Just when I thought I’d shaken my Starbucks habit after their April devaluation of rewards for my relatively low-cost Americano, they reprised their Starbucks for Life game which last appeared around the year-end holidays. And I’ve been there four days in a row.

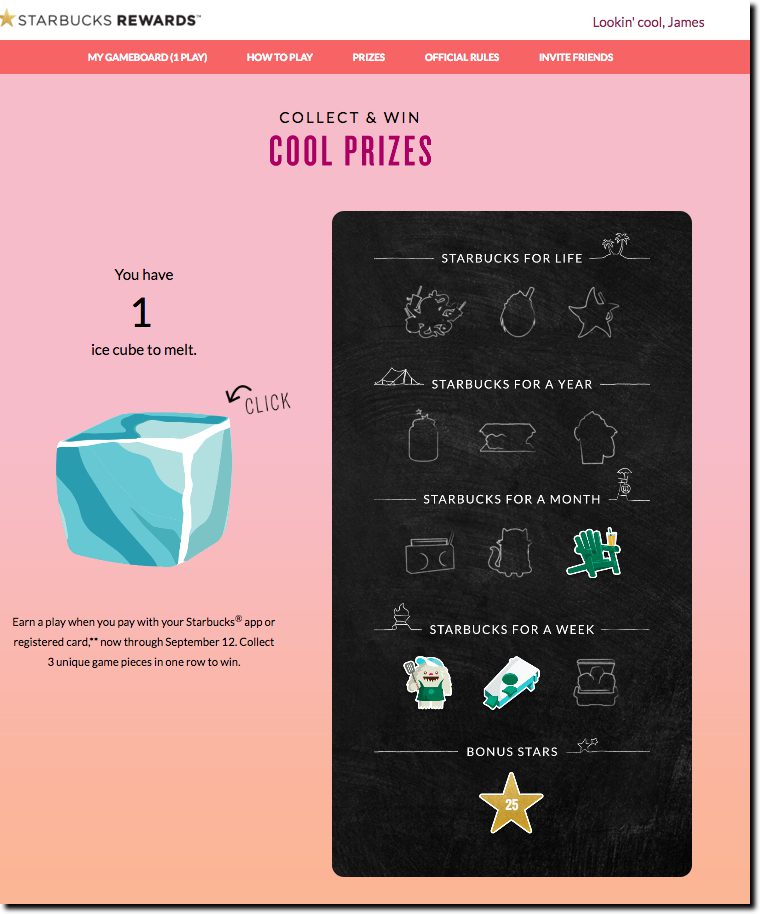

Starbucks for Life is no Pokemon Go, but it’s a lot simpler. Customers earn a virtual game piece with every purchase through 12 Sep ’16 (see inset, rules here). In the summer version, it’s an ice cube that melts away with a mouse click to reveal game pieces that fit on a virtual bingo card.

The main prize is free Starbucks for the rest of your life (30 years max). Or you can win a year, month or week’s worth of caffeine as well. And just to keep people interested, there are 2 million 25-star bonuses, which are worth about $0.50 in your chase to a free drink. My only complaint is lack of integration with the mobile app, but I’m sure they’ll get to that next time.

Sweepstakes are a tried-and-true method of encouraging usage, and costwise, they needn’t break the bank. Merchant partners can supply the prizes, and your mobile app provides a low-cost way to amplify the effectiveness with alerts, redemptions, and extra features. And email keeps pulling customers back to the game.

I’d like to earn a game piece with every:

- Credit/debit card transaction

- Bill payment

- ACH debit

- Recurring ecommerce transaction (e.g., Uber, Amazon, Apple iTunes, etc)

- ATM visit

- Customer self-service session

- Check reorder

- Increase in my savings account balance

Bottom line: Sure, you may not have anything quite as addictive as coffee to maintain interest. But people are pretty happy with free anything, so don’t shy away from gamifying your mobile banking. It’s a marketing tactic that works across a variety of demographics and is flexible enough to support multiple bank goals.