The ID Co. announced late this week that its NoMo solution is the first mobile app to leverage Open Banking to give users simple financial cashflow tracking. The solution is currently available on iOS with an Android version expected in December.

“We have been working on building a consumer app that allows customers to answer one very simple, but important question, and we’re confident that this premise means NoMo will be a great success with customers,” James Varga, CEO of The ID Co., said. He noted the new offering, combined with its DirectID solution for FIs, adds a significant dimension to the company and would “broaden (its) appeal within the market.”

“We look forward to the reception NoMo will receive now it has been launched,” Varga said.

NoMo provides cash-flow averaging, spending recommendations, personalized updates, and a financial performance overview that tracks your performance and progress in growing your cash account, specifically. Just in time for the trend toward rising short-term interest rates, view of the user’s account is “read-only,” adding to its security and privacy. NoMo is free to download and only available for U.K. users.

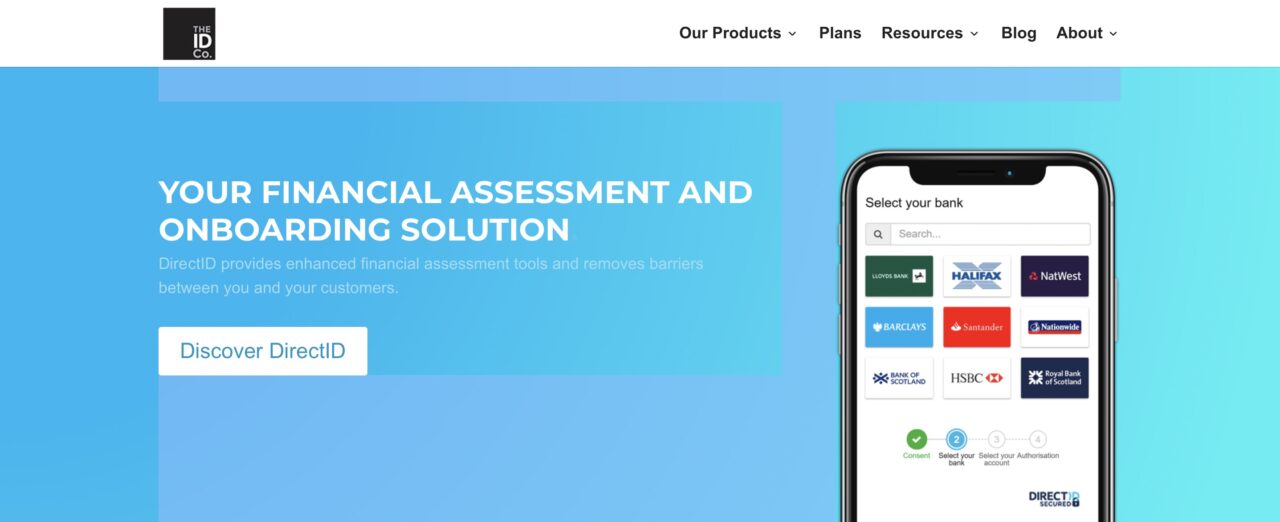

Two years into its rebrand from miiCard, The ID Co. continues to help banks and financial services companies onboard customers faster and more efficiently while meeting compliance standards and requirements. In August, The ID Co. partnered with CYBG (Clydesdale Bank and Yorkshire Bank), integrating its DirectID user verification technology into CYBG’s mobile banking app. The previous month, the company launched its Open Banking API platform, making it easier for businesses to use DirectID to access open banking services with major U.K. banks.

With customers including OakNorth Bank, Navient, and fellow Finovate alum, Prosper, The ID Co. has raised more than $9 million in funding. The company is headquartered in Edinburgh, Scotland.