Business owners are optimists. It’s a job requirement. So whether or not a small business is currently seeking capital, most hope to grow down the road, so the POTENTIAL to tap more funding is a huge factor when selecting a bank. It’s why small businesses have long sought to establish quality relationships with community banks or larger FIs.

But in the aftermath of the 2008-to-2012 downturn and all the negative press about the “credit crunch” (both real and imagined), business owners are less confident that their bank will come through for them when they need it. That’s why banks should offer credit to ALL small- and micro-business customers. It doesn’t have to be a large amount, or free of fees, or at an APR that would make the CFPB happy (it’s commercial credit we are talking about). FIs just need to demonstrate they have their client’s back.

![]() Along the same lines, most banks could do better providing peace of mind. The most important factors are transaction/payment reliability, service quality and, probably most important these days, security. Again, it’s about the peace of mind knowing that your bank will run your account flawlessly while keeping thieves at bay. And failing that, reimburse the losses without a business disruption.

Along the same lines, most banks could do better providing peace of mind. The most important factors are transaction/payment reliability, service quality and, probably most important these days, security. Again, it’s about the peace of mind knowing that your bank will run your account flawlessly while keeping thieves at bay. And failing that, reimburse the losses without a business disruption.

These things cost money. But the good news is that businesses understand that and will pay for it. Most growing businesses are price-insensitive when it comes to their transactional bank account. It’s just not a material expense, especially if you factor switching costs. In fact, I have long stated that I’d be happy to pay $500/mo for a business banking account with my ideal mix of banking, security and accounting services.

That said, it won’t be easy to get to three-figure monthly fees for SMB banking. Here’s a more normal example, a fictional starter business bank account priced at $50 to $60/month ($10/mo less if paperless):

- Checking account/debit card

- Small-biz-branded mobile-banking app

- Security and transaction alerts

- Outbound payments (billpay, P2P, mPay, ACH)

- Inbound payments (ACH, P2P, cards, mPOS)

- Bundled credit facility (line of credit and/or credit card) with overdraft protection

- $10/mo discount to go paperless (no paper checks, no paper statements, no in-branch deposits)

- Credit score with alerts (sourced through Credit Karma)

- Account scanning for fraud and questionable charges (sourced through BillGuard)

- Loan concierge to help the business find funding (via alt-lenders if needed)

- Basic accounting/money-management tools (outsourced to Mint, FreshBooks, Expensify, etc.)

- Commercial eBanker (email night and day with same person if possible)

- Fraud-loss guarantee for first $5,000, then $x/mo per $10,000

- Multifactor security using mobile phone/GPS

- Basic business property insurance for first $5,000, then $y/mo per $10,000

——

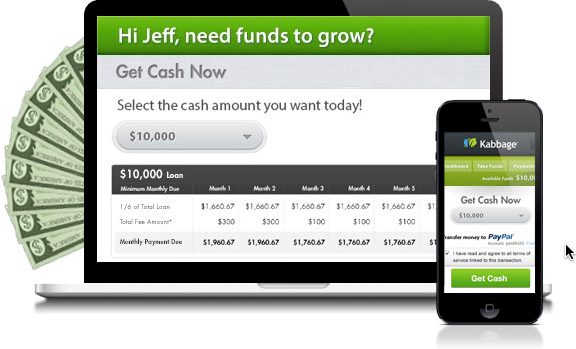

Graphic from alt-lender Kabbage