A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

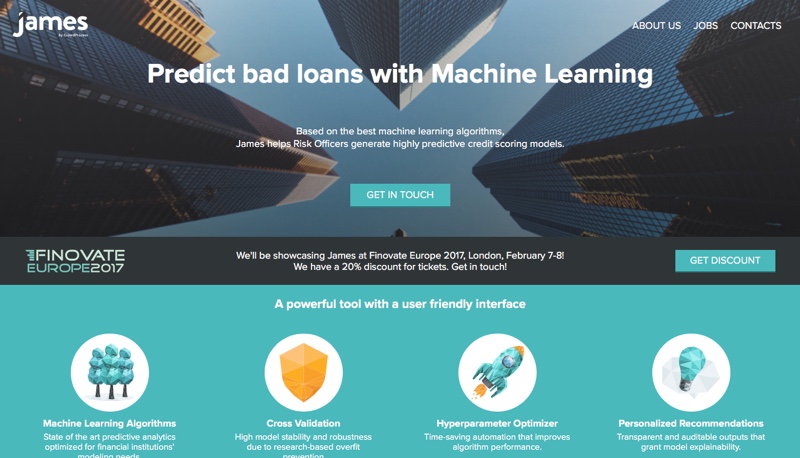

James by CrowdProcess allows financial institutions to create highly predictive models for credit risk management through state of the art machine learning algorithms and techniques.

Features

- NPL avoidance

- Loan portfolio growth

- Operational cost reduction

Why it’s great

James creates high-performing predictive models that are both easy to integrate and fully compliant with banking regulations. This allows lenders to grow without taking additional risks.

Presenters

Presenters

Pedro Fonseca, CEO

In addition to being CrowdProcess’ CEO, Fonseca is the company’s Head of Data Science. He’s an experienced public speaker and known for being able to communicate complex issues to non-expert audiences.

LinkedIn

Gonçalo Garcia, Head of Product

Gonçalo Garcia, Head of Product

Garcia is the person in charge of James’ roadmap. Though he started his career as a business developer, he is now part data scientist, part developer which makes him a natural head of product.

LinkedIn