Personalization and customization are the watchwords when it comes to designing a top quality digital banking experience. Unfortunately, for banks and credit unions lacking the technological know-how, the task of building a banking UI/UX that meets increasingly tough consumer standards can be a Herculean one.

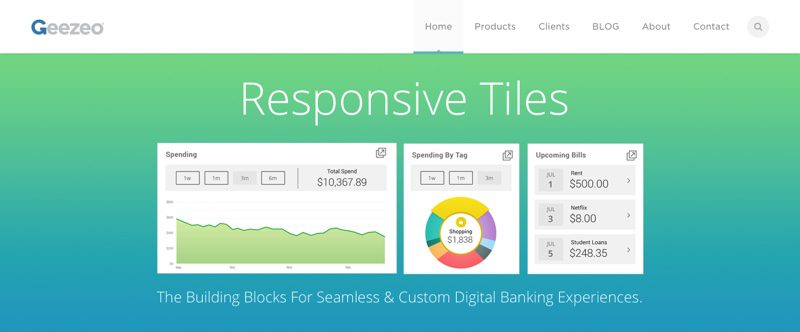

The good news is that financial management solutions provider Geezeo has developed and released a new set of tools to enable FIs to create the same kind of seamless, personalized consumer experiences that people have come to expect with every other digital interaction in life. Responsive Tiles give banks and credit unions the ability to mix and combine core personal financial management features and content into both mobile and online platforms.

Pictured (left to right): Geezeo CEO Shawn Ward and President Peter Glyman demonstrating the TrueBusiness – Business Financial Management platform at FinovateFall 2014.

Providing more options by removing artificial barriers was front of mind for Geezeo in developing the new technology. “Consumers want simple money management tools that support daily and long-term financial needs, and banks are recognizing that they need to blur the lines between traditional digital banking features and PFM,” Geezeo President and co-founder Peter Glyman said. Matt Tollerton, VP and Director of Digital Banking at Central Bancompany praised the way the platform “incorporates simplicity and contextual relevance” and said Responsive Tiles would support the bank’s goal of being seen as a responsible and trusted partner for customers. “We’re putting the tools where the customer will use them, at a place and point where they’ll need them,” Tollerton said.

Responsive Tiles leverage Geezeo’s API to give FIs ready access to a suite of solutions that can be incorporated into existing online and mobile banking channels. The solution supports all display types, and tiles can be configured to match the colors and sizes designated by the bank or credit union. Geezeo can also build 100% custom tiles for clients. “We want to help make their digital banking experience unique and representative of their mission and brand,” Glyman said. “A Responsive Tile strategy is likely the best model for most our clients to see this idea come to fruition.”

Among the solutions included in the Responsive Tile library are:

- Account Sync (aggregation)

- Categorical Expense Tracker

- Daily Spending Calculator

- Net Worth Analyzer

- Recent Cashflow Analyzer

- Spending Analysis Tool

Founded in 2006 and headquartered in Braintree, Massachusetts, Geezeo demonstrated its TruBusiness – Business Financial Management platform at FinovateFall 2014. In April, the company announced a partnership with Liberty Bank, the oldest mutual bank in Connecticut, with $4.5 billion in assets and 55 banking offices throughout the state. Other partnerships forged this spring include an agreement with digital banking platform provider, Computer Service Professionals, and a deal with fellow Finovate alum Jack Henry & Associates. In May, the company’s marketing arm, Geezeo Interactive, introduced its digital reputation management solution. The service is geared toward credit unions and community banks and is designed to help smaller FIs establish a positive presence and share their message online.