In a round led by venture capital firm Northzone, Swedish personal finance management innovator Qapital has raised $1.3 million in seed financing. The investment will help the company grow its team as well as prepare its technology for launch in the U.S.

Pär-Jörgen Pärson, partner at Northzone and an early investor in and board member of Spotify, called Qapital “the way an everyday banking service should work.” Added George Friedman, Qapital CEO and co-founder, “Once they use it, I think people will start realizing that managing money isn’t boring.”

“Spending and saving smart should be easy and sometimes even fun.”

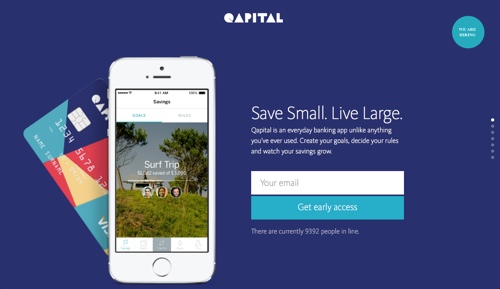

Currently in private beta, Qapital’s PFM technology combines personal finance management with features like safe balance and a “rule-based” savings and goals planner in a single application. State of the art account aggregation

powered by Social Money means that transactional data from linked accounts is transferred and available to see in real-time, which helps “connect everyday savings with everyday results.”

“To save money, you have to make a good trade between now and later, and that’s pretty difficult and abstract,” Friedman said from the Finovate stage this spring. “The real key to our product is that we actually help you change your behavior and save in ways you’ve never done before.”

Qapital encourages users to focus on specific goals, and uses a rule-based savings approach to accomplish this. For example, one rule may say that every time you buy a product from the local pastry shop – or every time you go the gym to workout – you set aside $10 toward one of your pre-set goals.

And while people think about saving this way all the time, Qapital’s account aggregation makes this savings happen automatically between linked accounts. No worry having to remember to transfer the money in your banking app, or to stash dollar bills in an envelope. As soon as you do the transaction, the savings are allocated to the appropriate goal.

Views: 1,892