CoreIQ is a marketing automation system developed by Onovative that speeds onboarding and broadens cross-selling opportunities for community banks and credit unions. The platform leverages the data in the banks’s core banking system to automatically distribute marketing content in a variety of formats, from email and SMS to phone calls and postcards.

“We are a hybrid between CRM and marketing automation,” Onovative CEO Michael Browning explained in a conversation during FinovateSpring 2015 in San Jose earlier this year. “We bring data from all their systems and keep it behind their firewall, then use APIs to reach out to Trulioo and other companies for other functions (like Facebook ads).”

From left: Onovative co-founders, CEO Michael Browning and CTO Clay Turner, demonstrated CoreIQ at FinovateSpring 2015 in San Jose.

Onovative sees its technology as a challenge to the Salesforces of the World, and similar platforms. One observer at FinovateSpring 2015 referred to Onovative as “Mailchimp for Banks and Credit Unions.” On that point, Browning admitted that “as a company, we love taking on bigger companies. It’s part of the fun of being a startup.”

Company facts:

- Founded in June 2013

- Headquartered in Jeffersonville, Indiana

- Six employees

- Raised $400,000 in capital

- Michael Browning is CEO and co-founder

How it works

Onovative’s CoreIQ is designed to give community banks and credit unions the same high-caliber marketing tools to better engage their customers that larger financial institutions have access to. Among the key differentiators is the way Onovative handles a client’s sensitive customer data. “We centralize the data. Companies don’t have to upload to the cloud,” Browning explained. “We use APIs to access it, but we keep the data where it belongs.”

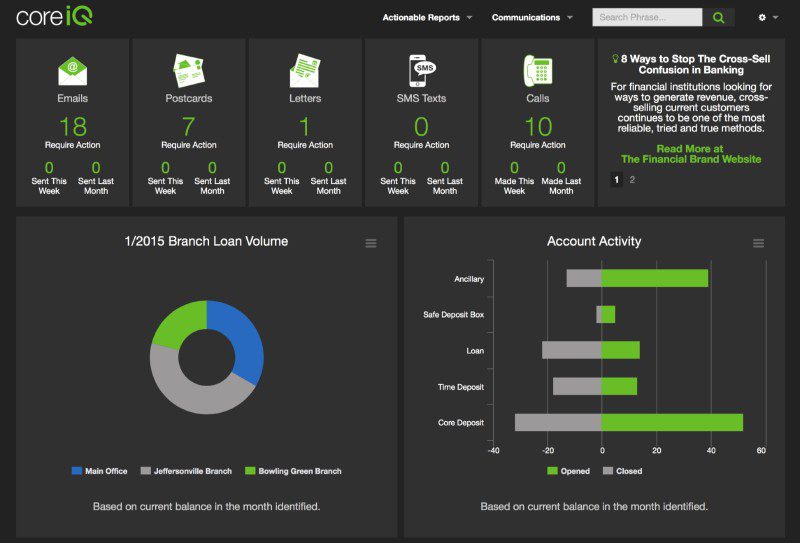

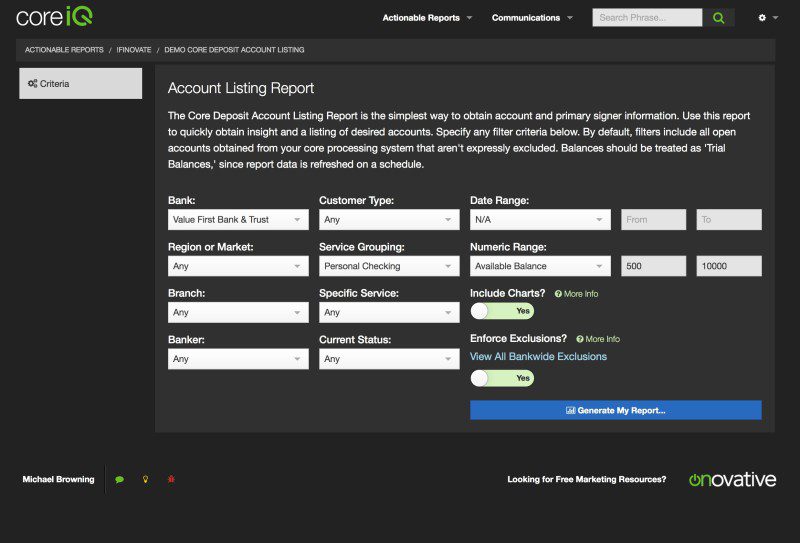

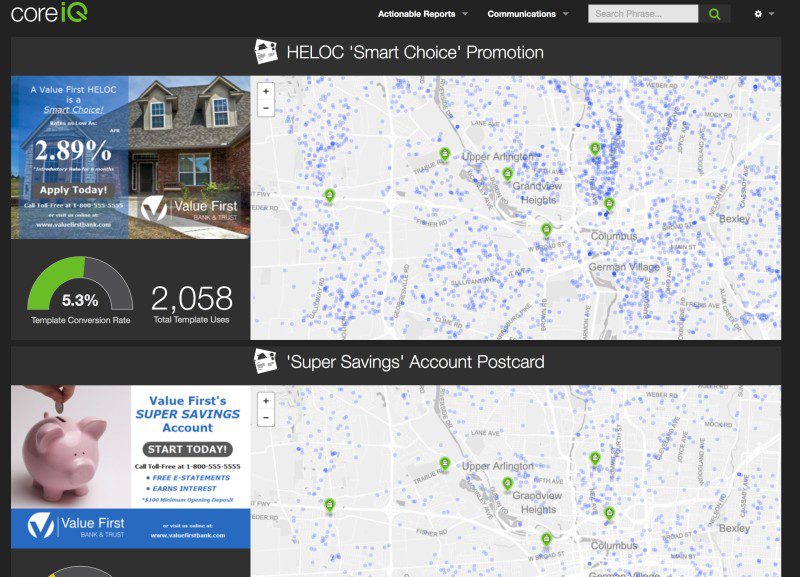

From the main CoreIQ dashboard (above), a marketing team has insight into every client in the bank or credit union. Marketers can use the dashboard’s Account Listing Report to build customized lists for a variety of outreach campaigns—e.g., “Select personal checking account customers with balances of more than $1,000″—or to build a campaign based on the customers of a single branch, a region, current status, account type and much more.

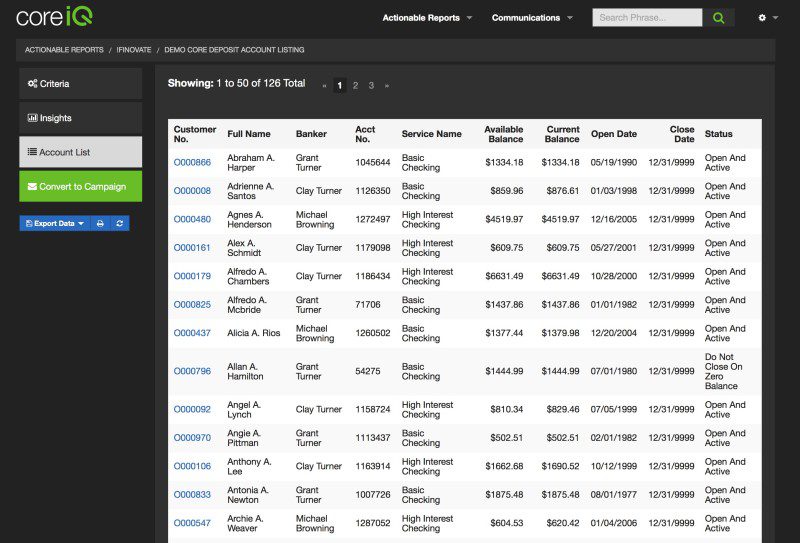

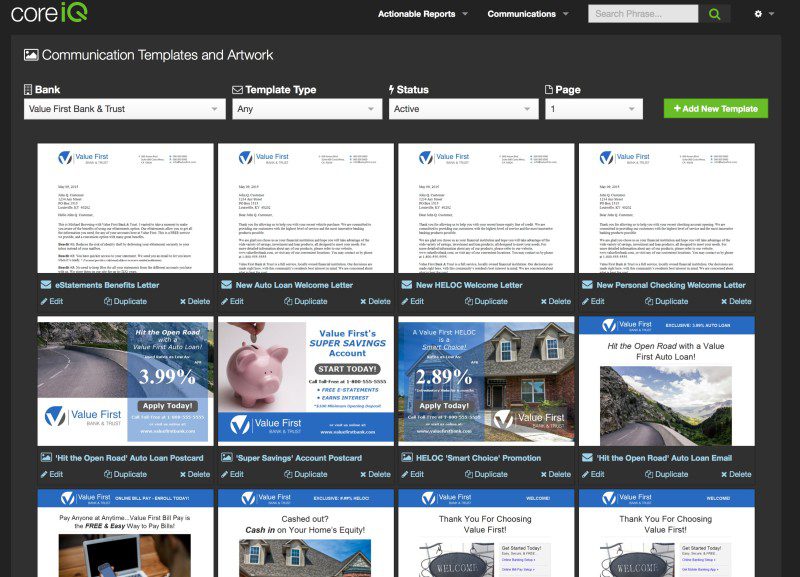

Client data can be analyzed through one of CoreIQ’s visualizations or presented in a simple list form (see below) for ready use in a campaign. Campaigns can be developed to operate through a variety of channels—from email and SMS to postcards and outbound telephone calls—and the platform provides a number of predesigned templates. These templates help not only marketers to save time, but also make it easier for community banks and credit unions to remain compliant since the message is consistent.

“In just a few seconds I can go from a list of people to a campaign,” Browning said. “And because all of this data is kept behind the firewall in CoreIQ, I’m able to see all the way through to conversions, as well.”

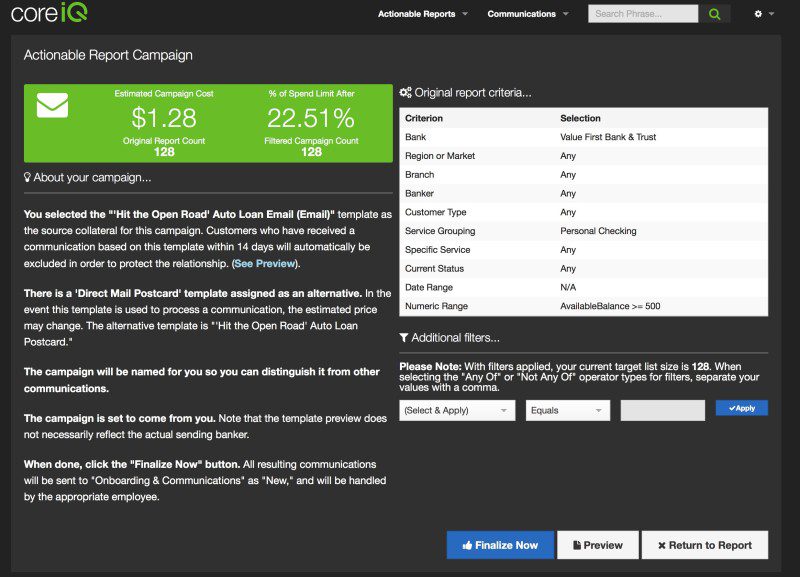

CoreIQ also provides an Actionable Report Campaign tab (below) that gives marketers insight into how much their campaigns will cost, how the cost of the campaign will impact the budget, and other important campaign information and criteria. The user can also see how the actual text or SMS or email will look when it is delivered.

Part of helping community banks and credit unions engage their customers with the same efficiency and sophistication as larger institutions includes things like providing a wide variety of templates and artwork to accompany marketing messages. Templates for email, postcard, SMS, and other message channels are available for banks and credit unions to choose from.

Importantly, as Browning pointed out in his FinovateSpring demo of the platform, CoreIQ’s template library can also include elements that have an API-component, as well. “So we have things in the pipeline like the Facebook-ad network and other display networks,” Browning said.

Campaigns can be easily tagged for reference and analysis, separating “offers” from “courtesy followups” and “debt collections.” Campaigns can also be linked with specific offers such as business checking or auto loans. The “Communication Template” features both an “approved by compliance” toggle button, as well as a signature space for any revisions to the template to be noted and approved.

And because the reality of multichannel communications means that not every customer is available on every channel, CoreIQ has a feature that allows any email or electronic campaign to be issued in print format if the platform detects that no electronic channel is available for a given customer. For example, the system could be configured to send a direct-mail postcard whenever it encounters a customer with no available email address.

The future

Onovative’s to-do list is long, but all items carry a central theme: Make the necessary connections to bring more data to the hands of FIs seeking deeper engagement with customers. Browning says Onovative is partnering with “people that already have a lot of consumer data and connecting it with what banks already have.” At Finovate, those partners were largely the technology folks, the payment processors and core systems providers. “We want to hook their data into our system,” Browning explained. “Reaching out via SMS, email, print, Facebook ads, Google display ads, issuing gift cards via API, integrating behavioral data from other networks … it’s all important,” he said.

At a starting price of $900 a month for the complete CoreIQ suite, Onovative offers FIs the ability to try the platform for a few months before making a commitment, and insists there are no long-term contracts. Browning added, “We put price right out in front. People love the fact that price is transparent.” The company recently celebrated its partnership with Massachusetts-based Avidia Bank ($1 billion in assets), and in June 2015 was featured in a Credit Union Times article on onboarding strategies for small and medium FIs.

“The most important thing a credit union can do is to understand its members as much as possible as soon as possible,” Browning said in the CU Times feature. “Cross-selling is important, but you won’t know what to cross-sell until you fully understand their situation.”

And with CoreIQ, Browning is betting that the ability for community banks and credit unions to reach that kind of full understanding will become a lot easier.

Check out the FinovateSpring 2015 demo video for Onovative below.