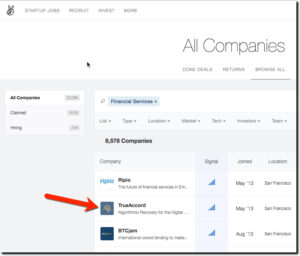

Perusing the hot financial services startups on AngelList today, I noticed Finovate alum TrueAccord (FS2015 link) in second place across more than 8,600 companies. TrueAccord’s core service, a digital-first approach to consumer debt collection, is a great example of the profound changes occurring all around us. Every transaction, every process, every customer interaction (and every job), is being rewired for the digital world.

Perusing the hot financial services startups on AngelList today, I noticed Finovate alum TrueAccord (FS2015 link) in second place across more than 8,600 companies. TrueAccord’s core service, a digital-first approach to consumer debt collection, is a great example of the profound changes occurring all around us. Every transaction, every process, every customer interaction (and every job), is being rewired for the digital world.

Think about the typical non-digital collection process at large lenders and other merchants. A series of annoying calls that were both stressful for the recipient, who is often in the middle of some life crisis, and awkward for the financial institution, especially if they had an ongoing relationship with the customer outside the delinquent credit account. Both sides were easily riled, leading to combative communications that were the opposite of transparent, honest and collaborative. And really, it’s almost impossible to rationally assess repayment options on a phone call you are desperate to not have.

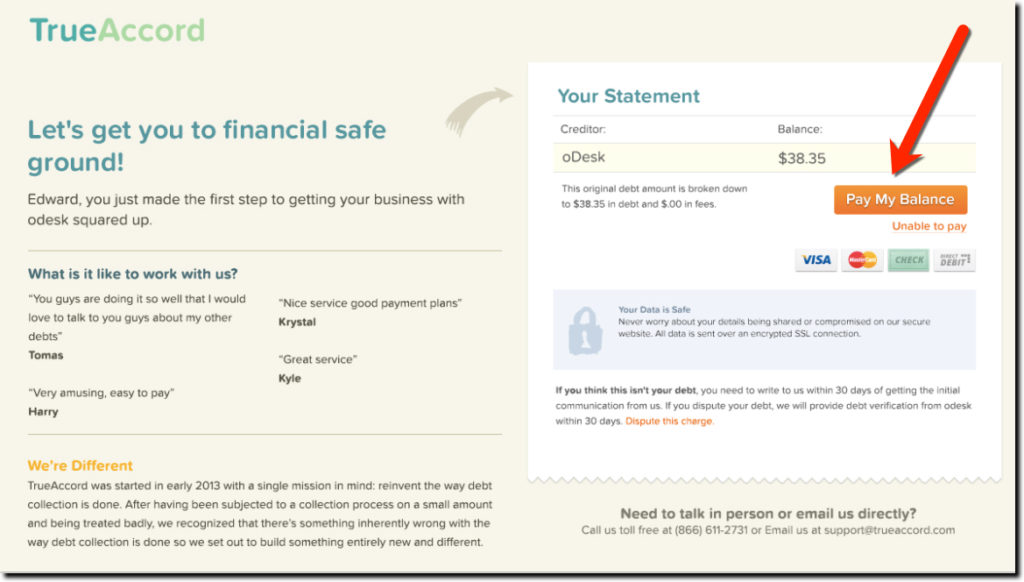

Compare that with the 3-step digital debt collection process (outlined below). Consumers receive a well-crafted email message inviting them to begin a dialogue to work together to solve the problem. While many recipients will avoid the emails, just as they avoid phone calls, and snail mail, those that are truly interested in resolution can review their options in the privacy of their own web browser (or phone), and select what works best for them.

Step 1: Email to delinquent customer with giant Resolve Now button

Step 2: Choose a repayment plan. Note the variety of choices with the amount “You Save” at the bottom for faster repayment.

Step 3: Make first payment via credit card or bank transfer

My take: Obviously, not everyone will respond to the kindler and gentler digital approach. Deadbeats and fraudsters are still deadbeats and fraudsters. And non-responders will continue to receive harshly worded voice messages from hardened collectors. But for the forgetful and/or the well-intended, laying out their options visually in a safe and neutral manner is a great improvement for the customer relationship, which will pay dividends over time.

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as

Principal of BUX Advisors, a financial services user-experience consultancy.