ACH Alert provides enterprise-grade, SaaS-based advanced fraud prevention solutions to financial institutions and fintechs. At FinovateSpring earlier this year, ACH Alert President David Peace and CEO Deborah Peace demonstrated Fraud Prevention HQ, which turns the challenge of fraud prevention into a revenue-making opportunity. ACH Alert’s fraud monitoring platform provides real-time, actionable, out-of-band alerts based on voice biometrics, and the rule sets are fully-customizable. The platform gives users a dashboard to view transactions flagged by the system before the transactions take place. But what is particularly Fraud Prevention HQ, as CEO Peace explained, is the way it empowers customers and clients. “This is the only platform available in the market that allows account holders to interact to stop suspicious ACH, wires, and check activity in real-time without financial institution intervention,” she said.

This is why, when it comes to cost savings of fraud prevention, Peace gives the credit to the customer. “In 2016, our system monitored $80 billion worth of transactions for the 70 financial institutions that we work with today,” she said. “And the account holders, not the financial institutions, were able to return $625 million.”

Pictured (left to right): ACH Alert’s David Peace (President) and Deborah Peace (CEO) demonstrating Fraud Prevention HQ at FinovateSpring 2017.

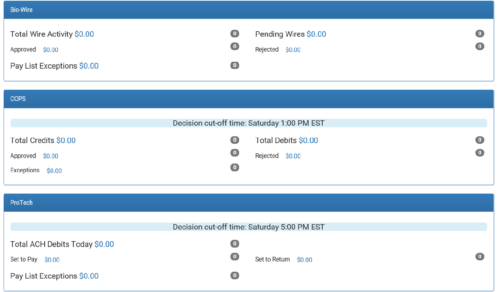

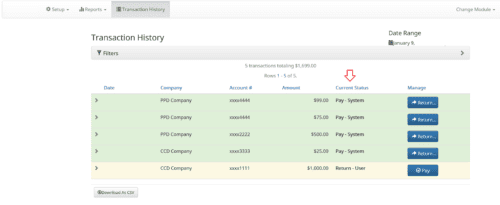

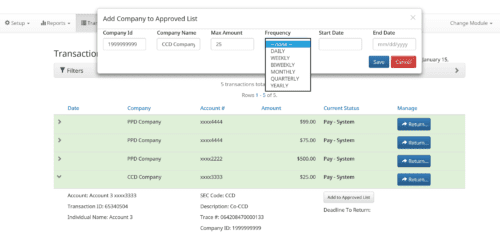

For the company’s live demo, the Peaces walked the audience through log-in on the client portal, which is integrated into the financial institution’s system and can be accessed online or mobile. They showed the Fraud Prevention HQ’s dashboard where basic information on wires, check, and ACH transaction activity is located, before focusing on the latter to show, for example, how easily a customer can respond to an alert by managing an individual ACH transaction entry. The ability to do this quickly and accurately is important for corporate clients, the team emphasized, because – unlike consumers – companies only have one day to detect and return a suspicious transaction. “We had one customer of a financial institution that returned a single item for $77 million one day,” Peace said. “So that saved them a significant amount of money.”

Fraud Prevention HQ: Dashboard View.

Features of Fraud Prevention HQ include debit blocks and filters for retail customers as well as corporate clients, electronic dispute forms that can be digitally signed, and automated exception settlement handling. Importantly, Fraud Prevention HQ’s dispute resolution process sends alerts before money actually changes hands. This way, in the event of a return, the customer doesn’t have to wait several days for the funds to come back to the account. The goal, as she explained, was to take financial institutions out of the backroom fraud monitoring and instead put those responsibilities “in the hands of paying customers.”

Company facts

- Founded in 2008

- Headquartered in Ooltewah, Tennessee

- Won Innovative Solutions Award for Authentication/Fraud/Cybersecurity from BankNews

We spoke with Debbie Peace during the networking session at FinovateSpring 2017 in San Jose, and followed up with a few questions by email. Below are her responses.

We spoke with Debbie Peace during the networking session at FinovateSpring 2017 in San Jose, and followed up with a few questions by email. Below are her responses.

Finovate: What problem does your technology solve?

Debbie Peace: It prevents unauthorized checks, ACH, and wire transfers from withdrawing funds from an account holder’s account. It moves costly fraud monitoring out of the backroom of financial institutions and into the hands of paying customers. It completely automates the return and dispute resolution process for the account holder and financial institution.

Finovate: Who are your primary customers?

Peace: Banks and credit unions of all sizes across the U.S.

Fraud Prevention HQ’s Transaction History Current Status screen enables users to see and manage account activity.

Finovate: How does your solution solve the problem better?

Peace: It automates the verification process by alerting the account holder and giving them the ability to accept or reject suspect transactions. Most financial institutions are monitoring for suspicious activity but when a suspect transaction is identified, they have to make a judgement call, process it or call the account holder. That slows down transaction processing time, it’s costly and it is not a good customer experience. Our solution allows a financial institution and account holder to agree upon customized rules related to their account, relevant, actionable alerts are sent to the account so fraud is stopped by the account holder, before funds are withdrawn from their account – without financial institution intervention.

Finovate: What in your background gave you the confidence to tackle this challenge?

Peace: My background consists of business management, credit underwriting and risk monitoring, software development for payment systems, and extensive sales and marketing experience.

Adding companies to the Approved List from Fraud Prevention HQ’s Transaction History page.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

Peace: We will be rolling out a cross channel payment services application, underwriting and monitoring system called S.C.O.R.E.

Finovate: Where do you see your company a year or two from now?

Peace: I see our customer engagement, fraud prevention solutions being the standard for fraud prevention for financial institutions and their clients, widening our base of financial institution clients nationwide.

ACH Alert’s Deborah Peace (CEO) and David Peace (President) demonstrating Fraud Prevention HQ at FinovateSpring 2017.