AI savings technology innovator savedroid is leveraging the booming interest in crypto currencies to raise capital: both crypto and conventional.

On the crypto-fundraising side, savedroid announced the beginning of its ICO in February. The company noted that the pre-sale of the savedroid token featured more than 3,800 backers and sold out within seven hours.

“savedroid’s vision to connect the technical crypto world with the average user by leveraging the latest technology to provide easy access to crypto currencies has convinced me,” said crypto entrepreneur Dennis Weidner, an investor in savedroid. “Given their track record and the experience of the management team I want to support the successful scaling of the business model with my investment and thereby realize my dream of a unique and independent crypto ecosystem.”

On the more conventional fundraising side, savedroid announced a new equity investment of ($1.84 million) €1.5 million from the Investment and Economic Development Bank of Rheinland-Pfalz (ISB), Weidner, serial fintech investor Alfred Schorno, and others. The new funding will be used to help grow the savedroid’s technology and operations to better support crypto saving and investing. The company’s total capital stands at more than $4.29 million (€3.5 million.)

“savedroid offers a convincing and globally scalable business model,” Schorno said. “Their AI-based app enables users to successfully overcome their weaker self and consistently save money, which is a very strong value proposition.”

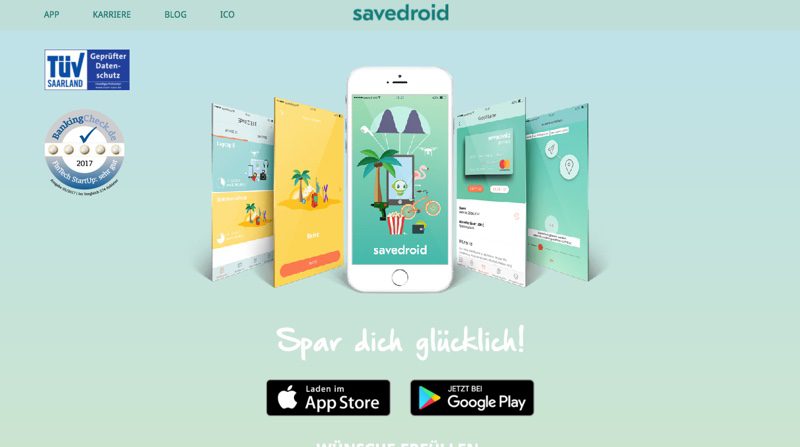

Founded in 2015, and headquartered in Frankfurt am Main, Germany, savedroid demonstrated its algorithm-based savings technology at FinovateSpring 2016, simultaneously injecting a new term, “smooves,” into the fintech lexicon. By turning everyday activities into automated savings opportunities, savedroid’s app enables users to improve their lifestyle and their savings at the same time. savedroid founder and CEO Dr. Yassin Hankir discussed his company’s technology and the future of savings technology in our feature on savings tech last spring.

The company’s recent embrace of crypto currencies is designed to democratize cryptocurrency savings and investment by providing ready access to cryptocurrency-based savings and investment plans including portfolios, futures, and ICOs. savedroid anticipates making its cryptocurrency-based savings plans available in mid-2018, with switching and credit card payments added in 2019, and smart investments in crypto-based portfolios, derivatives, and ICOs to be integrated in 2020.