analyzed and the user is given advice on how much income protection and life insurance would be advisable. The technology also lets users know how long they should be covered and why. Starling Bank notes that the intention is to provide income protection and insurance coverage that is not just the most affordable, but is also the best choice for the consumer, as well.

“Bancassurance 3.0 is a reality,” Anorak wrote on its LinkedIn page today. “Technology redefines the way people access life insurance. With Starling Bank we help sole traders easily protect their biggest asset, themselves.”

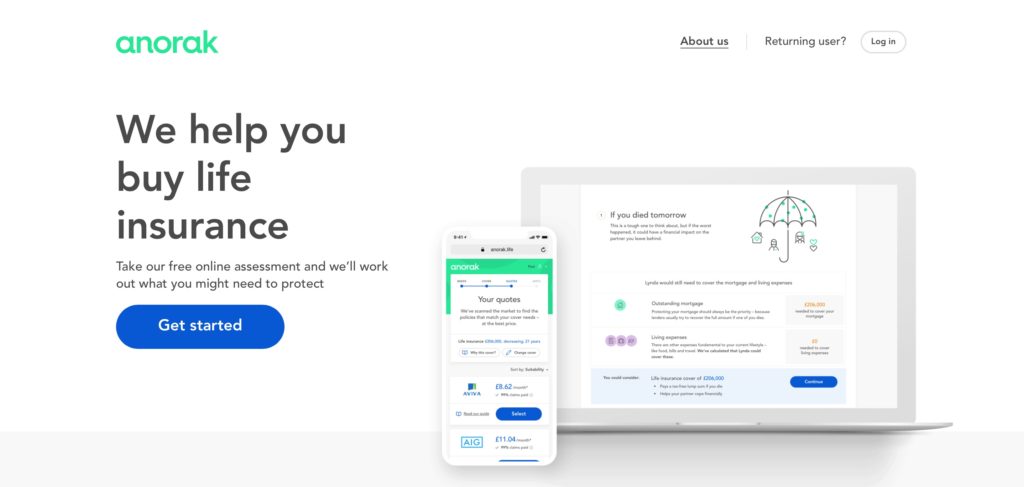

Anorak demonstrated its Smart Life Insurance solution at FinovateSpring 2018. Embedded into the bank’s mobile app and leveraging bank data to provide quick insurance assessments, Anorak’s technology is designed to make it easy for partners ranging from challenger banks to online retailers to investment platforms to offer their customers personalized insurance options.

Named to FinTech Global’s list of the top 100 insurtech companies, Anorak teamed up with protection and mortgage advice company Albany Park over the summer. The partnership brought telephony protection advice to Anorak’s online platform. Anorak began the year with news that it was joining the FinTech Innovation Lab London’s 2019 cohort – along with fellow Finovate alums Exate Technology and FutureFlow.

Founded in 2017 and headquartered in London, U.K., Anorak has raised $11.5 million (£9 million) in funding and includes French insurtech startup studio Kamet among its investors. David Vanek is co-founder and CEO.