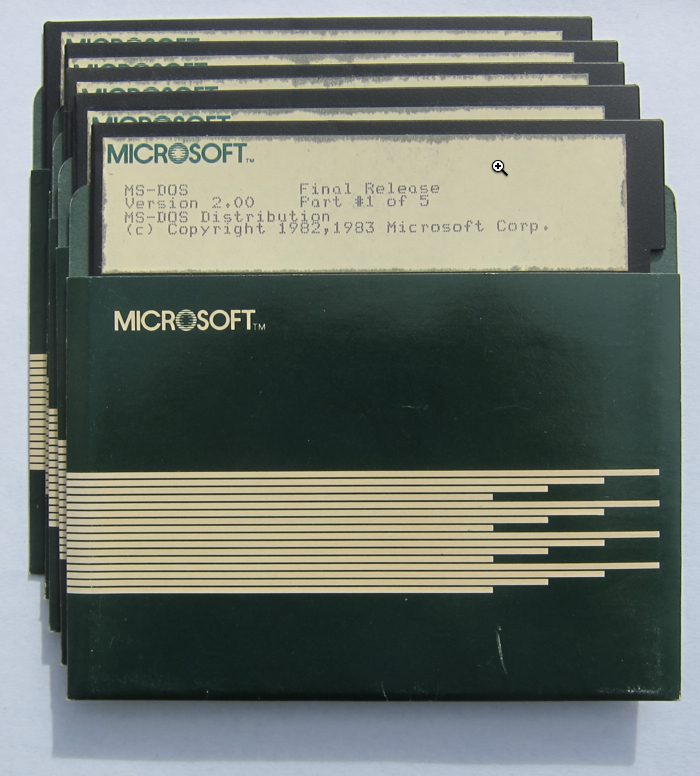

Ever since Microsoft made its vast fortune off the back of MS-DOS, becoming the “operating system for ____” has been a software nirvana. And look what happens when you substitute financial terms for computer terms in the OS definition. It describes a position that fintech companies around the globe aspire to: “the software that controls/manages the flow of money.”

Ever since Microsoft made its vast fortune off the back of MS-DOS, becoming the “operating system for ____” has been a software nirvana. And look what happens when you substitute financial terms for computer terms in the OS definition. It describes a position that fintech companies around the globe aspire to: “the software that controls/manages the flow of money.”

Financial Operating System

noun

1. Software that manages personal finances, controlling and scheduling spending, managing deposits, transfers in/out, communications and security.

Abbreviation: FinOS

Intuit has captured this spot for small businesses (SMB) in the United States with Quickbooks. But even Intuit has given up trying to be the OS for consumers. Why? It’s too hard to gain trust while also providing enough value to wrest consumers away from their primary bank or credit union.

So guess what, all you bankers and CUsters? You are the de facto operating system for your customers’ finances. Embrace it, but don’t take your good fortune for granted or you may find yourself irrelevant to the next generation of consumers. Like successful tech companies, you need to keep upgrading the system. Here are a few core features missing at most financial institutions:

- Complete fraud protection

>> 100% guarantee against losses - Advocacy

>> Make it an open network, even if a product recommendation sometimes leads outside your FI - Credit for all

>> If you can’t make the loan yourself, deliver customers to someone who can - Rational fees

>> Fees are fine, large PENALTY fees should be avoided - Family connections

>> Real-time funds-transfer, spending tracking, and so on - Risk management

>> Insurance for anything I’m worried about - Business intelligence

>> Help me grow/start/manage my business even if it’s just a hobby

——–

Notes:

(1) See also Part 1: The technical side of the bank as an operating system.

(2) OS definition at top from Dictionary.com

(3) MS-DOS picture courtesy of Computer History Museum