In a round led by MARCorp Financial, global money transfer platform Paysend has raised $20 million in new funding. The company said that the capital, which takes the company’s total to $23 million, will help it launch new services and expand globally.

“Paysend has created the first integrated B2B and B2C global payments business which is already disrupting the market,” said MARCorp Financial Chairman Michael Fazio. “Their three businesses – Global Transfers, Global Account, and Global Processing – are leaders in their respective fields. We look forward to being a part of the next stage of Paysend’s growth.”

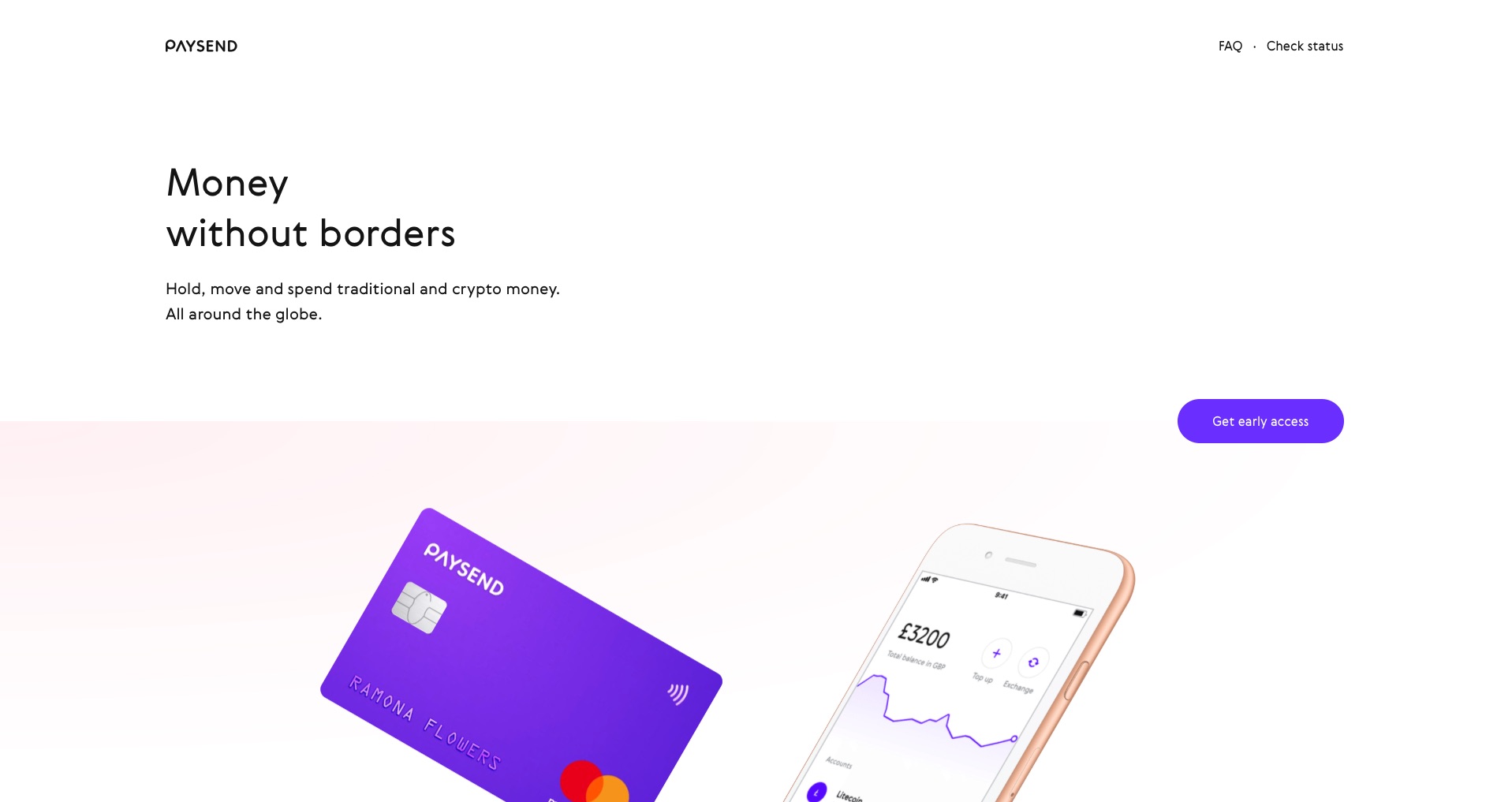

Paysend CEO Europe Ronald Millar demonstrating the Paysend Global Account at FinovateSpring 2018.

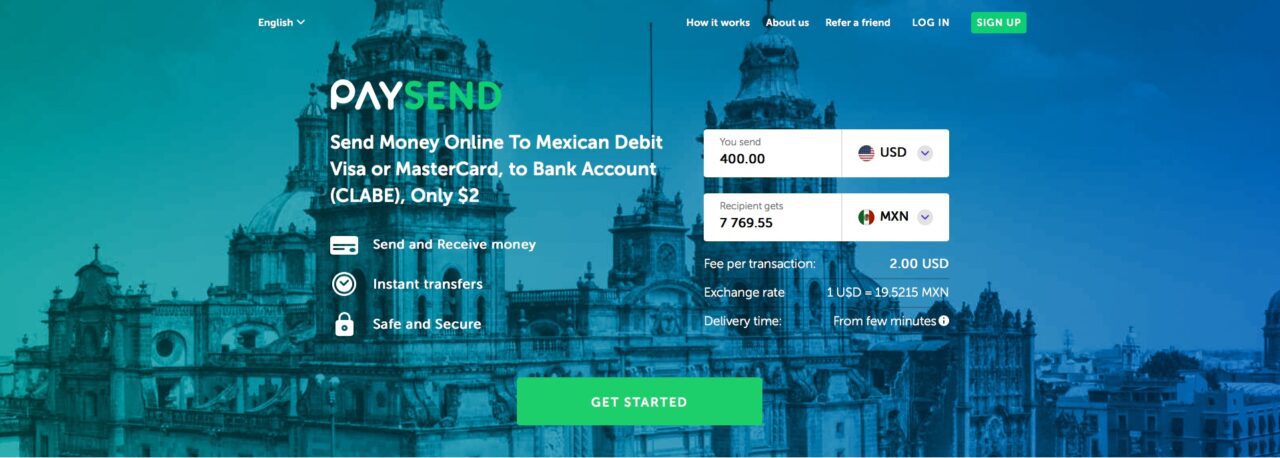

Via its Global Transfers service, Paysend enables card-to-card money transfers from customers in more than 60 countries. With the recipient’s name and a 16-digit card number, cardholders can make fast, secure, low-cost money transfers 24/7. Paysend charges a fixed rate for international transactions regardless of the amount transferred. Recipients can withdraw cash from millions of ATMs around the world, and pay by card at any merchant that accepts Visa or Mastercard. The service is accessible via both an iOS and Android app as well as online.

Global Account, demonstrated live at FinovateSpring 2018 in May, provides a digital wallet for both fiat and crypto currencies. The solution enables fund transfer between currencies as well as sending money to other Global Accounts or crypto wallets, and making online and in-person payments. The account comes with a prepaid card, physical and virtual, that can be linked to any of the currencies in the account, enabling the user to pay with both fiat and crypto currencies. Cardholders can also withdraw cash from the account in 125 different currencies.

Paysend’s Global Processing division processes credit and debit cards, and helps boost revenue for merchants by taking what the company calls a “data-driven approach to customer shopping.”

“I am proud of what we have achieved to date, and what we have planned for the future,” Paysend CEO Europe Ronald Millar said. “We are the only global card-to-card platform, and the technological and operational expertise required to create that could only have come from an executive team with special knowledge, creativity and ambition – our team.”

London, U.K.-based Paysend announced a number of major service expansions this year including launches in Turkey in June, in Israel in May, and in both Canada and the UAE in April. Nigeria was added in February. Paysend’s partnership with China UnionPay, announced back in December, enabled card-to-card transfers to China.