Mobile-first investment platform Stash is about to go mobile-first in the field of online banking. The New York City-based startup, which demonstrated its Stash Retire solution at its Finovate debut last month at FinovateFall, announced today that it plans to offer a variety of banking services for mobile-centric customers.

“When we launched the Stash platform, we redefined the financial services experience by providing affordable access and education to millions of Americans,” Stash CEO and Co-Founder Brandon Krieg explained in a statement. “Our new banking services will take that promise a step further. We are pioneering ways to relieve stress and improve our clients’ financial security for years to come.”

Stash CEO and co-founder Brandon Krieg demonstrating Stash Retire at FinovateFall 2017.

The services, bundled as Stash Banking and slated to be available in early 2018, include common banking solutions such as billpay, direct deposit, and debit cards. The platform has a goals-based savings feature, with auto and smart-save functionality as well as access to Stash’s proprietary long-term financial security strategy, The Stash Plan. Accounts with Stash Banking are free, FDIC-insured, with no fees, no minimum balance requirement and are accessible via the largest ATM network in the U.S.

Talking about the decision to launch the new service, Ed Robinson, President and co-founder of Stash, emphasized both the potential cost savings and the opportunity to provide better support and guidance to financial services customers. “When we talked to our clients and analyzed their expenses, we were shocked by how much they were paying in fees,” Robinson said. “We dug deeper and discovered traditional banks offered very little guidance or tools to help Americans manage their money,” he added. “We’re building our banking services to solve that and bring new tools, coaching and complete transparency to the process.”

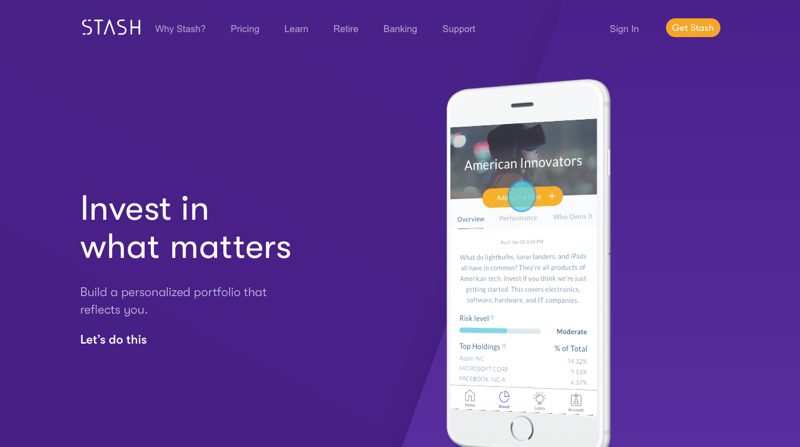

Founded in 2015, Stash demonstrated its Stash Retire solution at FinovateFall 2017. Stash Retire gives investors the opportunity to participate in low-fee, self-directed IRA accounts while still taking advantage of Stash Invest’s core features such as auto-invest and the ability to invest in increments as small as $5. With more than 2.5 million subscribers and more than 1 million clients, Stash has raised more than $78 million in funding, including a $40 million Series C completed this summer. The company includes Breyer Capital, Coatue Management, Goodwater Capital, and Valar Ventures among its investors.