![]() One of the great promises of the Internet is a better shopping experience. While most retail products have indeed become easier to shop for—think automobiles or vintage postcards—the financial services experience is still a mixed bag.

One of the great promises of the Internet is a better shopping experience. While most retail products have indeed become easier to shop for—think automobiles or vintage postcards—the financial services experience is still a mixed bag.

It's certainly much easier to compare savings rates online, a capability that has fueled growth at ING Direct and others. But loans are still much harder to shop for. The lead-generation sites, such as BankRate, GetSmart, LendingTree and Interest.com, have made it easier to contact multiple lenders, but in most cases, the customers still has to select a single lender, complete an application, and hope that there are no nasty surprises at closing in the form of extra fees or higher rates.

However, Mortgagebot is about to change all that and hopefully usher in a new era of transparency in mortgage pricing, with the launch of Mortgage Marvel, making its debut at our FINOVATE conference tomorrow.

How it works

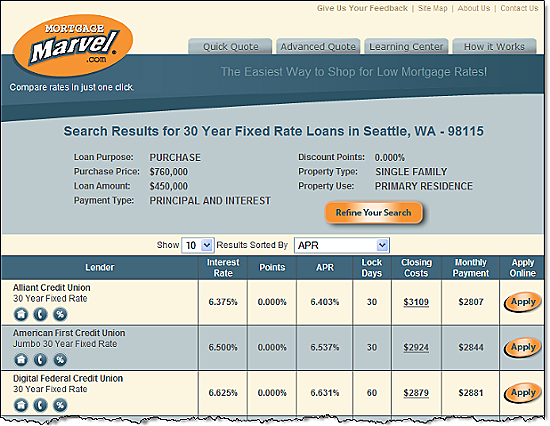

Mortgage Marvel is a destination site where mortgage shoppers can search and find actual rate and fee information for participating lenders, usually at a nearby bank or credit union. And there is no personal info required, just the loan amount, property value, and zipcode. If the shopper finds what they want, a simple click on the APPLY button sends them directly to the lender's application to lock in the rate and fees listed (see screenshot below).

The key to making the marketplace work is having a wide variety of participating lenders with recognizable brand names at the local level. Normally, that's extremely difficult. But Mortgagebot, with more than 700 bank and credit union clients on its mortgage platform, can plug its existing client base into the exchange with ZERO systems integration (note 1). Currently, there are 250 lenders on the system.

And Mortgagebot clients have little to lose by placing themselves into the exchange which for the most part, only charges fees when mortgages are originated through the marketplace.

Right now, all mortgage lenders are displayed equally in order of lowest APR. But in the future, the company may offer preferred placement for additional fees.

Summary

For the first time, U.S. consumers can easily shop and compare the total price for mortgages from competing lenders. And thanks to the Internet, they can complete an application in less time than it takes to drive to the nearest loan office.

Note:

1. Currently, only Mortgagebot mortgage-platform customers are allowed to participate in the network.