And you thought the stock market had a great 2013.

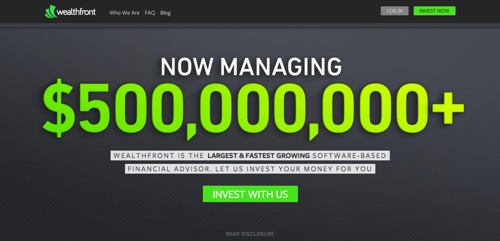

Online investment manageme service Wealthfront announced this week that it now manages more than $538 million in assets. Given that the company began 2013 with assets under management of approximately $100 million, it is no exaggeration to say that Wealthfront is doing a strong job of attracting investors looking for alternatives to traditional financial advisory.

Wealthfront credits its rapid growth on two factors: the rise of passive investing and the entry of the millennial generation into their investing years.

Some interesting metrics about Wealthfront and its clients:

- More than 55% of the company’s users are under 35 years old

- More than 80% of the company’s users are under 50 years old

- The average investment with Wealthfront is between $80,000 and $100,000

- More than 16% of Wealthfront’s users have a liquid net worth of more than $1 million

At the same time, it is worth pointing out that Wealthfront is not just for rich guys and gals. A fifth of the company’s investors have less than $50,000 in liquid net worth.

Growth in the online investment advisory business is a good thing for Wealthfront – not the least because the company is far from alone in the space. Among Wealthfront’s rivals are companies like Betterment, Personal Capital, and SigFig, as well as similar services with slightly different models such as FutureAdvisor, Jemstep, and LearnVest (and, yes, Finovate alums all).

Formerly known as KaChing, Wealthfront

picked up $20 million in funding in March of last year. This took the company’s total investment to $30.5 million. Wealthfront was founded by Andy Rachleff, former co-founder and general partner of Benchmark Capital, now serving as Wealthfront’s president and CEO.

The company was among the earliest of Finovate alumni, showcasing its technology as part of

FinovateStartup in 2009.

Views: 808