Definition: loy·al (loi![]()

![]() l) adj. Steadfast in allegiance

l) adj. Steadfast in allegiance

–

When I was a graduate student 17 years ago, I did a lot of research into so-called loyalty programs. At that time, other than the airlines and grocery stores (think S&H Green Stamps); it was a relatively new concept.

When I was a graduate student 17 years ago, I did a lot of research into so-called loyalty programs. At that time, other than the airlines and grocery stores (think S&H Green Stamps); it was a relatively new concept.

Now, just about every modern retailer has a loyalty program of one form or another, from pizza joints (our favorite spot has a “frequent pier” discount), to book stores ($25 annual fee for at 10% discount at Barnes & Noble), and even pet stores. The programs typically provide discounts, VIP services, and/or special programs for frequent customers.

–

Many financial institutions provide loyalty features such as relationship pricing, rewards for credit/debit card usage, personal bankers, and events for high-net-worth clients. But Citibank is breaking new ground with its Thank-You Points program.

–

The new rewards program has been featured in media campaigns for the past several months (thank you Citibank for focusing on the positive rather than continuing to over-publicize the identify theft problem). The program delivers points both for the depth of the Citi relationship and the amount of debit card spending. Spending on the many of the bank’s credit cards, including the new Simplicity card, also count for points.

Debit card spending is straightforward, earning 1 point for every $2 spent on signature debit and 1 point for every $3 spent on PIN debit. Credit card spending earns 1 point per dollar.

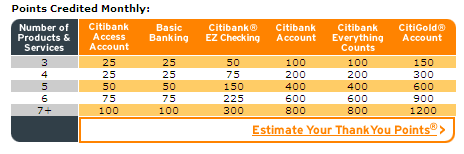

Relationship points are earned for anyone having 3 or more accounts with the bank, and range from 25 points per month with 3 products and a Citibank Access checking account to 1200 points per month for someone with 7 or more products and a CitiGold Account (click on inset for more detailed information). An online tool is available to help users estimate the reward points they will accrue.

Relationship points are earned for anyone having 3 or more accounts with the bank, and range from 25 points per month with 3 products and a Citibank Access checking account to 1200 points per month for someone with 7 or more products and a CitiGold Account (click on inset for more detailed information). An online tool is available to help users estimate the reward points they will accrue.

Customers are NOT automatically enrolled; they must call a toll-free number to enroll. There is no online enrollment option. Points can be redeemed by phone or through a dedicated website, <ThankYouRedemptions.com> which is currently closed for remodeling and due to reopen next week.

–

Example rewards:

-

20G iPod = 50,000 points

-

round-trip coach air fare = 25,000 points

-

make a wish = 25,000 minimum

-

gift certificates: $5 = 1000 points; $10 = 1500 points; $25 = 3000; or $10 per thousand for larger amounts

Analysis

Loyalty programs can have a significant impact on customer retention and purchase behavior. However, the programs have three inherent problems:

- Cost of communicating the incentives and member reward status

- Consumer disinterest/apathy/fatigue with the program

- Cost of the incentives

Online delivery helps solve the first two problems. With email and web-based delivery the cost to communicate the details of the loyalty program are negligible, other than the fixed cost to create the communication. Second, the program can be kept fresh with continual feedback to the user when logged in to online banking. A progress chart along and program news serves as a constant reminder of the program benefits.

However, online delivery does little itself to impact the cost of the incentives. In fact, by making it easier to track and redeem rewards, you may be actual increase incentive costs due to higher redemption levels. On the other hand, if you increase interest and awareness, you may be able to get equivalent lift from lower-cost rewards.

–

The final word: Online delivery has the potential to greatly increase the impact of bank loyalty programs. So, expect other major banks to enact programs similar to Citi’s. If you have a loyalty program, you may want to look at how it’s delivered online. If you are not doing anything to systematically reward your best customers, you may want to add this to your 2006/2007 plans.

–

—JB

–

Reference: Citi ThankYouRewards screenshot (links do not work)